The Free Application for Federal Student Aid (FAFSA) is an important step to help you obtain funds for college. While thinking about completing the FAFSA may feel a bit stressful, it’s actually a lot easier than you might think! So let’s demystify the FAFSA, and walk you through everything you need to know!

FAFSA Basics

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarships

The FAFSA is a free application that current and prospective college students can complete to determine their eligibility for need-based financial aid. This single application is the gateway to a wide range of aid, including federal Pell Grants, work-study, and federal student loans. Many states and colleges also use the FAFSA to determine eligibility for their own aid programs.

The FAFSA opens on October 1st of each year for the following school year and typically closes on June 30th. However, many colleges and states have their own earlier deadlines, so it’s critical to check the deadlines for every college you’ll be applying to. You’ll also want to submit your FAFSA as soon as you can after it launches on October 1st, as some aid is distributed on a first-come, first-served basis.

Who is Eligible to Submit the FAFSA?

Any U.S. citizen or eligible non-citizen who is a high school senior, a current college student, or a graduate student can submit the FAFSA.

Who is an “Eligible Non-Citizen”?

An eligible non-citizen is someone who is not a U.S. citizen but who already is a U.S. national, a U.S. permanent resident (green card holder), or has a specific immigration status such as a refugee, asylum granted, Cuban-Haitian Entrant, or a parolee.

The FAFSA is not available to undocumented students or most international students. If you fall into these categories, while you won’t be able to submit the FAFSA, you may still be eligible for other financial aid through certain state-specific programs (like the California Dream Act) as well as scholarships from businesses and organizations like what you’ll find on the ScholarshipOwl platform, as well as scholarships offered by universities.

Why All Eligible Students Should Submit the FAFSA

Regardless of your family’s income status, every eligible student should submit the FAFSA. Many students assume they won’t qualify for need-based aid if their family’s income is too high, but the only way you’ll know for sure what you’ll qualify for is by submitting the FAFSA.

In addition, even if you are unable to qualify for federal grant aid, you may be able to qualify for federal work-study, or for grants offered by your state. And if you might want to take out federal student loans, you’ll need to submit the FAFSA to be able to do so.

You also never know when family circumstances might change, and a submitted FAFSA ensures you have access to a full range of aid options.

Recent Updates to the FAFSA

In the past few years, the FAFSA has undergone a significant transformation to make the process easier and more intuitive for families. The new FAFSA is shorter and uses more streamlined language, making it easier for students and parents to complete. Another big change relates to the replacement of the term “Expected Family Contribution (EFC)” with the new Student Aid Index (SAI). More about this below!

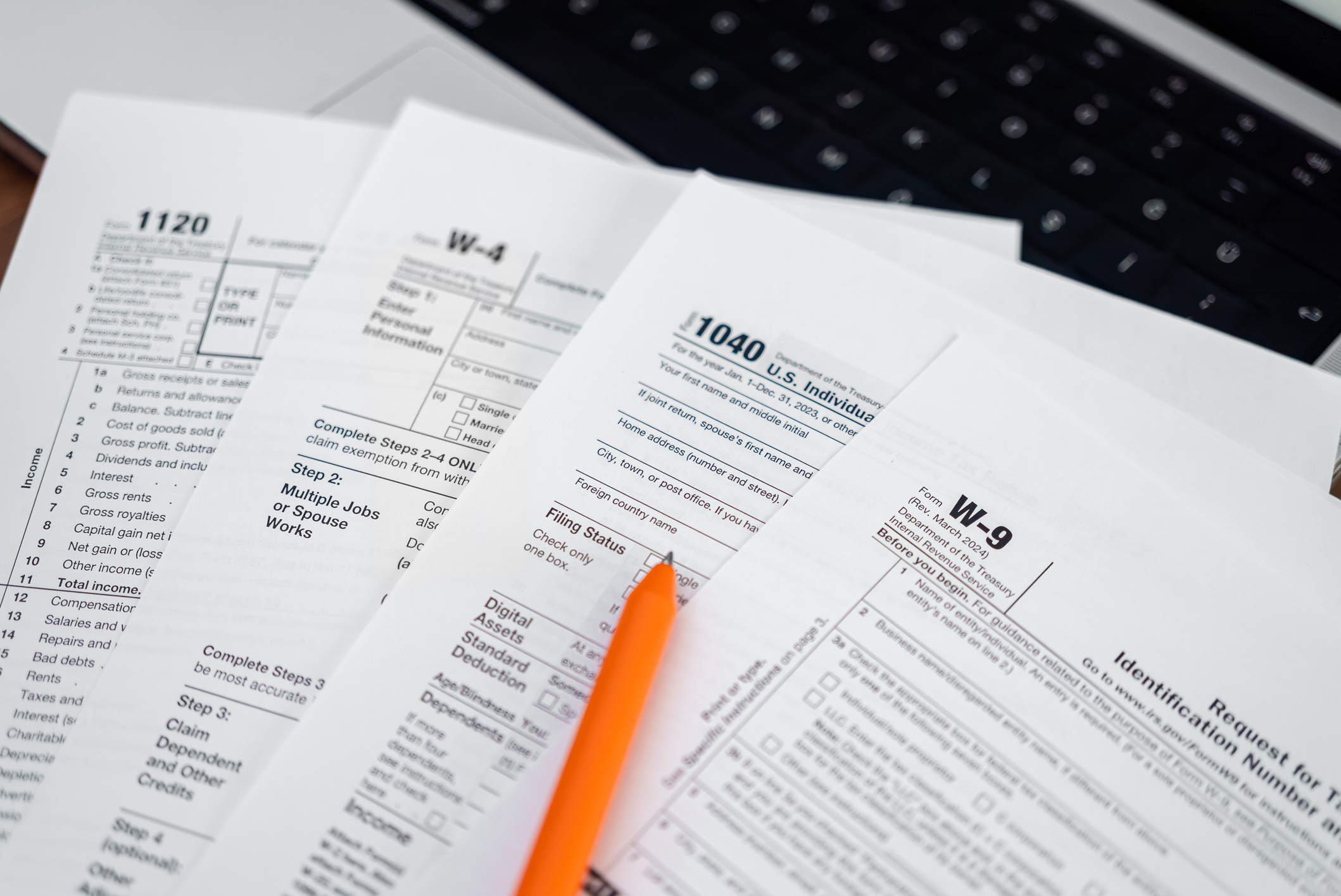

What Documents Do You Need When Preparing to Submit the FAFSA?

Before you sit down to complete the FAFSA, have the following documents on hand to make the process go smoothly:

- Student and Parent FSA IDs, if you already have them: These are usernames and passwords used to electronically sign the FAFSA. If you don’t yet have an FSA ID, you can create them on the Federal Student Aid website.

- Social Security numbers for the student and parents. Sometimes it can be a bit confusing to determine which parent(s)’ information needs to be provided on the FAFSA, as families can differ in so many ways. Find out more to ensure you know what parental financial information is needed on your FAFSA.

- Federal tax information for the year “prior prior” – in other words, your tax data (W-2s, 1040 forms, etc.) from 2024 if you are submitting the FAFSA for the 2026-27 academic year.

- Bank statements and records of investments and other assets.

- Records of untaxed income.

Who Is a Dependent vs. Independent Student on the FAFSA?

For the FAFSA, a student is considered dependent unless they meet very specific criteria. This means the vast majority of undergraduate students will need to provide parent information, even if they don’t live with their parents or their parents don’t provide financial support.

You are considered an independent student on the FAFSA if you can answer “yes” to at least ONE of the following questions:

- Will you be 24 or older by January 1st of the school year for which you are applying for financial aid?

- Are you married as of the day you submit your FAFSA?

- Do you already have a bachelor’s degree and will now be working toward a master’s or doctorate degree?

- Do you have children who receive more than half of their support from you?

- Are you a veteran of the U.S. Armed Forces?

- At any time since you turned age 13, were both of your parents deceased, were you in foster care, or were you a ward of the court?

- Are you an emancipated minor or are you in a legal guardianship as determined by a court?

- Are you an unaccompanied youth who is homeless or at risk of being homeless?

If your answer is “no” to all of the above questions, you are considered a dependent student.

My Family Situation is Unique and I’m Not Sure What to Do

My Parent/Guardian is Unable or Unwilling to Complete the FAFSA

This is a challenging and sensitive situation. It is important to understand that in the event that your parent(s) are unable or unwilling to complete the FAFSA, that in and of itself will not mean that you are an independent student. Unless you can answer “yes” to at least one of the questions above, you will still be considered a dependent student on the FAFSA.

If you are a dependent student but your parent is unwilling or unavailable to complete the parent portion of the FAFSA, you can still submit the form without their information. However, you will be flagged by the system and will not be eligible to receive any federal or state grants. You will, however, remain eligible for federal student loans. In this situation, it is crucial to speak with your high school counselor or the financial aid office at your target college to see if they feel you might qualify for a “dependency override.” Dependency overrides are a rare but possible exception for students who have unusual circumstances. See details about this below in the “How to Appeal Your Financial Aid Offer” section.

My Parent Isn’t a U.S. Citizen

If you are a U.S. Citizen or eligible non-citizen, you can submit the FAFSA, even if one or more of your parents are not a U.S. Citizen. In fact, your parents’ citizenship status will not affect your eligibility for federal student aid.

If your parents are not U.S. Citizens, they can still create a FAFSA account to access and complete their part of your FAFSA application. If they don’t have a social security number (SSN), they can select the box that indicates they don’t have an SSN. If they have a Taxpayer Identification Number (ITIN), they can input that in a separate ITIN field on their part of the FAFSA form. If they don’t have an ITIN, they can leave that question blank.

If your parent lives outside the United States and files taxes in their country of residence, they will need to manually input their financial information from their foreign tax return into the FAFSA. If your parent lives in and files taxes with a U.S. territory or a Freely Associated State, and files a U.S. tax return, you’ll want to contact the financial aid office at the college you attend or plan to attend to find out which tax information your parents need to provide.

Other Common Pitfalls & Confusion

The FAFSA can be tricky, but a little bit of awareness can help you avoid common errors:

- Don’t miss the deadlines. Make sure you know and adhere to the earliest deadlines for your schools and state. Try to apply early within the FAFSA filing period so that if you have questions, you’ll have time to get assistance to ensure your FAFSA is accurate.

- Use the correct tax year. The FAFSA asks for financial information from the “prior-prior year” (for example, for the 2026-27 school year, you would use 2024 tax information).

- Double-check your information for accuracy. Inaccurate information will delay your FAFSA results, and/or could give you results that are incorrect.

- Don’t pay for help. The FAFSA is free, and there are many free, legitimate resources available to help you.

FAFSA Strategies: Fact vs. Fiction

The FAFSA now requires you to utilize the IRS Retrieval System to automatically populate your financial data into the FAFSA form. As such, there really isn’t any flexibility when it comes to how to share your financial data.

There are many businesses and consultants who claim they can help you “maximize” your FAFSA results for a fee. The reality is that the FAFSA is a formulaic application, and there are no secret tricks or strategies to get more money. The best strategy is simply to complete the form accurately and on time, using the free tools and resources available to you. Be wary of any service that charges you to fill out the FAFSA, as these are often scams.

What Happens After You Submit the FAFSA?

Within a few days of submitting the FAFSA, you’ll receive a FAFSA Submission Summary. This document summarizes all the information you provided on your FAFSA and will list your Student Aid Index (SAI). Make sure to review this summary carefully for any errors. The Department of Education will then send your information to the colleges you listed on your application.

What is the Student Aid Index (SAI)?

The SAI is a number that represents a student’s eligibility for financial aid, and it has replaced the old EFC (Expected Family Contribution) number. Unlike the EFC, the SAI is a more streamlined calculation that can go as low as -1,500 (whereas the EFC’s lowest number was 0). The SAI is calculated based on a formula that considers the income and assets of the student and, if applicable, their parents. Colleges use the SAI to determine how much aid to offer.

Here’s what your SAI number means for your eligibility for federal grant aid (the maximum Pell Grant for 2025-2026 is $7,395):

- If your SAI is between -1,500 and 0, you are eligible to receive the maximum Pell Grant.

- If your SAI is greater than 0, you may still be eligible to receive a Pell Grant, but it will be less than the maximum amount.

- If your SAI is $14,790 (which is double the maximum Pell Grant) or higher, you are not eligible for a Pell Grant.

When to Expect Financial Aid Offers

Colleges will begin sending out financial aid offers in the spring, typically after you’ve been accepted. Your financial aid offer may include grants, scholarships, work-study, and/or loans. Compare the offers you receive, looking at the mix of aid and the overall “net cost” of attendance.

How to Appeal Your Financial Aid Offer

Appeal Due to a Change in Financial Circumstances

If your family’s financial situation has changed dramatically since you filed your “year prior-prior” taxes and/or since filing the FAFSA, or if you feel your offer doesn’t accurately reflect your family’s circumstances, you have the right to appeal. This is known as a “professional judgment appeal.” You can initiate this process by contacting the financial aid office at the college and explaining your situation, providing them with any relevant documentation to support your case.

Valid reasons that could qualify you for a professional judgement appeal:

- You or a parent experienced job loss or a reduction in pay

- Your parents divorced or separated after the FAFSA was filed or after your “year prior prior” taxes were filed

- Death of your parent or spouse

- You or your parent incurred costs due to a natural disaster

- One-time or non-recurring income that inflated your income or your parent’s income on the FAFSA

- High medical or dental expenses that were not covered by insurance

- High dependent-care costs

- Other changes in income or assets that may impact your eligibility for federal financial aid

- Tuition expenses at a private elementary or secondary school

Dependency Override Appeal

For dependent students who do not meet the federal requirements to file as an independent student as described on the FAFSA form, there is a possibility that you may be able to qualify for a Dependency Override. If successful, you would be able to be considered as an independent student for financial aid purposes. Note that Dependency Overrides are rare, and only allowed under special circumstances such as:

- Abusive family environment

- Abandonment by your parent(s)/guardian(s)

- Incarceration or institutionalization of both parents

- An unsuitable household requiring legal intervention

- Severe estrangement from parents

- Parent mental incapacity

- Death of a parent/guardian

If you feel you may qualify for a Dependency Override, reach out to the financial aid office at your college or the college you plan to attend, and ask them to explain the process of applying for a Dependency Override. Also be aware that you’ll need to provide evidence that demonstrates how and why you qualify. Evidence may include:

- A written personal statement from you that explains your circumstances

- Supporting documentation, such as:

- Legal documents

- Death certificate for a deceased parent

- Records from a social service agency or shelter

- Letters from professionals that verify your stated circumstances (social worker, mental or medical health professional, clergy member, school counselor, school official, law enforcement officer, etc.)

What If I Don’t Qualify for an Appeal But I Was Only Offered Loans?

It’s always disappointing if you discover after submitting the FAFSA that your financial aid offer consists solely of loans. Federal and state financial aid is designed to help the students with the most significant financial need. Due to limited funding, not every student will qualify for grants. That said, remember that even for students who qualify for federal or state grants, the amount offered is rarely enough to cover all college costs. This is why it is so important for students to be proactive in seeking out multiple sources of funds for college. And it’s also crucial that you not wait to receive your financial aid offers to take those steps. Because if you wait, you’ll miss out on funds that could have been yours!

Prioritize Applying for Scholarships

Similar to grants, scholarships are “free money” that you don’t have to pay back. There are three primary sources of scholarships:

-

University Scholarships

Apply for scholarships offered by the college you are attending or the ones you are applying to. Colleges offer both merit scholarships and need-based scholarships. So whether or not you qualify for grants through the FAFSA, you may qualify for university scholarships.

-

Local Scholarships

Local scholarships often have far less competition. Ask your high school or college counselor to find out more.

-

Scholarships Offered by Businesses and Organizations

This is where ScholarshipOwl comes in! At any given time, we have at least $500,000 in active and available scholarships on our AI-powered scholarship platform! Be sure to apply year-round, aiming for at least three scholarships per week to maximize your chances. If you aren’t yet a ScholarshipOwl member, start your free 7-day trial at www.scholarshipowl.com!

Get a Job and Save your Earnings for College

Don’t overlook the power of earning money. Working a part-time job during school and full-time during the summer can provide income to help pay for books, supplies, and living expenses, reducing your reliance on loans. Your financial future is in your hands, and with a proactive approach, you can still achieve a debt-free or low-debt college experience.

Add a Side Hustle

Need some extra money to help you when money is tight? A side hustle can really make a difference! When might money be especially tight?

- At the beginning of the semester when you need to buy books and supplies for classes

- The holidays, when you’ll need to buy or make gifts for your family and friends

- At the end of the semester when your financial aid is running low

- When you have to pay to join a sorority or fraternity

- When you need to book travel to get yourself home or back to school

What’s great about a side hustle is that you control your own hours, so when money is tight, you’re open for business. And when you’re cramming for exams or have a really challenging class schedule, you can simply choose not to take on any side hustle work.

Side Hustles that Can Get You Through

- Drive for a ride-share app

- Deliver groceries or meals

- Nanny/babysit

- Pet-sitting and/or dog-walking

- Freelance design projects

- Creating and selling your crafts on Etsy

- Handyperson tasks

Where to Get Help With Your FAFSA Questions

You don’t have to navigate the FAFSA alone! Here are some excellent resources:

- Federal Student Aid Website: This is the official source for all FAFSA information.

- You can call the FAFSA hotline for assistance with your application: 1-800-4-FED-AID (1-800-433-3243)

- Your high school counselor can provide personalized guidance and support to help you navigate the FAFSA.

- The financial aid officers at your target schools are experts in the process and can answer any questions you have.

FAFSA is Just One Step Toward a Debt-Free College Experience

Submitting the FAFSA is the first and most important step toward funding your college education. With preparation and the right information, the FAFSA is a manageable task that can unlock thousands of dollars in financial aid. Remember, don’t let the process intimidate you. Be proactive, get your documents in order, and submit the FAFSA as early as you can to give yourself the best possible chance at a debt-free degree.

But it is important to plan on having to utilize multiple sources of funds to be able to graduate debt-free:

- Need-based federal and state grants, if you qualify

- Scholarships

- Income from a job

- Income from a side hustle

- Your personal savings

- Financial assistance from family

By focusing on multiple sources of funds, you’ll be able to forge an affordable path to college that doesn’t rely on loans. To find out more, visit www.scholarshipowl.com!