Applying to college involves more than just essays and test scores—it involves financial paperwork. While almost everyone knows about the FAFSA (Free Application for Federal Student Aid), the CSS Profile often remains a mystery. If you’re applying to private colleges or certain public universities, understanding and completing the CSS Profile is essential, as it directly unlocks institutional grants and scholarships that can significantly lower your educational costs.

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarships

Here is everything you need to know about the CSS Profile to confidently approach your college financing.

What is the CSS Profile?

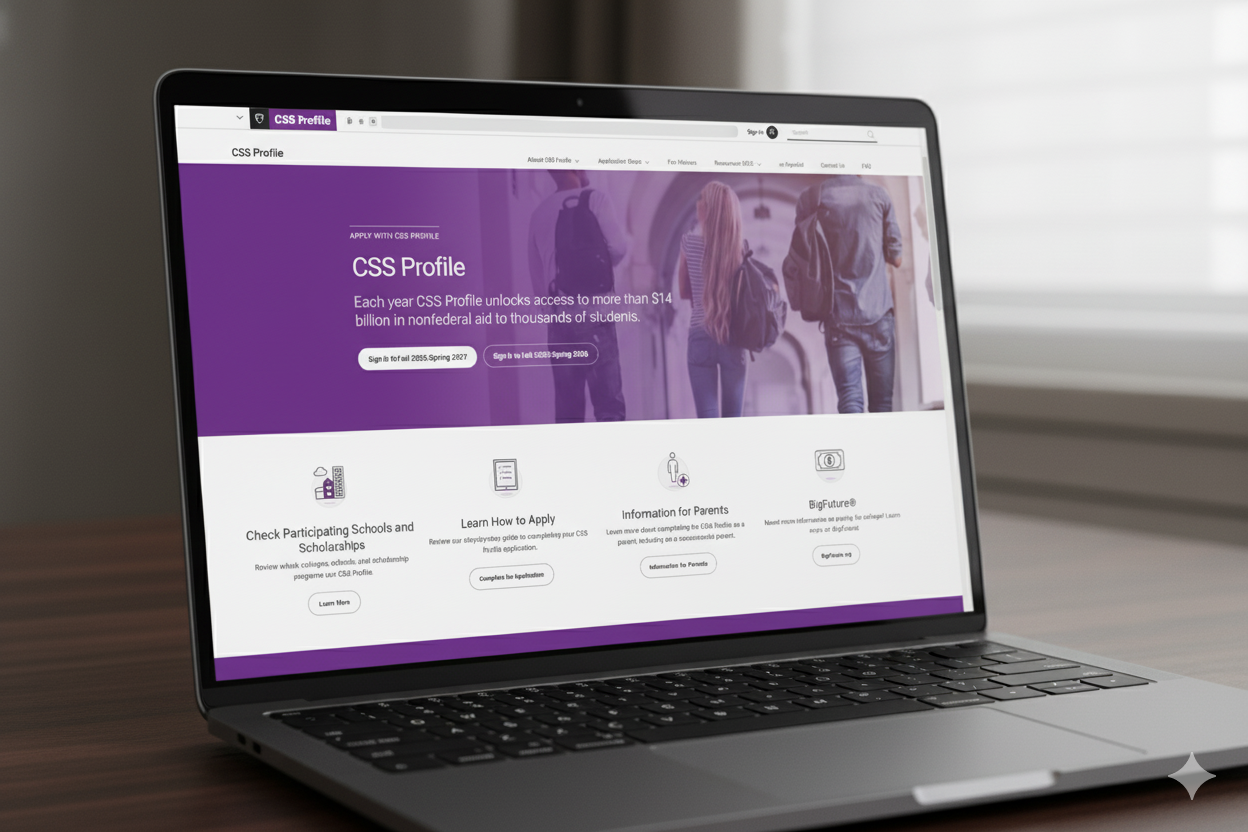

The College Scholarship Service (CSS) Profile is an online application managed by the College Board that many private colleges and certain public universities use to gauge a family’s financial strength and determine eligibility for non-federal institutional aid.

Which Colleges Accept the CSS Profile?

The CSS Profile is accepted by roughly 400 colleges and scholarship programs across the United States. These are typically private institutions and certain highly selective public universities (like the University of Michigan or the University of Virginia). To find out which colleges require the CSS Profile, click here.

CSS Profile vs. FAFSA: What’s the Difference?

While both forms assess your family’s financial situation, they differ in purpose, method, and impact:

Purpose

The FAFSA determines your eligibility for Federal aid (Pell Grants, federal loans, etc.). The CSS Profile determines your eligibility for Institutional aid (scholarships and grants funded by the college itself).

Method

The CSS Profile is a much more detailed application. It delves deeper into your family’s finances to calculate your actual financial need.

Assets Included

-

-

- The FAFSA generally only considers assets of the student and does not count equity in your primary home.

- The CSS Profile, however, collects information on all types of assets, including:

- Equity in the primary residence (home equity).

- Assets held by non-custodial parents (for divorced/separated families).

- Value of small businesses and rental properties.

-

Impact on Institutional Aid and Scholarships

The CSS Profile directly impacts your chances of receiving need-based financial help from the colleges themselves.

Colleges use the CSS Profile data to calculate your Institutional Expected Family Contribution (EFC). Since the CSS Profile includes more comprehensive asset information than the FAFSA, the institutional EFC calculated by the college often provides a more complete picture of your family’s ability to pay. The difference between the college’s total cost of attendance and your institutional EFC determines your financial need, which the college attempts to cover with its own grants and scholarships.

With the CSS Profile, Am I More or Less Likely to Receive Institutional Aid and Scholarships?

You are more likely to receive institutional aid and scholarships if you complete it. The Profile is the only way to be considered for a college’s own need-based funds. If you do not submit the Profile to a school that requires it, you will only be considered for federal aid (via the FAFSA) and merit-based aid (if applicable), but you will forfeit access to the institution’s primary pool of need-based grants.

Who Should Complete the CSS Profile?

The CSS Profile requires financial and household information from the student as well as the student’s parent(s) or guardian(s). For the purposes of the CSS Profile, the term “parent” includes ALL of the following:

- Both parents, if they are still married or living together

- In the event of divorce or separation:

- Custodial Parent: The parent with whom the student lived the most during the past 12 months

- Non-Custodial Parent: The non-custodial parent must complete a separate CSS Profile application (unless the college specifically waives this requirement)

- In the event of remarriage:

- Step-Parents: The CSS Profile also requires information from step-parents.

- If the student is under legal guardianship, then information from the legal guardian(s) is required, but parent information does not need to be supplied

Preparing to Complete the CSS Profile

Completing the CSS Profile requires careful preparation. It will take a few hours to complete, but it’s worth your time and effort because it is the gatekeeper for institutional aid.

What Documents Are Needed to Complete the CSS Profile?

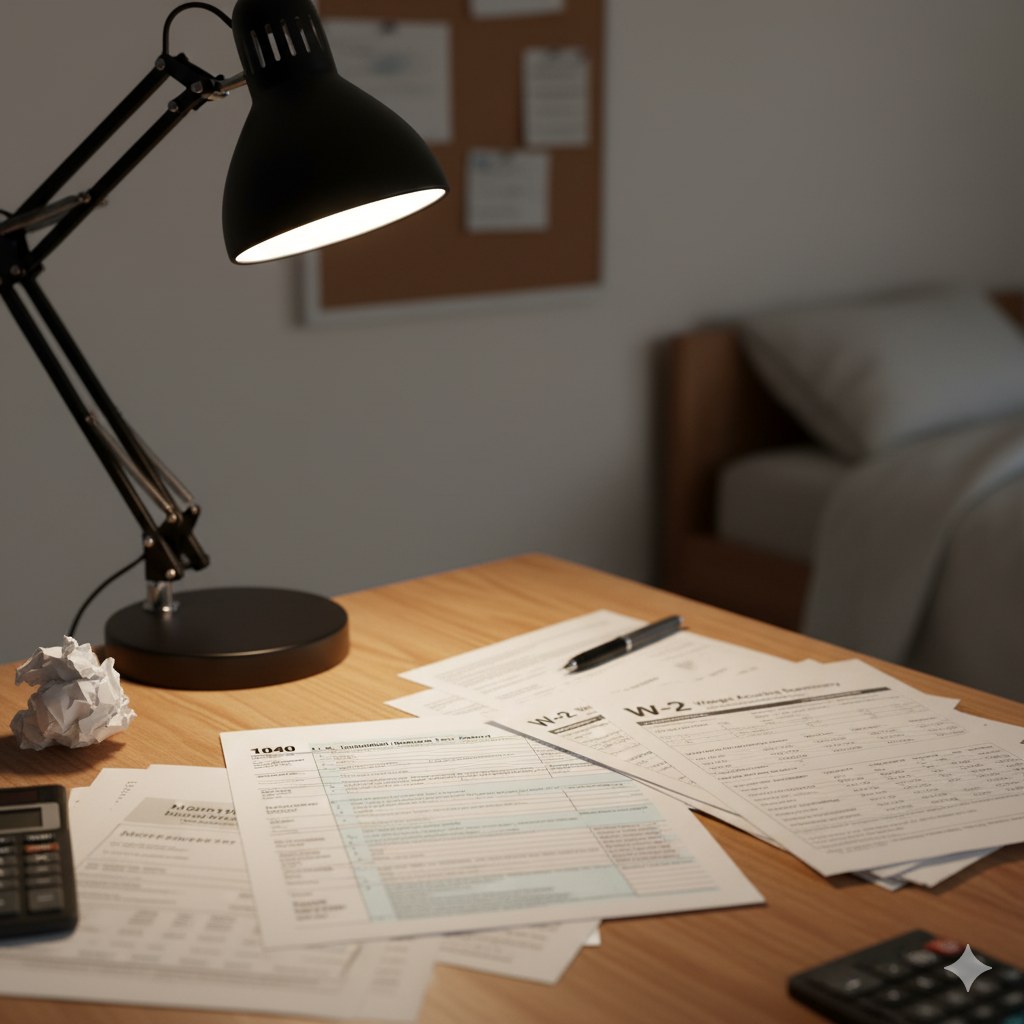

You must have specific financial documents readily available before you begin. You will need:

-

-

- Federal tax returns for the student and the parent(s) from the previous TWO tax years (e.g., for the 2026-2027 academic year, you’d use 2023 and 2024 tax returns).

- Records of untaxed income, such as Social Security benefits, child support received, and welfare benefits.

- Current bank statements and records of savings and investment accounts (stocks, bonds, mutual funds, 529 plans, etc.) for the student and parents, as well as information about 529 plans for the student’s siblings.

- Records related to real estate owned, such as mortgage statements and records of equity in the primary home, vacation homes, and/or rental properties.

- Records for any businesses or farms owned by the family.

- Child and dependent care costs for members of the household who receive more than 50% of their support from the family.

- Information on unreimbursed medical expenses, private school and tuition expenses for siblings, and other special circumstances impacting your family’s finances.

- An estimate of the current year’s income and expenses.

-

Make sure that your documents are digital (PDF files) rather than paper documents. This is because you’ll be asked to upload your documents and attach them to your CSS Profile application. If you only have paper documents, plan ahead by logging on to your financial account portals and downloading the necessary documents and/or scan your paper documents to create digital versions.

Tips for completing the CSS Profile

Start Early

Gather all documents before you begin the online application.

Explain Special Circumstances

The Profile includes a section where you can describe any special circumstances affecting your family’s finances (e.g., job loss, medical expenses, care for an elderly relative). Use this to provide context that the numbers alone might not capture.

Honesty, Ethical Reporting, and Verification

Can You Hide Money and Assets to Get a Better CSS Profile Result?

No, you cannot hide money and assets. While some “advisors” or companies may suggest strategies to legally minimize your Institutional EFC, any advice encouraging you to intentionally misrepresent or omit facts (i.e., hide money) is illegal and highly unethical.

Using a service to outright “hide” money during the application process is fraudulent; however, you may wish to consult with a fee-based college financial advisor or tax consultant to learn about legal tax-planning strategies before the application year to optimize assets (e.g., paying down debt or moving assets into certain accounts).

How Would a College Know If the CSS Information Was Accurate?

Colleges often require financial aid verification documents (like tax transcripts). If they find that you intentionally misrepresented your income or assets, they can:

- Rescind the financial aid offer

- Require you to repay all institutional aid you received

- Rescind your offer of admission or dismiss you from the university

Logistics and Outcomes

How Long Does It Take to Complete the CSS Profile?

Since the CSS Profile is so detailed, it will take at least two to three hours to complete, even with all documents on hand.

Is the Time and Effort Required Worthwhile?

Yes, absolutely. If any of the colleges you are applying to require it, submitting the CSS Profile is the only way to qualify for the institutional grants and scholarships offered by those schools. For many private schools, their need-based aid packages are substantial and often make the cost comparable to public institutions.

What Will Happen If I Don’t Submit the CSS Profile to the Colleges that Accept It?

If you don’t submit it, you will not be considered for any need-based institutional aid from those schools. You will only be considered for federal aid (via the FAFSA) and any merit-based scholarships not tied to need. This is a huge risk, as you lose the opportunity for the most significant grants.

Negotiating Financial Aid

If you receive an offer that doesn’t meet your financial need, you can appeal the decision through a process called a financial aid appeal or professional judgment review.

Gather Evidence

- If your financial situation has changed since your last tax filing, provide details and documents that support your appeal. Changes that might support an appeal include a recent job loss, a death in the family, recent divorce or separation, unexpected medical expenses, etc.

- If you are basing your appeal on the receipt of a better financial aid offer from a competing school, be prepared to provide documentation demonstrating this.

Write an Appeal Letter

Address the financial aid director. Clearly and professionally state the following:

- Your appreciation for the school and why you want to attend.

- The specific dollar amount you need to make the school affordable.

- Any new, significant financial changes or special circumstances not included on your CSS Profile (e.g., job loss, unexpected medical bills).

- If you’ve received a compelling financial aid offer from a competing school, include the award letter as an attachment.

Beyond Institutional Aid: Unlocking External Scholarships

While institutional scholarships from colleges and universities are a fantastic resource, they are by no means the only path to funding your education. A vast landscape of additional scholarship opportunities exists, offered by a diverse array of businesses, community organizations, foundations, and even individuals. External scholarships can significantly reduce the financial burden of college, but students often overlook them when they focus solely on what institutions provide.

Maximize Your Scholarship Options

While institutional scholarships that are often tied to academic merit or specific departmental needs, external scholarships can have incredibly varied criteria. You might find scholarships based on:

-

-

- Field of Study

- Hobbies and Interests

- Community Involvement

- Specific Talents

- Demographic Factors

- Employer-Sponsored Programs

-

Accumulative Power

One of the greatest advantages of external scholarships is that they can often be combined with institutional aid and other forms of financial assistance. A few hundred dollars here, a thousand there – these amounts can quickly add up to make a substantial difference in your overall college costs.

Increased Access

Applying for external scholarships opens up your potential funding pool dramatically. It’s a proactive step that empowers you to seek out and secure money that isn’t dependent on your chosen college’s specific offerings.

Streamlining Your Search with ScholarshipOwl

The sheer volume and variety of external scholarships can feel overwhelming. Sifting through countless websites, checking eligibility requirements, and keeping track of deadlines for dozens of different applications can quickly become a full-time job in itself. This is where platforms like ScholarshipOwl become invaluable.

ScholarshipOwl is a comprehensive scholarship matching and application platform designed to simplify the entire scholarship process for students. It acts as a centralized hub, connecting students with relevant scholarships and streamlining the application experience.

Key Advantages of Using ScholarshipOwl

Personalized Matching

Instead of endless searching, ScholarshipOwl uses your profile information (academic achievements, interests, background, etc.) to match you with scholarships for which you are genuinely eligible. This saves an enormous amount of time and ensures you’re applying where you have the best chance.

Automated Application Process

This is arguably one of the most significant advantages of ScholarshipOwl. You’ll never have to fill in all of those dreaded application forms you normally would face when applying to scholarships! Instead, the ScholarshipOwl platform automatically populates all of your applications with information from your profile. In some cases, with your permission, it can even apply to multiple scholarships on your behalf with a single click, dramatically reducing repetitive data entry!

Deadline Management

Keeping track of application deadlines is crucial. ScholarshipOwl helps you stay organized by providing a clear overview of upcoming deadlines, ensuring you don’t miss out on opportunities.

Access Our AI Essay Assistant and Text Editor to Write Your Application Essays

When applying for essay scholarships, you’ll have access to in-platform tools that streamline your essay process. Can’t stand starting your essays from a blank page? Now you won’t have to! Simply launch our AI Essay Assistant to get an initial essay draft that is relevant to both the essay prompt as well as your profile. From there, simply edit and modify that essay using our text editor to create the exact essay you want to submit.

Comprehensive Database

ScholarshipOwl aggregates scholarships from a vast number of sources, including national, local, and niche opportunities that might be difficult to discover otherwise.

By leveraging ScholarshipOwl, you can transform the daunting task of finding and applying for external scholarships into a much more manageable and efficient process, freeing up valuable time to focus on your studies, college planning, and your life outside of school!

Not yet a member of ScholarshipOwl? Get started with a free 7-day trial at www.ScholarshipOwl.com!

Forging Your Debt-Free Path to College

The journey to a debt-free college education might seem complex, but it is entirely achievable by viewing the financial aid process as a three-pronged strategy: Federal Aid, Institutional Aid, and External Scholarships. Each component plays a vital and complementary role, and successfully navigating all three is the ultimate solution to managing college costs.

The Foundation – FAFSA for Federal and State Aid

The FAFSA (Free Application for Federal Student Aid) is your absolute starting point. It uses a consistent, standardized formula to determine your Student Aid Index (SAI), which unlocks federal grants (like the Pell Grant), state aid, and federal loan eligibility. It is the mandatory first step that establishes your eligibility for the largest pool of government-backed funding.

The Deep Dive – CSS Profile for Institutional Aid

The CSS Profile steps in where the FAFSA leaves off, providing a detailed, holistic look at your family’s finances. Used by hundreds of private colleges and universities, this deep-dive assessment allows institutions to award their own, non-federal institutional grants and scholarships. This is the critical component that often bridges the gap between the Cost of Attendance and the limited aid provided by the FAFSA, transforming a large tuition bill into an affordable final cost.

The Final Boost – External Scholarships for Zero Debt

Finally, external scholarships (from businesses, organizations, and platforms like ScholarshipOwl) act as the powerful final layer. These scholarships, which are not dependent on either the FAFSA or the CSS Profile, are essentially free money that can be stacked on top of your federal and institutional aid. In many cases, these funds replace the loan and work-study components of your financial aid package. By proactively searching and efficiently applying for these external awards, you can systematically reduce the need for student loans, allowing you to walk onto campus with your educational funding completely secured.

By diligently completing your FAFSA, strategically utilizing the CSS Profile for top institutional aid, and aggressively pursuing external scholarships, you are not just applying for financial help—you are forging a comprehensive plan for a debt-free education. This combined strategy empowers you to secure the funding you need, making the dream of a high-quality, affordable, and debt-free college degree a reality!