Senior year of high school is a whirlwind of “lasts,” excitement, as well as a healthy dose of nerves about what comes next. You’re balancing challenging academics, extracurriculars and your social life while also working on your college applications. And while all of this is happening, you’re also stressing about the cost of college, and how you’ll manage to pay for it.

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarshipsWith so many changes happening in the world of financial aid and student loans resulting from actions taken by the Trump Administration such as the “Big Beautiful Bill Act” recently signed into law, it’s so important to have a clear roadmap to follow. This checklist is designed to help you stay organized, maximize your opportunities, and navigate your path to college and career success.

Your Senior Year College & Financial Aid Checklist

I. Summer Before Your Senior Year

-

Refine your college list

- Narrow down your potential colleges to a manageable list (5-10 schools is a good target).

- Research their academic programs thoroughly – do they truly align with your interests and potential major?

- Visit the campuses in-person if possible, or take virtual tours if needed.

- With colleges now facing increased accountability for student loan defaults resulting from the “Big Beautiful Bill Act,” research the financial stability of the institutions you’re considering.

- Are they well-established?

- Do they have sufficient funding to overcome potential fiscal impacts?

- Are they committed to the major you’ve selected, or are there rumors of program cuts/consolidations?

-

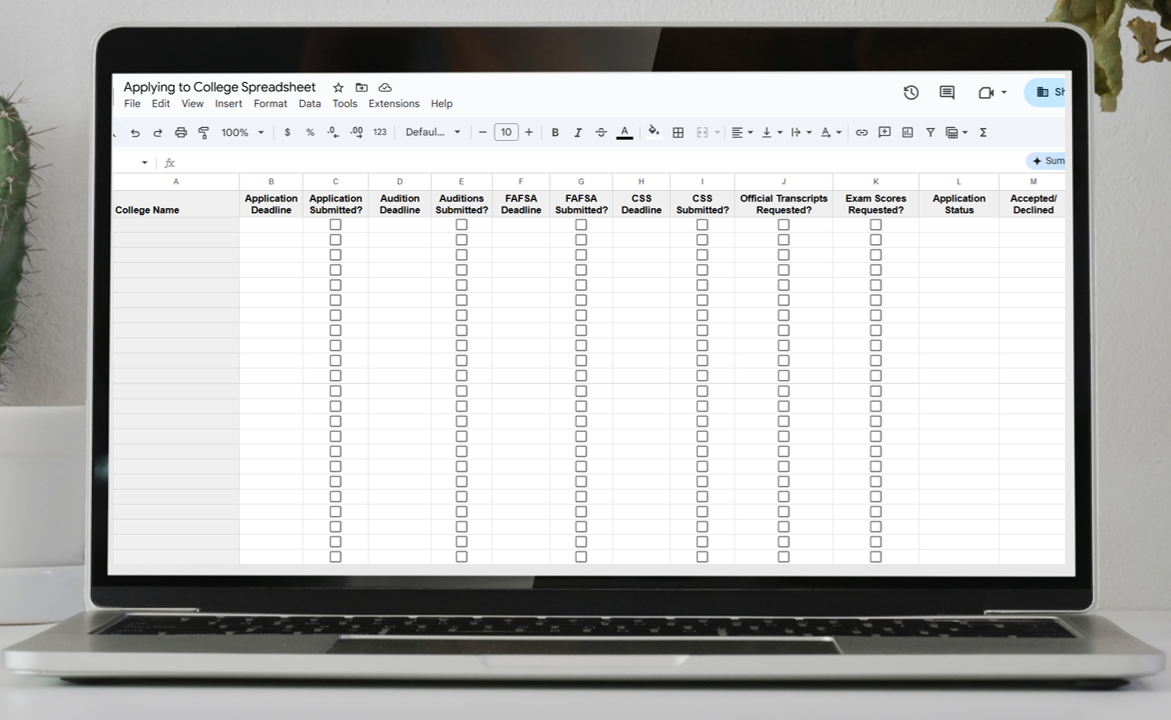

Create a simple spreadsheet to help you organize your college applications

- Use Google Sheets or Excel to create a spreadsheet with rows and columns you can fill in.

- Within your spreadsheet, list the colleges you plan to apply to, along with relevant deadlines for each school – application deadlines, FAFSA deadlines, CSS deadlines for the colleges that require you to submit the CSS Profile, and any other special deadlines that might be relevant to you. For example, if you are a performing arts major and must audition, or if your major requires you to submit a portfolio of work, you’ll want to have columns for those deadlines.

- You can also create columns for requesting that official transcripts be sent, and that official exam scores are sent.

- Here is an example of a spreadsheet I created on behalf of a student majoring in musical theatre:

-

Conquer standardized tests (SAT/ACT)

- Have you taken the SAT and/or ACT yet? If not, and if you are planning to apply to colleges that require one of these exams, make sure you register for an exam asap. If you have already taken the exam but would like to earn a better score, you can register to retake the exam. Dates for first-timers as well as repeat-testers are below:

- Also, remember that some colleges are test-optional, meaning that you can choose whether or not to submit scores. And some colleges are actually test-blind, meaning that even if you’ve taken the SAT or ACT, the colleges won’t consider your scores when making their admission decision. To explore these colleges, check the links below:

-

Draft your college application essays & personal statements

- Most college applications open on August 1st, but their essay prompts are typically available much earlier. Get started now with the Common App, Coalition App, or if you are applying to public universities, you’ll likely need to apply directly through the applicable university application.

- Use the summer to brainstorm ideas, outline, draft, and refine your essays. Get feedback from parents, trusted teachers, or mentors. This is where you can truly showcase your unique personality, personal passions, your achievements, and your community service and work experience.

-

Leverage ScholarshipOwl to apply for as many scholarships as you can

-

- Sign up for your free 7-day trial at ScholarshipOwl.com. Our platform uses AI and machine learning to match you with relevant scholarships, streamlines the application process with a universal application, and even helps you identify low-competition scholarships to maximize your chances!

- Make scholarship applications a consistent priority throughout senior year, and throughout college. Aim to apply for at least 3 scholarships per week, year-round, starting now and continuing throughout your senior year as well as throughout college.

- With recent federal student loan changes, including stricter caps on borrowing and reduced options for future loan forgiveness, securing debt-free funding through scholarships is vital to cover costs.

- ScholarshipOwl offers numerous advantages when applying for scholarships – advantages that not only make it faster and easier to apply for scholarships, but that also give you the tools you need to boost your chances of winning!

- AI-powered weekly scholarship recommendations tailored just for you

- Unparalleled matching system that streamlines your process – no need to do the search and match yourself; we take care of that for you

- One universal application form for all of the scholarships in your match list – all you need to do is complete your profile when you register with ScholarshipOwl, and then we’ll port that data into all of your applications so you won’t have to fill in application forms yourself

- Access sort and filter tools to organize your process

- Leverage our AI Essay Assistant to help you write your initial essay drafts, speeding your application process when applying to essay scholarships

- Apply for scholarships directly from our platform – no need to go elsewhere and have to deal with multiple browser tabs and windows, because you can do it all through ScholarshipOwl

- Leverage our Similarity Engine to quickly apply for similar scholarships

- Track your the status of your submitted applications

- Innovative easy-apply options to let you “set it and forget it” – we can literally be applying you for our “no requirement” and “recurring” scholarships even when you aren’t logged into the platform!

-

Work all summer long to build your profile as well as save money for college

-

- Seek out part-time jobs, volunteer opportunities, or internships. These experiences build your resume as well as demonstrate commitment, leadership, and curiosity – qualities colleges love!

- Paid and unpaid work creates potential opportunities for discussion in your college applications and application essays.

- And of course, any money you earn should be applied towards your college savings account.

-

Plan your senior year courses

- Work with your school counselor to ensure your senior year schedule is challenging and aligns with the academic requirements or recommendations of the colleges you’re applying to.

- Interested in earning college credits while you are still in high school? Explore dual enrollment, concurrent enrollment, and ROP classes at both your high school and your local community college, as well as online options through any community college in your state!

II. Early Fall

-

Finalize your college short list

- Confirm your definite list of schools, paying close attention to early action (EA) and early decision (ED) deadlines if you plan to apply that way.

- Update your spreadsheet that you created in the summer (see above for reference).

-

Request letters of recommendation

- Ask teachers, counselors, mentors, or work/internship supervisors who know you well to write letters of recommendation.

- Provide them with your resume, a list of your activities, and information about the colleges you’re applying to and why.

- Be sure to give them plenty of advance notice so that they can fit the time into their schedule to write you a detailed recommendation that covers your background, skills and experience in a way that truly represents you.

- Sometimes recommenders will ask YOU to draft your own letter of recommendation to help them get started. If you are asked to do this, follow our tips.

-

Polish and submit applications

-

- Finalize all application forms, essays, and supplemental materials. Get one last proofread!

- Submit applications well before their applicable deadlines to avoid last-minute stress or technical glitches.

- Update your spreadsheet throughout this process.

-

Request official exam scores be sent to your chosen colleges

- Request official exam scores be sent directly to all colleges on your list from the relevant test provider.

- Request SAT scores from the College Board

- Request ACT scores from ACT

- Request AP scores from the College Board be sent to colleges if your score earned you college credit – scores of 3 or higher may earn you credit depending on the college.

- Request CLEP scores from the College Board if you have earned a score of 50 or higher on any CLEP exams.

- Request official exam scores be sent directly to all colleges on your list from the relevant test provider.

-

Request official transcripts be sent to your chosen colleges

- Be sure to request official transcripts from all high schools and colleges you’ve attended. Be mindful of the deadlines that each college has set for receiving these materials. Don’t wait till the last minute, as it can sometimes take several weeks for the transcripts to arrive.

- If you attended dual enrollment, concurrent enrollment, or ROP classes where you earned college credit, make sure you request the transcripts from the college that awarded you credit, not just your high school transcript.

-

Tackle financial aid applications

-

- As soon as the Free Application for Federal Student Aid (FAFSA) opens (typically October 1st), complete it! This is your gateway to federal grants, work-study, and federal student loans.

- If any of the private colleges on your list require the CSS Profile, complete that as well.

- Gather necessary financial documents before you start.

- Understand that federal student loan and federal Parent PLUS loan options, including annual and aggregate caps, are now more stringent. This means you’ll need to clearly understand the federal aid available and how it may (or may not) cover your full costs, potentially leading you to explore private loan options, which have different terms and more limited protections. Where possible, if you are considering taking out private loans for college, focus on more affordable colleges, such as community college or an in-state public university in your home state.

-

Maintain scholarship momentum

- Keep applying for scholarships with the ScholarshipOwl platform

- Investigate and apply for scholarships offered directly by the universities you are applying to – some scholarships may be open in early Fall, while others might not be open till later fall or the Spring.

- Reach out to your high school counselor to find out about local scholarships in your community. Your high school might keep a list of such scholarships, and the school may also have a streamlined way to apply for them. Be aware of all deadlines and apply for as many local scholarships as you can!

III. Late Fall / Early Winter

-

Submit all remaining applications and materials

- Double-check every deadline and ensure your applications and all supplementary materials are submitted on time.

-

Monitor college portals and your college email accounts

- Check your college email accounts and college admissions portals frequently. This is how colleges will communicate with you about your application status, missing documents, or important updates. Don’t assume that they will email your personal email account that you used to apply to the college. In most cases, they won’t.

- Be aware that the colleges you’ve applied to might request additional materials, specific to their school. For example, you might be asked to:

- Submit responses to supplemental essay prompts

- Submit a portfolio or audition if you are applying to a creative major

-

Confirm financial aid documentation

-

- Ensure that all your FAFSA and CSS Profile documents have been received and processed by each college’s financial aid office.

- Keep an eye on the financial aid section of each college portal and follow up on any missing items immediately.

- Be aware that you might be asked to submit verification documents as part of your financial aid application. Be sure to submit whatever is requested promptly.

-

Keep scholarship applications flowing

- Continue applying for scholarships with the ScholarshipOwl platform.

- Apply for both university-offered scholarships and local scholarships according to their deadlines.

- Keep up with your weekly application goals.

-

Request mid-year transcripts

- Whether or not the colleges have asked you to submit new transcripts after your grades are in for your fall classes, as long as you are happy with your fall grades, you should send an updated transcript to the colleges. In many cases, even if the colleges haven’t YET asked you to do so, they eventually will. It’s best to get those transcripts out as soon as possible to help the colleges complete your application file faster – a completed file leads to a faster admission decision!

- In the event that your fall grades were not as high as you hoped, it’s best to wait until you are officially requested to send your mid-year transcript.

IV. Spring

-

Review admission offers & financial aid offers

-

- As admission decisions roll in, carefully compare admission offers alongside the financial aid offer from each college.

- If offered university scholarships, review the terms and conditions to be sure you understand the parameters of each scholarship. You may be required to earn a minimum GPA or live on-campus to maintain your scholarship.

- Focus on the “net cost” (sticker price minus grants and scholarships) so that you’ll know what your out-of-pocket cost will be for each college.

- Remember that loans are funds that have to be paid back with interest, so loaned funds are part of your out-of-pocket college cost.

- Given the recent changes in federal student loans, evaluate the loan components of your financial aid packages very carefully. Understand the difference between federal loans (now with stricter repayment options) and any private loans you might be considering to cover gaps. We always recommend that students choose the most affordable path to college when cost is a concern. Avoid attending a college that would only be possible for you if you take out private student loans.

- With new accountability measures for colleges, consider the financial health and long-term stability of the institutions you’re considering as your making your admission decision.

- If you’re struggling to make a final decision, visit your top choices in-person again.

-

Study for AP / CLEP Exams

-

- If you’ll be taking any AP exams or CLEP exams, be sure to study and prepare for those exams.

- The time and energy spent will be well worth the effort because passing these exams earns you college credit.

-

Make your college choice by May 1st

- Once you’ve made your admission decision, formally accept your admission offer and pay any required deposits.

- Decline your other college admission offers so that your admission slot can be opened to other interested students at those schools.

-

Apply for housing and new student orientation

- Complete the application for campus housing if you plan to live on-campus, and pay the required deposit. This deposit will likely be higher than your enrollment deposit.

- Sign up and pay for your new student orientation, typically held in the summer after you graduate from high school.

-

Request final transcripts

- After you graduate, request your final transcript be sent to the college you will be attending.

- Be sure to request transcripts from all high schools and colleges you attended.

-

Request any remaining exam scores

- Have you taken any AP or CLEP exams this year? If so, be sure to request official exam scores be sent directly to your chosen college from the relevant test provider.

- Request AP scores from the College Board be sent to colleges if your score earned you college credit – scores of 3 or higher may earn you credit depending on the college.

- Request CLEP scores from the College Board if you have earned a score of 50 or higher on any CLEP exams.

- Have you taken any AP or CLEP exams this year? If so, be sure to request official exam scores be sent directly to your chosen college from the relevant test provider.

-

Keep applying for scholarships

- Even after you’ve completed your senior year and committed to a college, don’t stop applying for scholarships! Scholarships are available for every year of college, and a few more wins could significantly reduce your out-of-pocket costs for freshman year and beyond!

V. Throughout Senior Year

-

Ask for help and support

- Senior year is challenging for everyone, no matter what your situation. Don’t feel that you have to “go it alone.”

- Ask a parent, guardian or trusted mentor to help you stay on top of your college applications and financial aid applications. You can also reach out to a faculty member at your school, or a friend’s parent to get the support you need.

- Your high school counselor is an invaluable resource for navigating applications, recommendations, local scholarships, and general advice.

- Always have a trusted adult review your college applications before submitting them to make sure that you completed everything correctly.

- It’s also best to have someone else review your application essays to get their feedback.

- If you’re struggling under the weight of everything, talk about it with your parent/guardian, school counselor, or a friend to get the support you need.

-

Grades still matter

- Continue working hard in school all the way until you graduate. Finish your senior year with a GPA you can be proud of.

- Refrain from participating in pranks or other activities that could put your commencement ceremony or grad night at risk.

- Unfortunately, colleges can and do rescind admission offers for significant drops in academic performance or for serious behavioral infractions.

-

Stay involved

-

- Continue your commitment to extracurricular activities and any leadership roles.

- Start thinking about which of these kinds of activities you would like to pursue while in college, as well as what new interests you would like to nurture.

-

Prioritize your well-being through senior year and beyond

- Senior year is stressful. Remember to manage stress, get enough sleep, take breaks, and lean on your support system.

- While this year is challenging, you have so much to celebrate! Be sure to take some time to spend with friends and family. You’ll feel rejuvenated, enabling you to keep going when you get stressed.

-

Build basic financial literacy

- Start learning about budgeting, managing money, and understanding financial statements. This will be crucial not only for college, for throughout the rest of your life.

- By developing good financial habits early, you’ll find it much easier to continue those habits after you graduate.

Senior year is a demanding, exhilarating, and ultimately an incredibly rewarding time. By staying organized, being proactive about your applications and financial aid, and leveraging powerful tools like ScholarshipOwl, you’ll set yourself up for a smooth transition and a successful college experience!