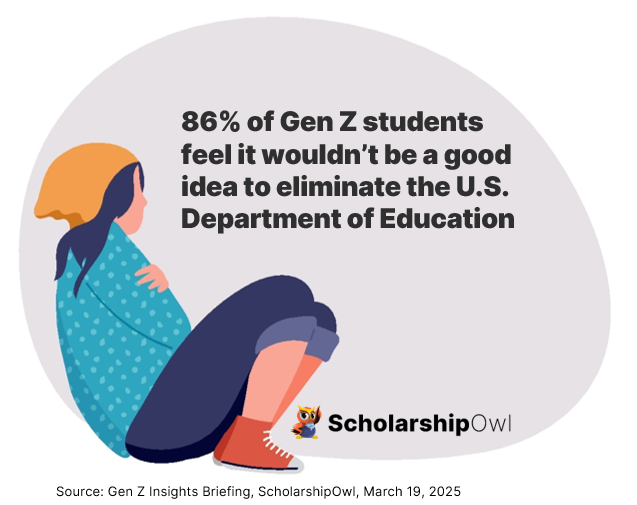

In February 2025, ScholarshipOwl conducted a survey to develop greater insight into how Gen Z students feel about the uncertainty regarding the status of the U.S. Department of Education and federal student aid, as a follow-up to continued exploration of this topic. Note that the survey was conducted prior to the Trump Administration’s actions related to the U.S. Department of Education, so students were surveyed regarding their views and expectations on possible changes before any changes took effect. The overwhelming majority of respondents (86%) did not feel that the U.S. Department of Education should be eliminated, and most expressed concerns about students’ ability to access federal student aid, the overall quality of education, as well as impacts on student support services and programs.

Who participated in the survey?

In February 2025, ScholarshipOwl surveyed 11,104 high school and college students on the ScholarshipOwl scholarship platform to learn more about their perspectives on potential changes to the U.S. Department of Education and federal student aid.

Among the respondents, 59% were female, 40% were male, and 2% identified themselves as a different gender identity or preferred not to respond to the question. Just over half (52%) were Caucasian, 18% were Black, 18% were Hispanic/Latino, 6% were Asian/Pacific Islander, 2% were American Indian/Native American and 5% selected “other” or preferred not to respond to the question.

Nearly two-thirds (64%) of the respondents were high school students, with the overwhelming majority high school seniors; over one-quarter (29%) were college undergraduate students, primarily college freshmen and college sophomores; 6% were graduate students and 3% identified themselves as adult/non-traditional students.

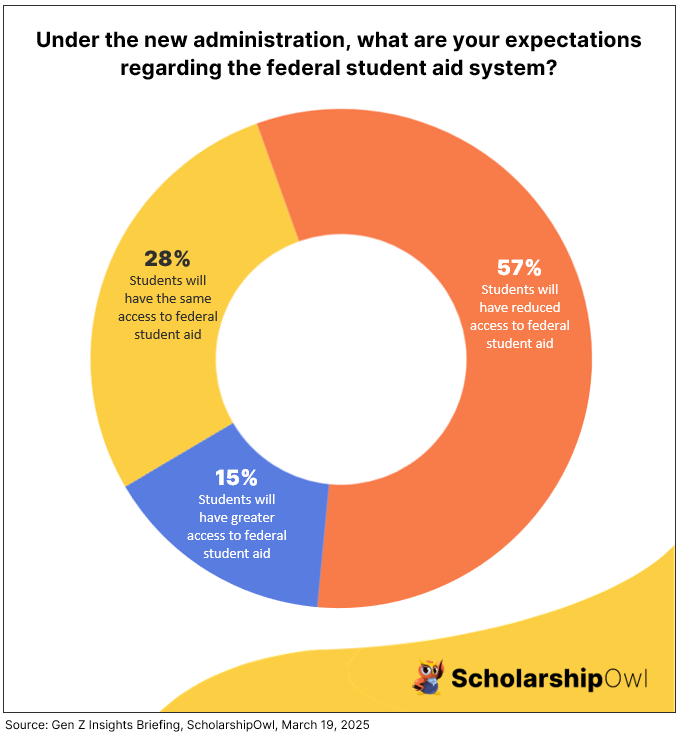

Under the new administration, what are your expectations regarding the federal student aid system?

- 57% said they think that students will have reduced access to federal student aid than under the previous administration

- 15% said they think that students will have greater access to federal student aid than under the previous administration

- 28% said they think access to federal student aid will remain essentially the same as it was before

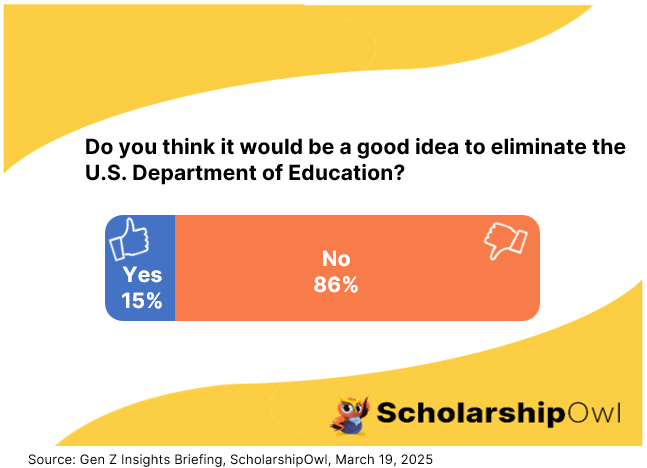

Under the new administration, there has been discussion regarding the possibility of eliminating the U.S. Department of Education. Do you think this is a good idea?

- 15% said yes

- 86% said no

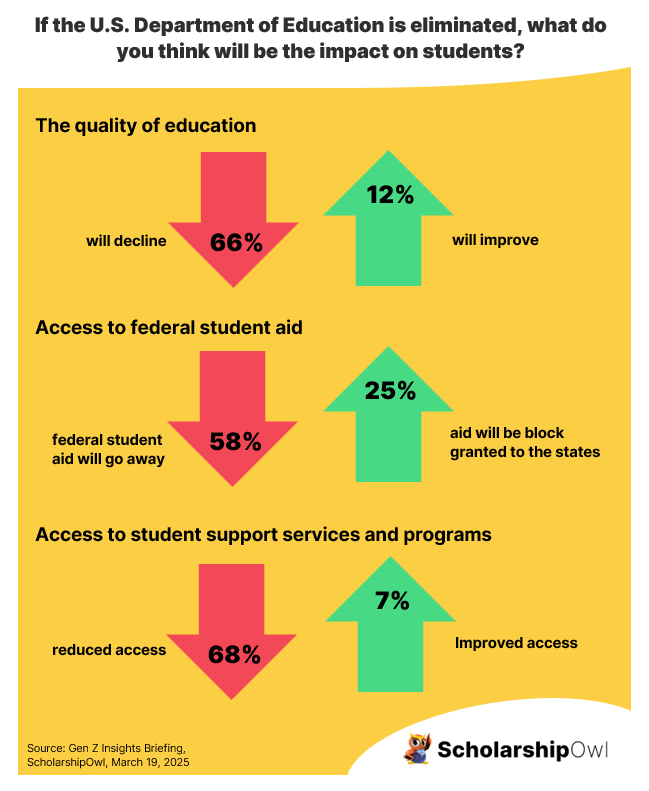

If the U.S. Department of Education is eliminated, what do you think will be the impact on students? Select all that apply.

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarships- 66% said they think the quality of education will worsen

- 12% said they think the quality of education will improve

- 58% said they think federal student aid will go away, making it harder for students to afford college

- 25% said they think the federal government will still provide student aid, but it will be block-granted to the states

- 68% said they think there will be reduced access to student support services and programs

- 7% said they I think there will be greater access to student support services and programs

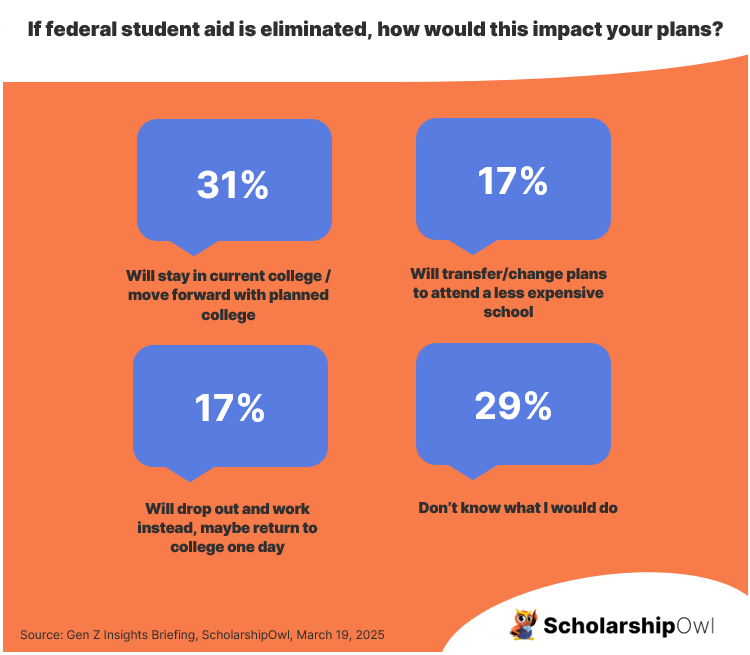

If federal student aid is eliminated entirely, how would this impact your plans?

- 31% said they plan to stay in their current college/move forward with the college they are currently planning to attend

- 17% said they transfer/change plans to attend a less expensive school

- 17% said they would drop out of college and work instead, maybe try to return to college one day

- 29% said they don’t know what they would do.

Key takeaways

The survey results indicate that the overwhelming majority of Gen Z students (86%) feel that the U.S. Department of Education should not be eliminated. Moreover, they feel that the quality of education is likely to worsen – in fact, just 12% feel that the quality of education will improve under the Trump Administration.. Gen Z students are also concerned about what will happen to student aid in under the Trump Administration. More than two-thirds (68%) feel that there will be reduced access to student support services and programs, and just 7% feel that there will be greater access to student support services and programs under this administration.

In the event that federal student aid is eliminated entirely, less than one-third (31%) of respondents felt that they would be able to stay in their current college or move forward with the college they are currently planning to attend, while the remaining 69% would have to change their plans, or wouldn’t know what they would do.

According to an article in USA Today, students should still be able to receive federal student aid even if the U.S. Department of Education is eliminated. This is because Title IV of the Higher Education Act of 1965 requires the federal government to “administer student loan programs, issue grants and ensure that schools receiving federal money don’t discriminate against students.” As such, if the U.S. Department of Education is eliminated – which would require an act of Congress – Congress would then need to charge a different federal agency with administration of federal student aid, including grants, student loans, etc. That said, if the federal workforce is significantly reduced in size, efforts to effectively manage federal student aid may be hampered.

What can students do to ensure they can afford college, regardless of what happens at the federal level?

The most important thing that students can do is to focus on what they can control, and try not to get wrapped up in what is beyond their control. What does this look like in practice?

- If you are a high school senior or will be in college next year, submit the FAFSA if you haven’t already. As of now, the FAFSA is still the only way to access federal grants, federal student loans, and federal work study.

- Prioritize applying for scholarships with ScholarshipOwl. Apply for scholarships all summer long, and throughout the school year.

- Work part-time during the school year and full-time during breaks – if you don’t have a job right now, get one as soon as possible. Save your earnings to use for your college education.

- Compare your financial aid offers and focus on choosing the most affordable college, even if that college isn’t your first choice. Given the uncertainty happening with the U.S. Department of Education, and uncertainty with federal funding for academic research etc., your best bet now is to choose the most affordable college.

- Don’t “fund your gap” with student loans – use debt-free sources instead. This is especially important now, as there is a high likelihood that even the Public Student Loan Forgiveness (PSLF) program will go away, and there is a possibility that student loans will be privatized and no longer guaranteed by the federal government. As such, it’s best to avoid taking out new student loans.

- Always consider starting at a community college, which offers a truly affordable option – and don’t forget that community colleges also offer federal and state grant aid, and they also offer scholarships. So even if you are planning to attend community college, always submit your FAFSA and always apply for scholarships!

Focus on applying for scholarships and jobs, NOT loans, so you can graduate debt-free. There IS an affordable path to college – for further information, and to start applying for scholarships, visit www.scholarshipowl.com.