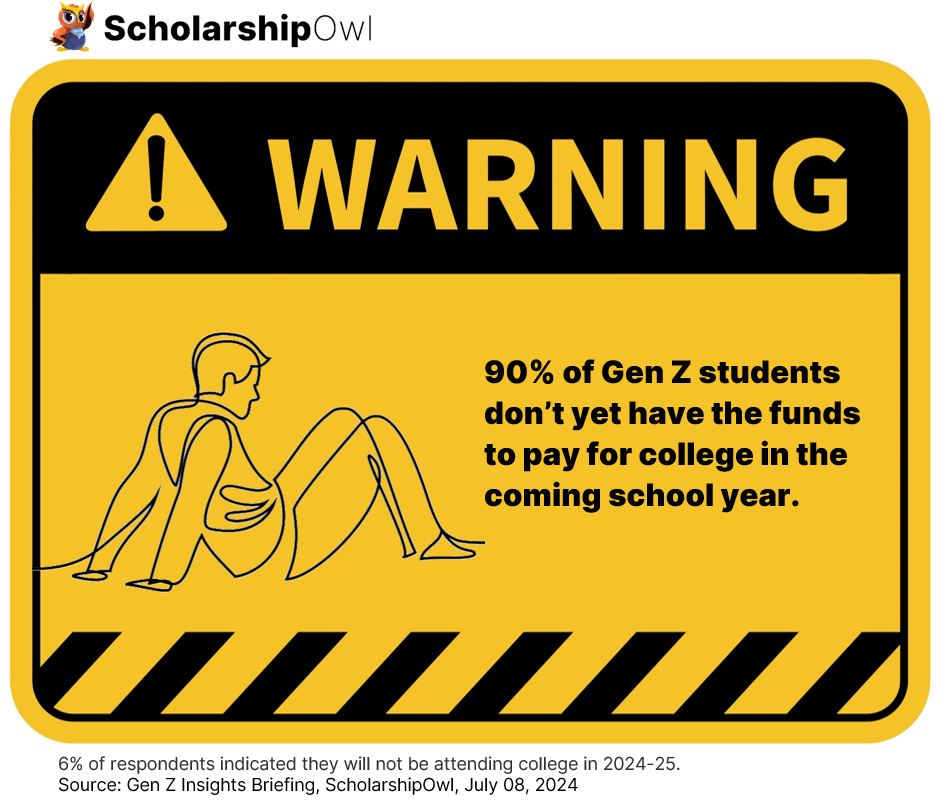

In June 2024, ScholarshipOwl conducted a survey to find out more about how well Gen Z students are prepared to pay for college in the 2024-25 school year. We were glad to see that most college-bound students will be relying on multiple funding sources to pay for college; however, despite those multiple sources, 90% of respondents reported that they don’t yet have enough funds to pay for college in 2024-25. With the fall tuition bill dropping in August, the unfortunate reality is that the majority of students will turn to student loans to make up the difference. Many students may also reconsider their current college plan, and look for alternate options.

Who participated in the survey?

In June 2024, ScholarshipOwl surveyed high school and college students on the ScholarshipOwl scholarship platform to learn more about their financial preparedness for college. A total of 9,097 students responded.

Among the respondents, 64% were female, 35% were male, and 1% identified themselves as other. Nearly half (42%) were Caucasian, 29% were Black, 17% were Hispanic/Latino, 6% were Asian/Pacific Islander and 5% identified as other.

The fastest path to earning scholarships

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarshipsNearly one-third (32%) of the respondents were high school students, with the vast majority high school seniors; over half (55%) were college undergraduate students, primarily college freshmen and college sophomores; 9% were graduate students and 4% identified themselves as adult/non-traditional students.

Survey questions

Topic 1 – Will you be attending college in 2024-25?

We began the survey by asking a qualifying question, so that we could ensure that most of the respondents were planning to attend college in the coming school year. We asked students, “Will you be attending college in 2024-25?”

- 93% said yes

- 7% said no

Topic 2 – How Gen Z students are planning to pay for college

Our next question was, “Which of the following sources do you plan to use to pay for college in 2024-25? Select all that apply.”

- 52% plan to use federal grant(s) offered in their financial aid award

- 35% plan to use state grant(s)/scholarship(s) offered in their financial aid award

- 41% plan to use university grant(s)/scholarship(s) offered in their financial aid award

- 45% plan to use external scholarship(s) they received through ScholarshipOwl or other sources

- 12% plan to use federal work-study offered in their financial aid award

- 55% plan to use their own income from a job and/or savings

- 32% plan to use financial support from their family

- 40% plan to take out federal student loans

- 16% plan to take out private loans

- 6% stated that they won’t be attending college in 2024-25

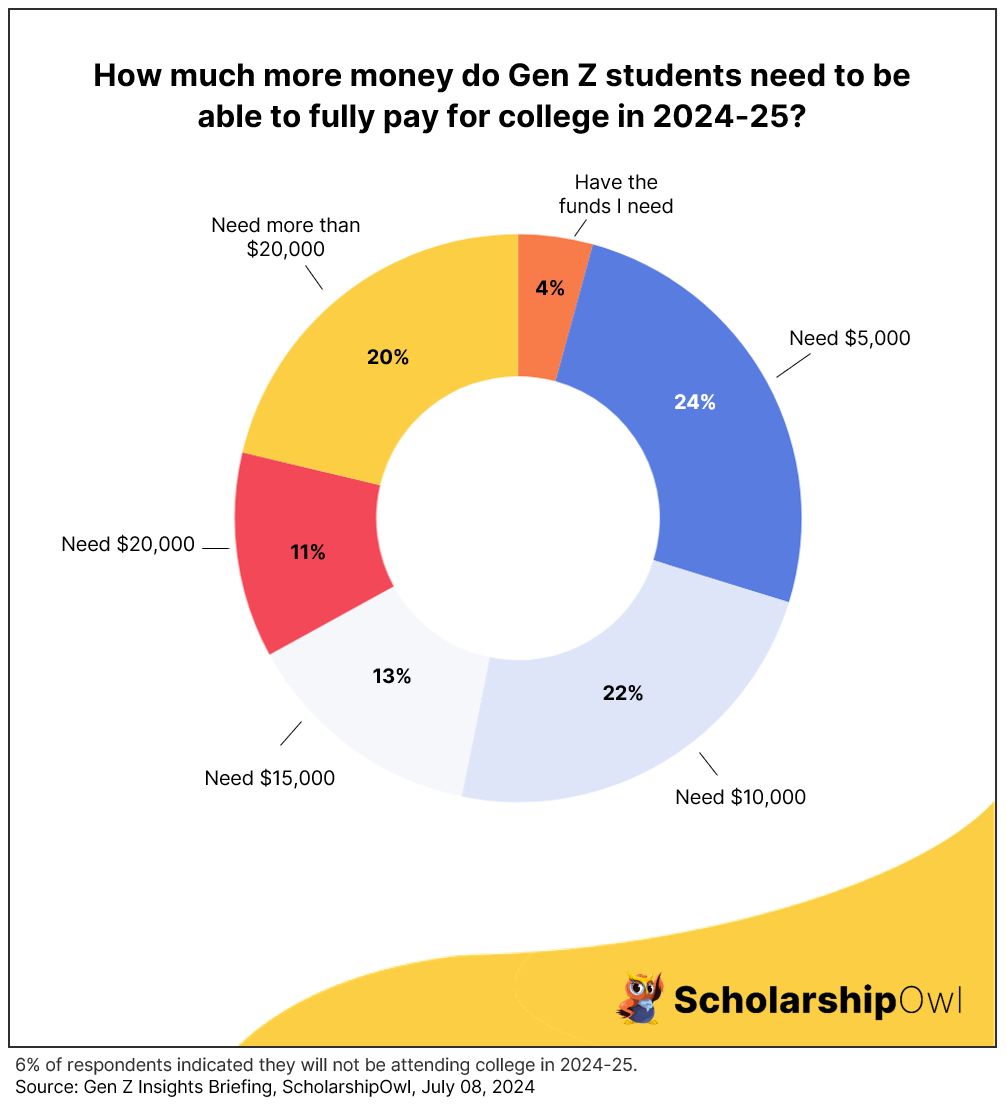

Topic 3 – Availability of the funds needed for college

We then asked, “How well prepared are you financially to pay for college in 2024-25?”

- 4% said they already have enough funds to be able to pay for college in 2024-25.

- 24% said they need to come up with another $5,000 to be able to fully pay for college in 2024-25

- 22% said they need to come up with another $10,000 to be able to fully pay for college in 2024-25

- 13% said they need to come up with another $15,000 to be able to fully pay for college in 2024-25

- 11% said they need to come up with another $20,000 to be able to fully pay for college in 2024-25

- 20% said they need to come up with more than $20,000 to be able to fully pay for college in 2024-25

- 6% said they won’t be attending college in 2024-25

Key takeaways

The results of this survey were eye-opening. Just 10% of respondents have the funds needed to pay for college in 2024-25, yet they will need to be ready to pay their fall tuition bill in August. Given this, it is likely that the majority of these students will need to rely on student loans to make up their gap in funding, and/or that many of them may need to consider an alternate college plan, such as starting at a community college, or taking a gap year or more to be able to work and save for their education. Many of these students may also be hoping that their family can provide additional financial support.

Despite this gloomy picture, there are some positives arising from this survey:

- The majority of students understand that they will need to access multiple funding sources to be able to pay for college.

- Well over half of the respondents will be utilizing grants and scholarships to help pay for college – these are funding sources that don’t need to be repaid. And more than half also plan to use their own income from a job and/or savings to help pay for college.

- All respondents are actively engaged in seeking private external scholarships through the ScholarshipOwl platform. As such, these students understand that they need to participate in the process of seeking financial sources to pay for their own education.

How can students ensure they can afford college in 2024-25 and beyond?

There are a number of steps that students can take to ensure they have an affordable path to college:

- Prioritize applying for scholarships with ScholarshipOwl. Apply for scholarships all summer long, and throughout the school year.

- Work part-time during the school year and full-time during breaks. Save your earnings to use for your college education.

- Submit the FAFSA every year for every year that you’ll be in college, beginning in your senior year of high school, and continuing to submit it annually until you complete your college education. The FAFSA opens on October 1st each year.

- When you receive your financial aid offers, compare them and focus on choosing the most affordable college. If your first-choice school offered you a less financial aid and scholarships than other schools offered, contact your preferred school to see if you can negotiate your offer to one that is more affordable for you.

- Always consider starting at a community college, which offers a truly affordable option – and don’t forget that community colleges also offer federal and state grant aid, and they also offer scholarships. So even if you are planning to attend community college, always submit your FAFSA and always apply for scholarships!

REMEMBER: Student loans should always be a last-resort option for paying for college. Focus on debt-free sources that will enable you to graduate without the burden of owing thousands of dollars for college! Focus on applying for scholarships and jobs, NOT loans, so that you can graduate debt-free. There IS an affordable path to college – for further information, and to start applying for scholarships, visit www.scholarshipowl.com.