You got your financial aid package, paid the tuition, and started the semester feeling financially secure. But now, it’s the middle of the term. The initial disbursement has covered the big bills, and you suddenly realize your remaining “living money” is dwindling fast. You’ve got weeks to go until the next check arrives, and the panic is starting to set in. How will you manage the mid-term money scramble?

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarshipsThis is a totally common experience—it’s what we call “aid anxiety.” It means you need a financial survival strategy, fast. Here is your roadmap to living cheaply, generating extra cash, and still enjoying college life without stressing over every penny.

Take Immediate Action with Extreme Budgeting and Cost Cuts

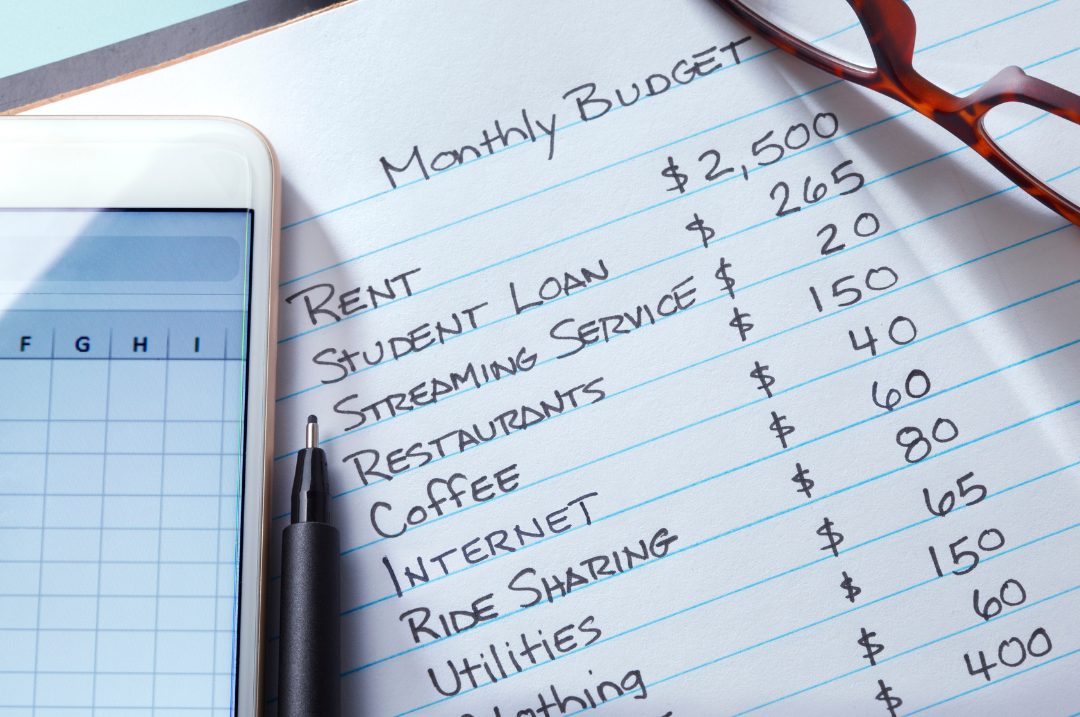

When funds are tight, your first step is a financial lockdown. Every dollar has a job, and that job is survival. That’s how you’ll get through the mid-term money scramble!

Track Every Penny

Stop using cash or cards impulsively. Use a free budgeting app (like Mint or You Need a Budget) or a simple spreadsheet to track every single purchase for three days. Seeing where your money actually goes is the most painful—and most effective—wake-up call.

Master the Food Budget

Food is often the biggest money drain. If you have a meal plan, use it strategically! Load up on healthy snacks from the dining hall to take back to your dorm. If you cook, stick to cheap, filling staples like rice, beans, pasta, and eggs. Don’t be afraid to visit your campus food pantry—they are confidential, they exist for this exact reason, and using them is a sign of resourcefulness, not failure.

Check SNAP Eligibility (Food Stamps)

College students may be eligible for SNAP benefits (Supplemental Nutrition Assistance Program, often called food stamps or EBT), depending on your state and enrollment status. While most students enrolled half-time or more must meet an exemption, you may qualify if you are working a minimum number of hours, are approved for work-study, or are a single parent. Check your state’s SNAP eligibility rules immediately at College SNAP Project because these benefits can make a huge difference in your monthly grocery budget. If you qualify, you’ll receive a debit card that you can use to pay for food at grocery stores and farmer’s markets that accept SNAP EBT cards.

Unlock Utility & Internet Discounts

Utility bills are a major expense. Low-income students should investigate state and federal assistance programs. Look for the Low Income Home Energy Assistance Program (LIHEAP) for help with gas and electric bills. For WiFi and phone service, check the federal Lifeline program or the Affordable Connectivity Program (ACP). Also, call your local providers (electric, water, internet) directly to ask about low-income, student, or energy-assistance rates—sometimes, all you have to do is ask!

Rethink Transportation

Ditch ride-share apps. Rely on walking, biking, or free campus shuttle services. If you must travel locally, utilize public transportation, which is often free or discounted for students.

Take Advantage of Your College Library

Don’t buy that required reading book. Check the campus library or the local public library first. If you must acquire a textbook, use campus buy/sell groups, rent it, or buy a used edition.

Scout Local Discounts

Find out about discounts available to students at local shops and restaurants. Sometimes all you have to do is show your student ID to get a discount!

Hold-Off on Greek Life

If you are thinking about joining a sorority or fraternity, it might be best to wait until you have more funds available. Most students don’t realize the expense that can be associated with Greek Life. New members typically have to pay a one-time initiation fee, as well as membership fees every semester. Costs can include both national and chapter dues, as well as housing and meal costs if you are planning to move into sorority or fraternity housing. On top of these costs, there are often fees for participating in social events, trips, gifts, and other chapter-related activities.

Strategies that Increase Your Available Funds

While cutting costs is essential, a proactive plan to bring in more cash is even better when your goal is to manage the mid-term money scramble.

Campus Employment

Prioritize finding an on-campus job (like working in the library, bookstore, or lab). Colleges are flexible with student schedules, and they look great on a resume. If you were offered work-study in your aid package, activate it immediately.

Gig Employment / Side Hustles

Explore flexible work options that allow you to set your own hours. This could include tutoring, dog-walking, freelance writing, delivering meals or groceries, driving for a ride-share app, or using local platforms for small errands. Look for skills you already have that you can monetize immediately.

Contact the Financial Aid Office

Visit the financial aid office to find out if there are additional scholarships or short-term financial assistance you can qualify for. Inquire about financial counseling services to see if a professional can help you create a sustainable budget.

Prioritize Applying for Scholarships

Don’t wait until next semester to apply for scholarships. Instead, apply year-round to boost your chances of earning scholarship dollars. When you receive scholarship dollars, you can apply them to the current term, or the next one. The ScholarshipOwl platform streamlines the process, enabling you to quickly apply to many more scholarships than you would by just Googling for opportunities. If you aren’t yet a ScholarshipOwl member, you can start your free 7-day trial at www.scholarshipowl.com.

Your Last Resort: Student Loans

If you have exhausted all other debt-free options, remember that federal student loans are still available and may be necessary to complete the term. Speak with your financial aid counselor about taking out the maximum amount of Direct Unsubsidized Loans you are eligible for. While not ideal, it’s better than failing a class or going hungry.

Living Richly on a Meager Budget

A low budget doesn’t mean a low-quality college experience. Resourcefulness is a badge of honor in college, and many of the best social opportunities are free.

Join Campus Organizations

Join campus organizations related to your major, cultural background, and/or religious background. These organizations provide low-cost social activities, and they may also have insight into financial assistance and resources geared toward your background or career interest. Plus, they often have free snacks!

Seek Out Like-Minded Friends

Seek out friends who are also focusing on limiting their spending. It’s a lot easier to focus on low-cost or free fun when your friends want to do the same!

Attend Campus Events

Colleges constantly host free events, concerts, movie nights, and lectures (often with free food!). Check the student activities board daily.

Participate in Events in Your Dorm

If you are living on campus, you’ll find many opportunities to socialize within your residence hall – and again, often with free food!

Outdoor Adventures

Go for walks, hikes, or bike rides. Many local parks, trails, and public beaches cost nothing.

Host a Potluck or Game Night

Instead of expensive restaurant dinners, invite friends over for a potluck where everyone contributes one dish. Board games or card games are free entertainment.

Utilize the Campus Gym & Free Classes

Your tuition already pays for the fitness center. Skip expensive yoga studios and use the free resources available on campus.

Museum Passes

Many local museums, aquariums, and zoos offer free admission or deep discounts with a valid student ID.

Managing the Pressure: Low-Cost Stress Relief

When your budget is tight, your stress levels often run high. It’s crucial to remember that managing your mental health is just as important as managing the mid-term money scramble. If you don’t take care of your mind, you won’t have the energy to tackle your budget or your schoolwork.

Prioritize Sleep

This is your most powerful, free mental resource. Aim for consistent sleep hours. A well-rested mind is less prone to anxiety and better at solving financial problems.

Move Your Body (for Free!)

You don’t need a gym membership. Take a brisk walk around campus, do a free workout video in your dorm, or find a flight of stairs and use them. Exercise is a proven, immediate stress reducer.

Eat Smart, Not Expensive

Focus on simple, whole foods like oats, rice, beans, and fresh or frozen vegetables. Good nutrition is essential for stable energy and mood, and eating well doesn’t have to break the bank.

Embrace Mindfulness

Download a free meditation app or take five minutes before bed to simply focus on your breathing. This simple act of stillness can reduce feelings of panic and help you regain a sense of control.

Talk It Out

Don’t suffer in silence. Use the free campus mental health or counseling services—that resource is already covered by your fees! Speaking with a professional or a trusted friend about your financial worry can drastically reduce the mental load.

Focus on Small Wins

Instead of worrying about the entire six weeks until your next check, focus on getting through the current week. Set small, achievable financial and academic goals, and celebrate those tiny victories to build momentum.

Embrace the Hustle

The stress of the mid-term money scramble is real, but remember that this period of tight budgeting is temporary. By immediately implementing a rigorous budget, being proactive in seeking income and emergency aid, and focusing on the wealth of free social opportunities your campus offers, you are building resilience and resourcefulness—skills far more valuable than any bank balance. Your focus right now should be on finishing the term strong. You are capable, you are supported, and you will get through this!

For more helpful tips and to start your free 7-day trial, visit www.scholarshipowl.com.