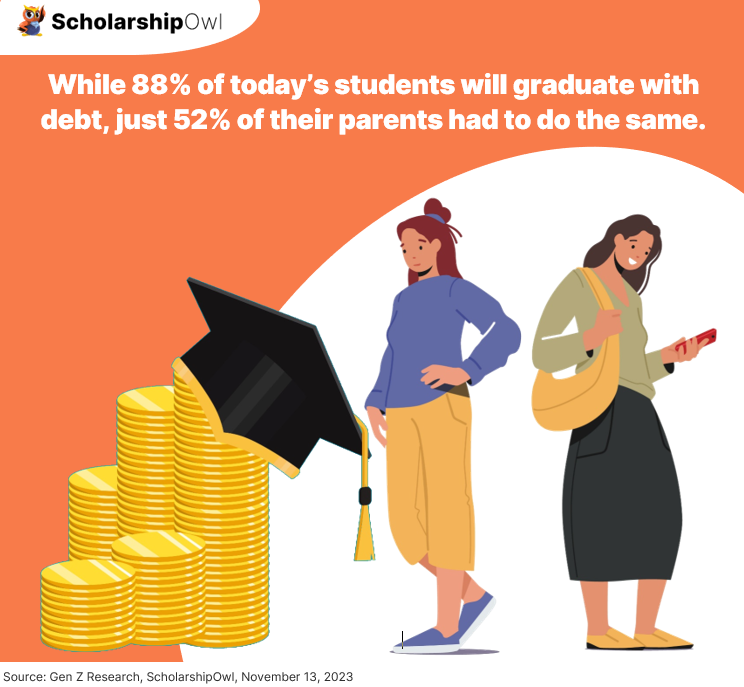

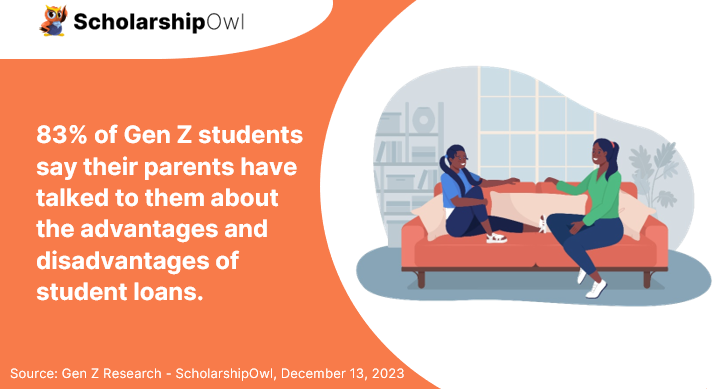

ScholarshipOwl conducts monthly surveys to help us to gain deeper insight into Gen Z’s perspectives about college, scholarships, financial aid, and their future. In November, we asked students about what they’ve learned about student loans from their parents to gauge how that may have impacted the students’ decisions about whether or not to take on student debt. While 83% of respondents indicated that their parents have discussed the advantages and disadvantages of student loans, the overwhelming majority of respondents still will graduate with student debt. What stood out the most was that 88% of respondents will graduate with debt, while only 52% of their parents had to do the same.

The fastest path to earning scholarships

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarshipsWho participated in the survey?

In November 2023, ScholarshipOwl surveyed high school and college students on the ScholarshipOwl scholarship platform to learn more about their views about the value of college. A total of 6545 students responded.

Among the respondents, 62% were female, 36% were male, and 2% identified themselves as other. Nearly half (49%) were Caucasian, 21% were Black, 16% were Hispanic/Latino, 6% were Asian/Pacific Islander and 6% identified as other.

More than half (58%) of the respondents were high school students, with the vast majority high school seniors; over one-third (34%) were college undergraduate students, primarily college freshmen and college sophomores; 5% were graduate students and 3% identified themselves as adult/non-traditional students.

Survey questions

Question 1

We began the survey by asking students, “Have your parents talked to you about the advantages and disadvantages of student loans?” The overwhelming majority (83%) said yes, while less than one-fifth (17%) said no.

Question 2

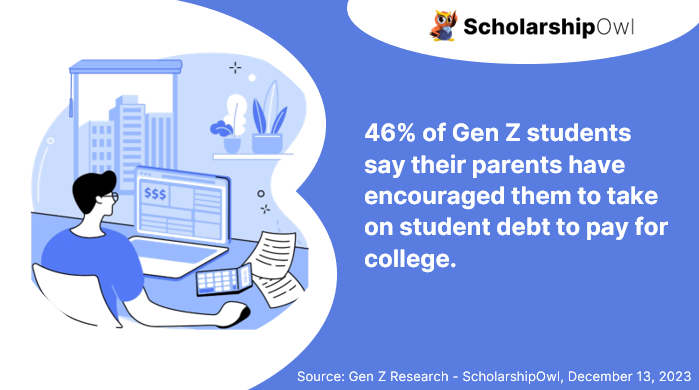

The next question was, “Have your parents encouraged you to take out student loans to help cover college costs?” Nearly half of the students (46%) responded yes, while just over half (54%) said no.

Question 3

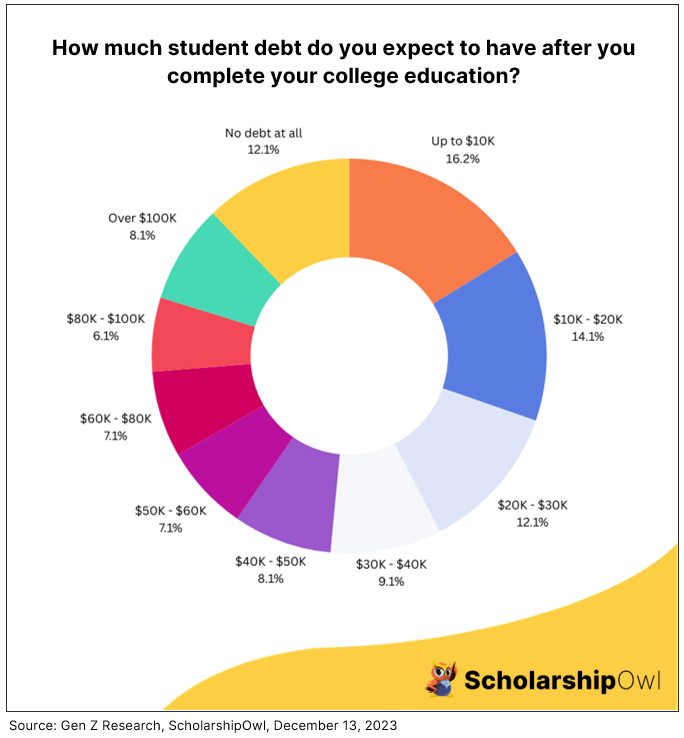

We wanted to learn the impact of these conversations with parents on student decision-making regarding student loans. We asked students, “How much student debt do you expect to have after you complete your college education?” Overall, 88% of respondents expect to graduate with some amount of student debt. The full breakdown:

- 16% expect to graduate with up to $10,000 in student debt

- 14% expect to graduate with $10,001 to $20,000 in student debt

- 12% expect to graduate with $20,001 to $30,000 in student debt

- 9% expect to graduate with $30,001 to $40,000 in student debt

- 8% expect to graduate with $40,001 to $50,000 in student debt

- 7% expect to graduate with $50,001 to $60,000 in student debt

- 7% expect to graduate with $60,001 to $80,000 in student debt

- 6% expect to graduate with $80,001 to $100,000 in student debt

- 8% expect to graduate with more than $100,000 in student debt

- Just 12% indicated that they would not graduate with any student debt

Question 4

The final question was, “If your parent(s) went to college, did they graduate with student debt?” Among all students surveyed, 5232 (66%) indicated that their parents attended college. Among these students, 52% said that their parents graduated with student debt, while 26% said no. Some respondents (13%) weren’t sure if their parent(s) graduated with student debt.

Key takeaways

The good news is that the overwhelming majority (83%) of parents are talking with their children about the advantages and disadvantages of student loans, but it’s disheartening to see that nearly half of these parents (46%) are encouraging their children to take on student debt to pay for college. And among those surveyed whose parents went to college, only about half of those parents (52%) graduated with student debt, yet 88% of the students surveyed expect to graduate with student. While these results are disappointing, they aren’t surprising. According to a 2021 study from Georgetown University, the cost of college has skyrocketed 169% since 1980, yet earnings for young adults between the ages of 22 and 27 have increased by just 19%.

Research conducted by the Economic Policy Institute indicates that wages have stagnated since the 1970’s. Middle-income workers have seen only a 6% increase in their wages since 1979, and low-income workers have actually seen their wages fall 5%. Yet those with the highest wages have seen a 41% increase, starkly demonstrated by the fact that CEOs earn 296 times more than typical workers within their industry.

While it is positive that parents are helping to educate their children about the advantages and disadvantages of student loans, parents also need to ensure that their children understand how to forge an affordable path to college – a path that does not include taking on student debt.

How can students afford college without taking on student debt?

Rather than taking on student loans, students can use debt-free sources to pay for college instead:

- Access federal and state grant aid by submitting the FAFSA.

- Prioritize applying for scholarships with ScholarshipOwl.

- Work part-time during the school year and full-time during breaks. Apply your earnings toward your college education.

- Choose a more affordable path to college, such as by starting at a community college.

Parents and school counselors need to encourage students to apply for scholarships and jobs, NOT loans, enabling students to graduate debt-free. There IS an affordable path to college – for further information, and to start applying for scholarships, visit www.scholarshipowl.com.