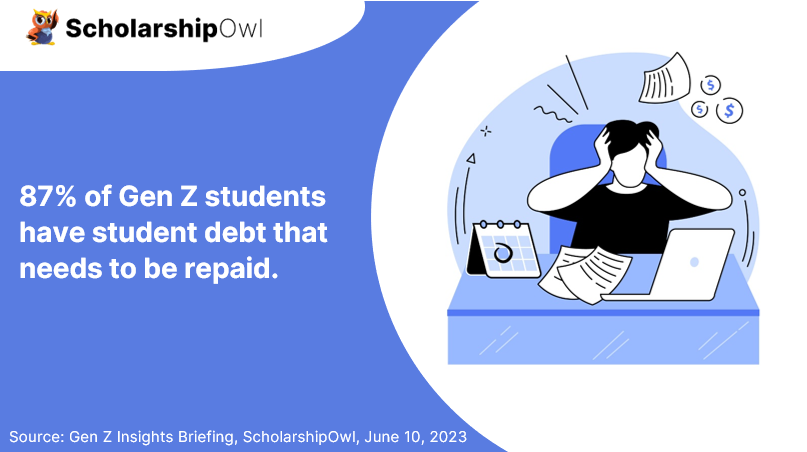

ScholarshipOwl conducts a survey each month to develop a deeper understanding of Gen Z. In May, we continued our recent deep-dive into the impact of student debt by asking students about how their student loans will affect their future after they graduate college. Based on the results, it is clear that there will be significant impact. Among all respondents, the overwhelming majority (87%) indicated they have student debt that needs to be repaid.

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarships

Who participated in the survey?

In May 2023, ScholarshipOwl surveyed over 10,000 high school and college students on the ScholarshipOwl scholarship platform to learn how prepared they are for the resumption of student loan payments, which will begin 60 days after June 30, 2023. We were particularly interested in finding out how student debt will impact the decision-making of students after they graduate. A total of 10,624 students responded to the survey.

Among the respondents, 64% were female, 34% were male, and 2% identified themselves as other. Nearly half (45%) were Caucasian, 25% were Black, 17% were Hispanic/Latino, 6% were Asian/Pacific Islander and 7% identified as other.

Nearly half (48%) of the respondents were high school students, with the vast majority high school seniors; 41% were college undergraduate students, primarily college freshmen and college sophomores; 8% were graduate students and 4% identified themselves as adult/non-traditional students.

Background

Student loan payments have been paused for over three years as a result of the COVID-19 pandemic. Although the Biden Administration has extended the payment pause, recent legislation commits the Administration to resuming loan payments 60 days after June 30, 2023. As such, additional extensions will not be possible. Borrowers need to prepare themselves for this change, which will have significant impact on their ability to accommodate loan payments along with other living expenses. This will be particularly challenging due to current economic conditions involving inflation, higher interest rates on mortgages, as well as layoffs in many sectors.

Survey questions

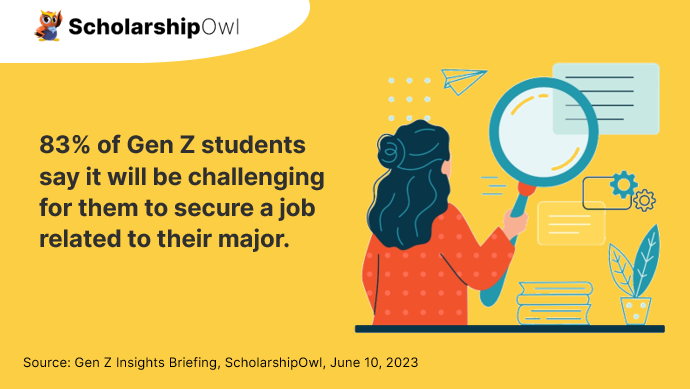

The first survey question was “Thinking ahead to your college graduation and keeping in mind the current economic conditions, how challenging do you think it will be to secure a job related to your major?”

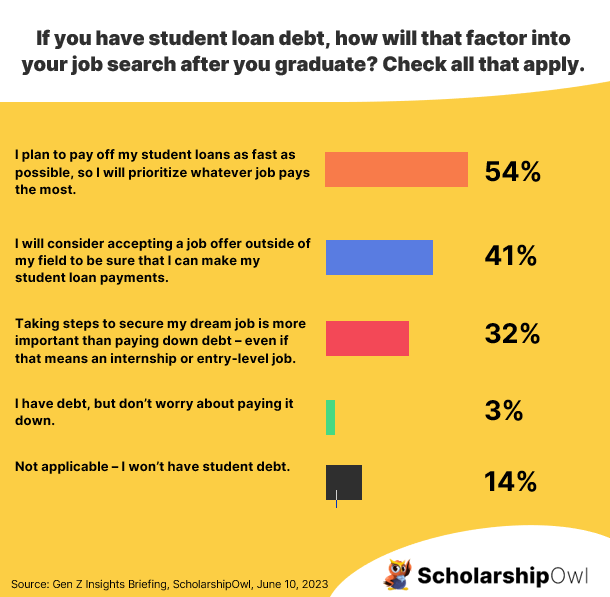

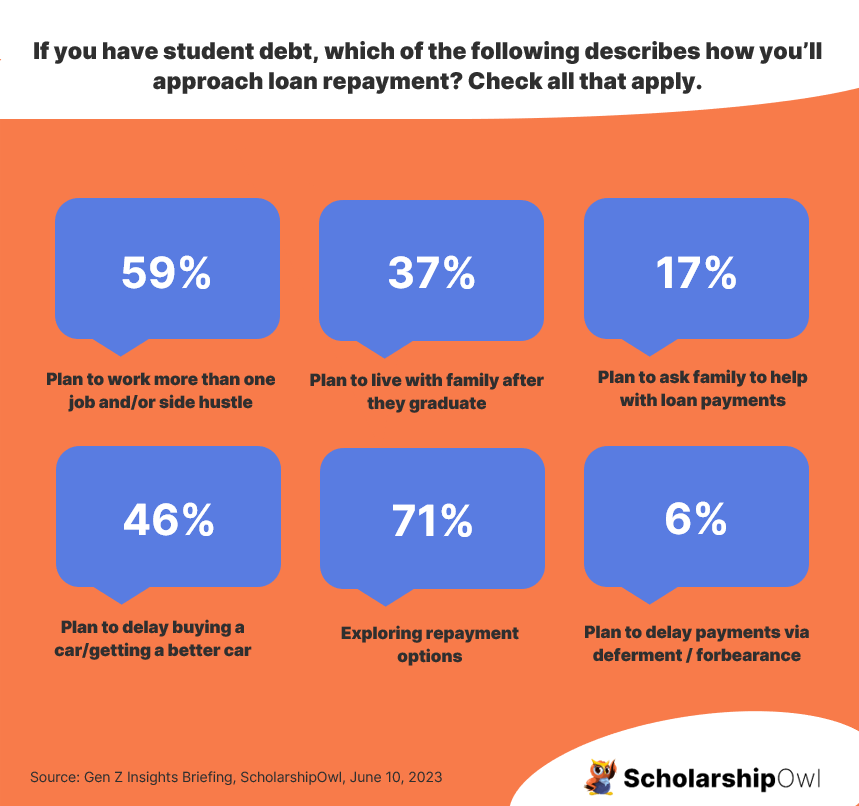

Many of the respondents plan on delaying major milestones, with nearly half (46%) planning to delay buying a car or getting a better car; one-quarter (25%) planning to delay marriage; half (50%) planning to delay buying a home. Nearly three-quarters (71%) are exploring repayment options – 30% are considering consolidating their loans into a single loan to simplify the payment process, and 41% are planning to select an income-based repayment plan that enables them to make lower payments initially until their income increases. A small minority (6%) plan to delay making their loan payments as long as possibly through deferment and forbearance options.

Perhaps most significant, the overwhelming majority (87%) indicated they have student debt that would need to be repaid.

Key Takeaways for Gen Z students

The survey results indicate that Gen Z students understand that challenges presented by the current economic conditions, with the overwhelming majority concerned about finding a job related to their major. On the positive side, student loan borrowers are planning ahead to manage loan payments, and the majority are prepared to make difficult decisions in order to stay on top of their loans. Most respondents demonstrated awareness of borrower options including loan consolidation and income-based repayment plans. These kinds of options offer greater flexibility, and also help borrowers to stay on track in making their loan payments. Finally, 13% of respondents were able to avoid the burden of student debt by paying for college through scholarships, grants, personal income, and family support. While this is good news for these students, this also means that the overwhelming majority (87%) of the students surveyed have student debt that they will need to repay – this clearly demonstrates that students and families need alternatives to avoid using loans to pay for college.

Brands can be the solution

There are simply not enough scholarships available to support the millions of students who need them. Brands can help by offering scholarship campaigns through the ScholarshipOwl for Business platform to support students, while also fulfilling their business and philanthropic goals. Through this platform, brands can quickly and easily create and launch scholarship campaigns to reach millions of students who apply for scholarships on the ScholarshipOwl platform. This both benefits students and brands, enabling businesses to build relationships with Gen Z in support of their marketing and communication goals.

To find out more about creating and launching a scholarship campaign, visit business.scholarshipowl.com.