The cost of a college education is a top concern for nearly all families. Parents and counselors often tell students to look for scholarships, get a job, and save money to pay for college. But what does their financial blueprint actually look like in today’s world? And when it comes to the scholarship search, how much are they really doing on their own? How much are their parents involved?

ScholarshipOwl wanted to go beyond assumptions and get the real story. We surveyed nearly 20,000 high school and college students to discover how they plan to pay for college, and to understand the role their families play in the scholarship journey. The insights are powerful and will help students, parents, and educators align their expectations and work together to build a debt-free future.

Who Participated in the Survey?

In August 2025, ScholarshipOwl surveyed 19,973 high school and college students on the ScholarshipOwl scholarship platform to learn more about how Gen Z students plan to pay for college.

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarshipsAmong the respondents, 62% were female, 36% were male, and 1% identified themselves as a different gender identity or preferred not to respond to the question. Nearly half (45%) were Caucasian, 23% were Black, 19% were Hispanic/Latino, 6% were Asian/Pacific Islander, 2% were American Indian/Native American and 6% selected “other” or preferred not to respond to the question.

Nearly half (49%) of the respondents were high school students, with the overwhelming majority high school seniors; more than one-third (41%) were college undergraduate students, primarily college freshmen and college sophomores; 7% were graduate students and 4% identified themselves as adult/non-traditional students.

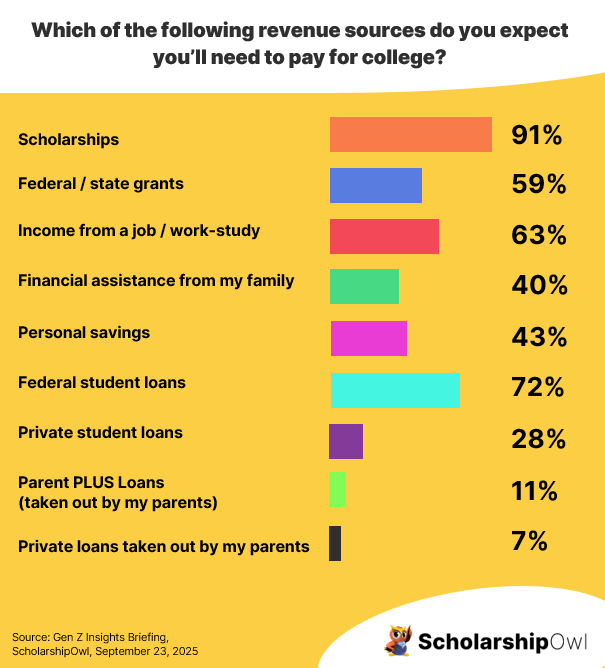

What Revenue Sources Do Gen Z Students Use to Pay for College?

- 91% selected scholarships

- 59% selected federal / state grants

- 63% selected income from a job / work-study

- 40% selected financial assistance from my family

- 43% selected my own personal savings

- 72% selected federal student loans

- 28% selected private student loans

- 11% selected Parent Plus Loan (taken out by my parents)

- 7% selected private loan taken out by my parents

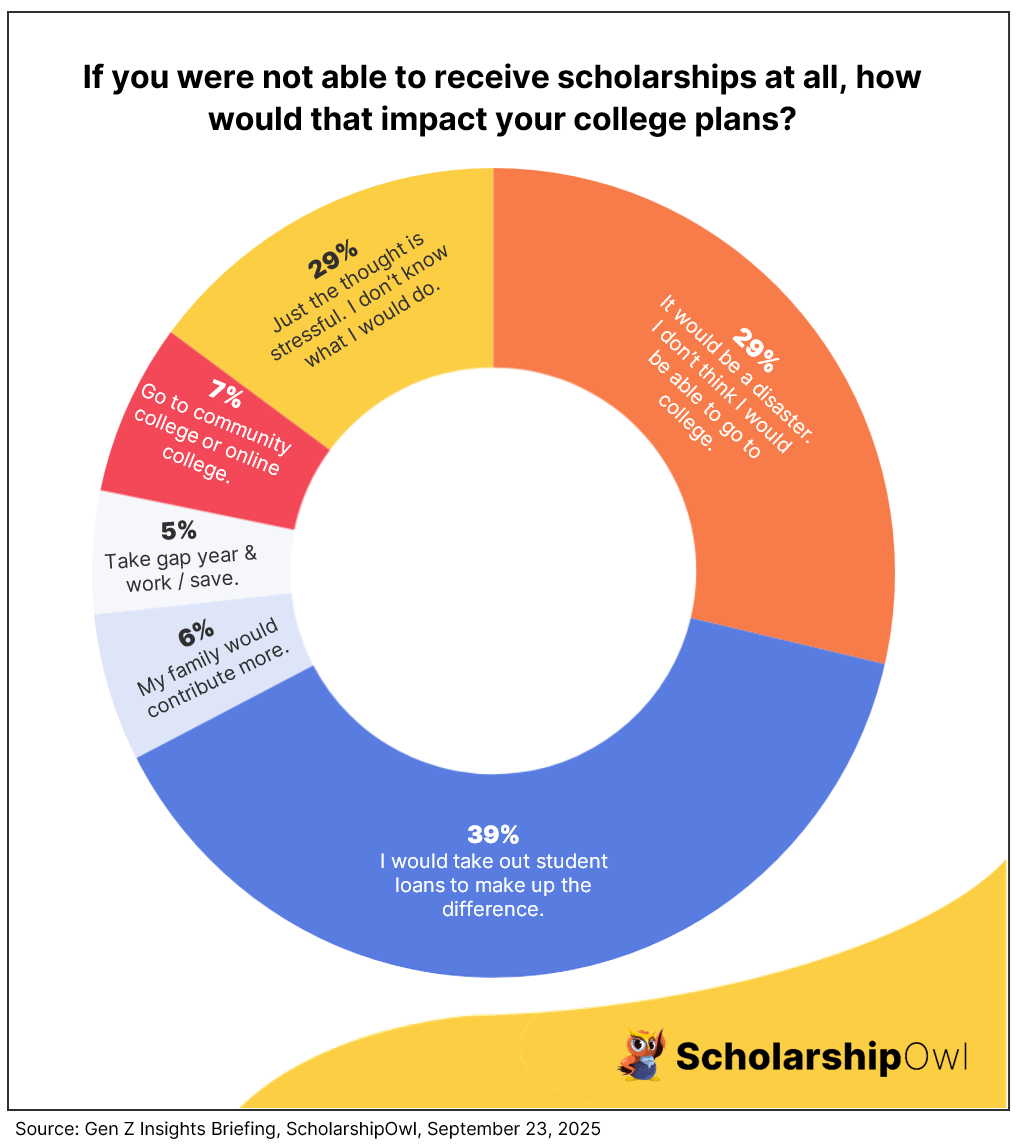

What Is the Impact When Students Don’t Receive Scholarships?

- 29% selected “It would be a disaster. I don’t think I would be able to go to college.”

- 39% selected “It would be disappointing, but I would take out student loans to make up the difference so that I didn’t have to change my plans.”

- 6% selected “It would be unfortunate, but I think my family would just increase the amount they are contributing to cover my out-of-pocket costs.”

- 7% selected “I would roll with it and choose a community college, online college, or a university near my home so that I could live at home rather than in a dorm or apartment.”

- 5% selected “I would take a gap year and work full-time, save my earnings, and go to college next year instead.”

- 15% selected “Just the thought of possibly not getting scholarships is stressful. I don’t know what I would do.”

How Involved Are Parents in the Scholarship Application Process?

- 15% selected “Signed me up for ScholarshipOwl so I can apply for scholarships.”

- 28% selected “Reminded me to apply for scholarships.”

- 2% selected “Completed and submitted entire scholarship applications on my behalf.”

- 12% selected “Suggested scholarship opportunities to me, but then I take it from there.”

- 3% selected “Accessed my ScholarshipOwl account to save scholarships that might be a good fit for me, to check my progress, see what applications have been submitted, check the status of my submitted applications, etc.”

- 5% selected “Helped me by reviewing my scholarship essays / videos and provided feedback.”

- .2% selected “Written 1st draft scholarship essays for me, and then I edit/finalize them.”

- 1% selected “Logged into my email to make sure that I don’t miss any notifications that I’ve been selected for a scholarship.”

- 24% selected “Not helped me at all, but I wish that they would.”

- 14% selected “Not helped and I’m really glad they haven’t.”

Key Takeaways

Our survey provides a clear and sometimes surprising look into how Gen Z plans to pay for college.

Scholarships are the Top Priority, Not a “Bonus”

An overwhelming 91% of students expect to use scholarships to pay for college—more than any other single source, including federal loans (72%) and grants (59%). This shows that for today’s students, scholarships are not just extra money; they are a fundamental part of their financial plan.

The Stakes of Not Earning Scholarships Are Incredibly High

The fear of not getting scholarships is very real. Nearly a third of students (29%) said not getting scholarships would be a “disaster” and could prevent them from going to college at all. Another 39% would have to rely on student loans to make up the difference, and a significant 15% felt so stressed by the thought that they simply “don’t know what I would do.”

Students Want More, Not Less, Parental Involvement

While parental involvement in the scholarship process is often hands-off, the data shows that a significant portion of students crave more assistance. Moreover, while only a small fraction of parents are involved in hands-on tasks like writing essays, a notable 24% of students said they wish their parents would help more. This finding is a powerful signal for parents and counselors that students are looking for guidance and support in their scholarship journey.

Paying for College Requires a Multi-Faceted Strategy

Students are realistic and proactive about how they will fund their education. Their plans are a mix of income from a job (63%), savings (43%), and family contributions (40%), alongside the almost universal reliance on scholarships and federal loans. The data shows that most students see their funding as a combination of multiple sources, not just one.

Your Path to a Debt-Free Future

Our survey shows that students are incredibly motivated and realistic about how to fund their college education. They see scholarships not as a bonus, but as a primary way to achieve their goals and avoid the burden of student loans.

The path to a debt-free degree is a multi-faceted one, and it requires you to be proactive. If you’re ready to turn your financial blueprint into a reality, we’re here to help. Get started today by signing up for your free 7-day trial at ScholarshipOwl.com!