Most students know that the way to apply for federal student aid is through the FAFSA – the Free Application for Federal Student Aid. But if you have filed the FAFSA in previous years, it is important to know that the FAFSA is changing.

Some of the changes are fairly minor, and have already implemented in the last couple of years – but the FAFSA that will be opening soon will be very different from the previous FAFSA. Many of the changes are positive, especially for students with significant financial need; however, middle-income students may find that the changes reduce their opportunity to obtain federal grant aid. Checkout our FAFSA FAQ below to find out everything you need to know!

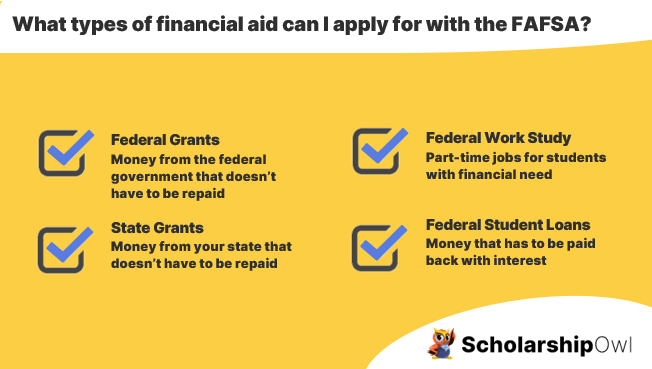

What type of financial aid can I qualify for with the FAFSA?

The fastest path to earning scholarships

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarshipsWhen you submit the FAFSA, you’ll be submitting financial data that will determine your eligibility for each of the following:

- Federal grants – money you can use to pay for college that doesn’t have to be paid back. Available grants include the Federal Pell Grant, the Federal Supplemental Educational Opportunity Grant (FSEOG), Iraq and Afghanistan Service Grant, Teacher Education Assistance for College and Higher Education (TEACH) Grant.

- State grants – if your state offers grants for college, your state will use the FAFSA to determine if your eligibility for those grants

- Federal work-study – part-time jobs for undergraduate and graduate students with financial need

- Federal student loans – money you can borrow to pay for college, but that you must pay back with interest

Why has the FAFSA changed?

Changes were made to the FAFSA for several reasons:

- To simplify and streamline the FAFSA application process

- To improve accuracy of the data submitted

- To reduce the likelihood of having to complete and submit verification documents

- To ensure that federal grant aid is targeted to the students with the greatest financial need

Will these changes reduce the number of students who qualify for a federal Pell Grant?

No! The good news is that these changes are expected to increase the number of students who receive a federal Pell Grant. In fact, it is expected that 1.5 million MORE students will receive the maximum Pell Grant as a result of these changes, bringing the total number of students who receive the maximum amount to 5.2 million students! This is because Pell Grant eligibility is now linked to family size and the federal poverty level, helping to significantly expand access to federal student aid. In addition, because the FAFSA application will be faster and easier to complete, it is hoped that many more families will decide to complete and submit the FAFSA.

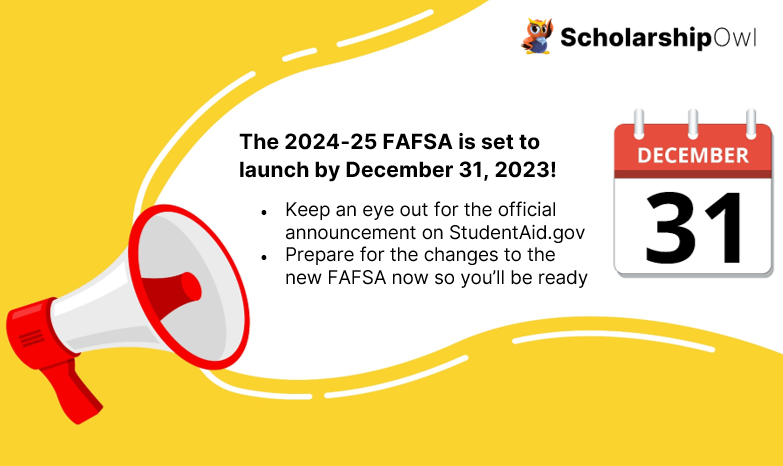

When can I submit the FAFSA?

In recent years, the FAFSA has opened on October 1st, but for the 2024-25 FAFSA, you won’t be able to start your application until late-December. Currently, the FAFSA is set to launch by December 31, 2023, but it is possible that it may be delayed until January.

Will the new FAFSA form be easier or more difficult to complete than in previous years?

The new FAFSA is simpler and easier to complete, which is great news! There are now just 36 questions instead of 108! In fact, depending on your family and income situation, you might only need to complete 18 of the 36 questions!

Why is the new FAFSA so much faster to complete? How is it possible that there are so few questions now?

The new FAFSA requires automatic transfer of IRS data to the FAFSA. This has been available on the old FAFSA for several years, but now it is required. Because the federal income data is transferred automatically reduces the number of questions that need to be asked on the FAFSA form. It also reduces the chance for error, and will reduce the likelihood that students will be asked to complete verification documents later on.

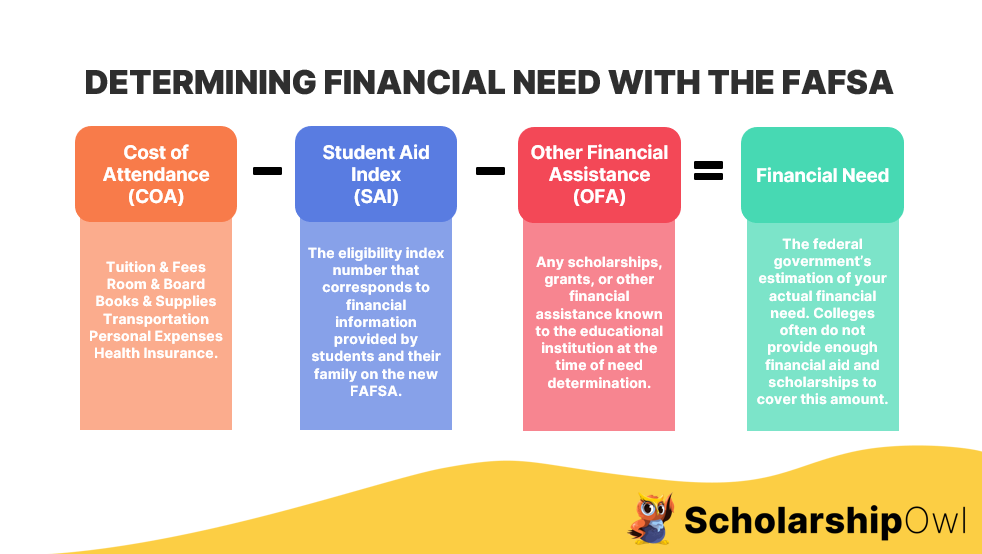

How is financial need determined with the new FAFSA?

To determine your financial need, the college’s financial aid representative uses a simple equation. With the old FAFSA, they subtracted your “Expected Family Contribution” (EFC) from the total Cost of Attendance (COA). The result was your financial need. But with the new FAFSA, the way that financial need is determined has changed.

- The new FAFSA no longer uses the term “Expected Family Contribution.” Students and families found this terminology to be confusing, so now instead of EFC, the new FAFSA uses the term “Student Aid Index” (SAI). The SAI is an eligibility index number that a college financial aid officer uses to determine how much federal student aid the student may receive if the student attends the school. This number results from the information that the student and their family provides in their FAFSA form. The SAI functions in a similar way to the EFC.

- When calculating financial need, the financial aid officer subtracts the SAI from the COA, and ALSO subtracts any Other Financial Assistance (OFA), to arrive at the student’s financial need. Examples of OFA could be external scholarships or grants, for example, or other financial assistance that the financial aid officer knows about at the time they are determining financial need. So the NEW FORMULA is COA – SAI – OFA = Financial Need.

How will I know if I’m eligible for the federal Pell Grant through the FAFSA?

Once you submit your FAFSA, you’ll receive your Student Aid Indext (SAI) number. This replaces the old Expected Family Contribution (EFC) number. One thing that is different between the old EFC and the new SAI: The SAI number may actually be a negative number. If your SAI is between -1500 and 0, you’ll qualify to receive the maximum Pell Grant of $7395. If your SAI number is higher than 0, you may still qualify for a Pell Grant, based on your family size, adjusted gross income, and poverty guidelines, but the amount you receive may be less than the maximum Pell Grant.

My parents don’t live together. Do both of my parents need to provide their financial data for the FAFSA?

For students who’s parents are divorced, separated or never married and do not live together, only one parent needs to complete the FAFSA. In the past, the parent who the student lived with the most needed to provide their financial data on the FAFSA; however, with the new FAFSA, the parent who provides the most financial support to you is now responsible for providing their financial data. Note that if this parent has remarried, the stepparent’s income, assets and dependents must also be reported on the FAFSA.

I’m from a single-parent household. Is it likely that I’ll qualify for federal need-based aid?

For dependent students with just one parent, OR independent students who are single parents themselves, there is some good news – the new FAFSA may enable you to have greater eligibility for need-based aid. So this is a potentially positive change, but remember, even though students in these situations may have increased eligibility, it doesn’t mean that you WILL qualify for federal grants. It just means that you MAY be eligible, depending on your household income and assets.

My sibling and I are both going to be in college at the same time. Are we likely to qualify for federal need-based aid?

One big change that will effect families with multiple students in college at the same time is that the new FAFSA will no longer allow you to “benefit” from this. In other words, if you and your sibling(s) are in college at the same time, the FAFSA no longer considers that in your federal financial aid determination. For low-income families, this won’t have significant impact; however, for middle-income and upper-income families, you may find that you have less eligibility for federal need-based aid.

What happens after I submit the FAFSA?

If you have recently applied to colleges, be sure to keep an eye on the portals for ALL of the colleges you’ve applied to. You’ll need to check the financial aid section of your portals to see if you need to submit any additional information or verification documents. Expect to wait awhile for each of the colleges to present you with their financial aid offer. While this has always been a challenging wait, it will be more so now since the FAFSA is new, and the calculation process has changed, so it’s a learning curve for everyone, including financial aid officers. Note that many colleges won’t work on your financial aid file until AFTER they have sent out an offer of admission – which can be frustrating. Private and out of state colleges do sometimes offer a scholarship at the time an admission offer is made, but even then, they may not have yet determined whether or not you will receive any state or federal grant aid.

If you are currently attending college, check with your financial aid officer to find out if you need to submit any additional information. Be aware that because the federal financial aid formula has changed, that the amount of federal aid you receive in the 2024-25 school year may be different that what you received this year.

What type of financial aid will I see in my financial aid offer?

Your financial aid offer might include a combination of federal and/or state grants, student loans, work study, scholarships, etc. Or it might include only one or two of those. Many students are offered loans only – it all depends on your Student Aid Index (SAI) number, as well as how much funding is available. If you recently applied to colleges, be sure that you understand your full financial aid and scholarship package from each college before accepting an offer of admission. If you have questions, follow-up with the financial aid office of the college(s) you are considering.

I still have questions about the FAFSA. Where can I find additional information?

To find out more about the new FAFSA, visit the federal student aid website. You can also contact the financial aid office at your college, or at the college you are applying to.

Help! I don’t think I can afford college! What can I do?

Many students worry that they won’t be able to pay for college. But it IS possible to go to college without taking on the burden of student debt. Here’s how:

- Access federal and state grant aid by submitting the FAFSA.

- Prioritize applying for scholarships with ScholarshipOwl.

- Work part-time during the school year and full-time during breaks. Use your earnings to pay for college.

- Choose a more affordable college, such as by starting at a community college.

Remember: Always apply for scholarships and jobs, NOT loans, so you can graduate debt-free. There IS an affordable path to college – for further information, and to start applying for scholarships, visit www.scholarshipowl.com.