ScholarshipOwl conducts a survey every month to gain deeper insight about Gen Z students. In September, we asked students about their familiarity with the Biden Administration’s newest income-driven student loan repayment plan, the Saving on a Valuable Education (SAVE) Plan. Despite robust efforts to promote the plan via social media, unfortunately just 46% of the survey respondents indicated they were familiar with the plan.

The fastest path to earning scholarships

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarshipsWho participated in the survey?

In September 2023, ScholarshipOwl surveyed high school and college students on the ScholarshipOwl scholarship platform to learn more about their knowledge of the SAVE Plan. A total of 6,776 students responded to the survey.

Among the respondents, 64% were female, 35% were male, and 2% identified themselves as other. Nearly half (46%) were Caucasian, 22% were Black, 18% were Hispanic/Latino, 7% were Asian/Pacific Islander and 7% identified as other.

More than half (55%) of the respondents were high school students, with the vast majority high school seniors; over one-third (37%) were college undergraduate students, primarily college freshmen and college sophomores; 5% were graduate students and 3% identified themselves as adult/non-traditional students.

Survey questions

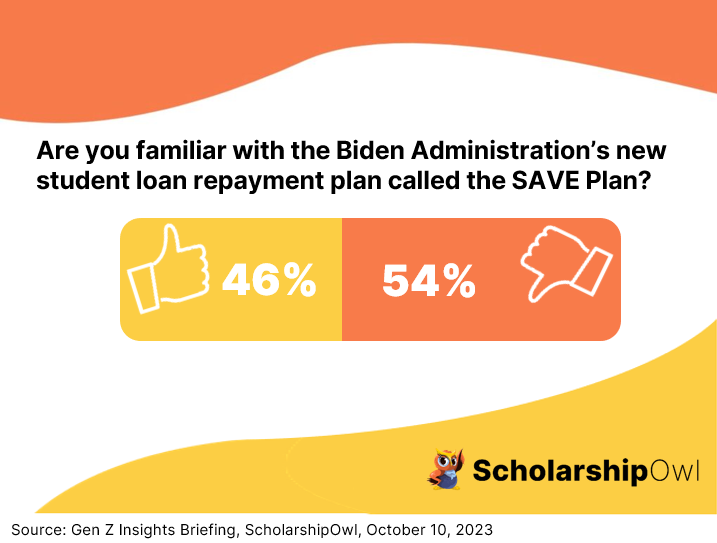

The first survey question was “Are you familiar with the Biden Administration’s new student loan repayment plan called the Saving on a Valuable Education (SAVE) Plan?” Less than half (46%) said they were familiar with the SAVE Plan, with the rest of the respondents (54%) saying they were not.

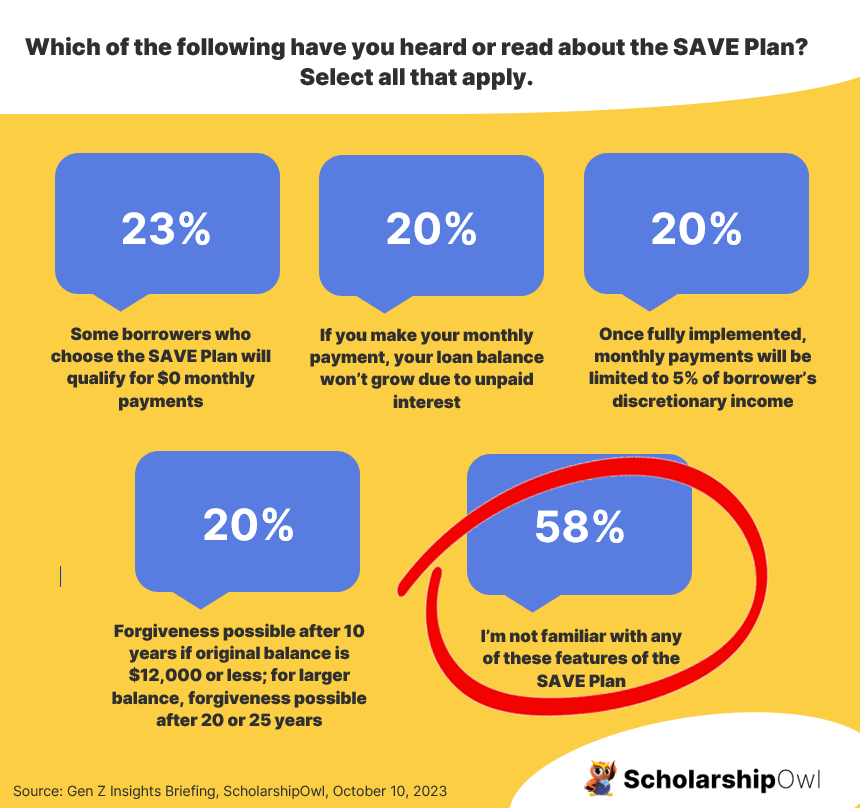

We then asked, “Which of the following have you heard or read about the SAVE Plan? Check all that apply.”

Nearly one-quarter (23%) said that they were aware that some borrowers who choose the SAVE Plan will qualify for $0 monthly payments. One-fifth (20%) had heard that if a student makes their monthly payment, their loan balance would not grow due to unpaid interest. One-fifth (20%) had heard that once the SAVE Plan is fully implemented in July 2024, monthly payments on undergraduate loans will be limited to 5% of the borrower’s discretionary income, rather than the current 10% cap. One-fifth (20%) are aware of the path to loan forgiveness available to students who choose the SAVE Plan – borrowers with an original principal balance of $12,000 or less will receive forgiveness after 10 years of timely payments; for each $1000 borrowed above that amount, an additional year of timely payments will be required for forgiveness, up to a maximum of 20 or 25 years. Unfortunately, 58% responded that they were not familiar with any of these aspects of the SAVE Plan.

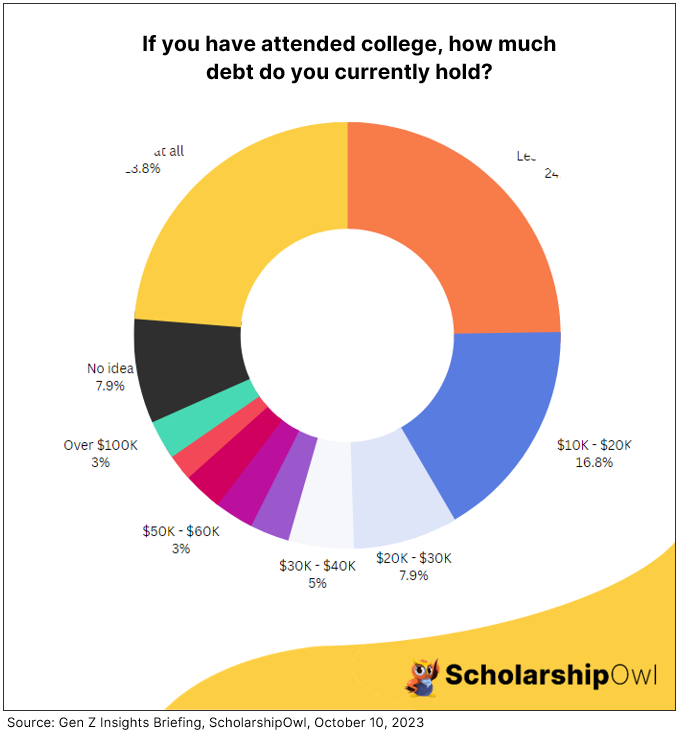

For the final survey question, we were interested in how much student debt respondents currently hold. Since high school students do not yet have student debt, we looked at the responses only from the students that have attended college now or in the past, totaling 3079 respondents. We asked these students, “In total, how much student debt do you currently hold?”

Overall, more than three-quarters (76%) already have student debt. This is very concerning, as the majority of these respondents are in their first or second year of college, and may well take on even more debt before they graduate. One quarter (25%) of the respondents indicated they have less than $10,000 in student debt. More than one-sixth (17%) indicated they owe $10,000 to $20,000 in student debt, while 8% stated they owe $20,000 – $30,000 in student debt. Five percent (5%) hold $30,000 to $40,000 in student debt. Just over one-tenth (11%) owe $40,000 to $80,000 in student debt, with 3% indicating they owe more than $100,000 in student loans. Concerningly, 8% of respondents stated that they had no idea how much student debt they have. On the positive side, just under one-quarter (24%) stated that they currently do not have any student debt.

Key takeaways for Gen Z students

The survey results indicate that the Biden Administration’s marketing and social media campaign promoting the SAVE Plan has unfortunately been inadequate, with less than half of Gen Z students (46%) having any familiarity with this new repayment plan option. The SAVE Plan offers numerous benefits for Gen Z students – and in most cases, when borrowers look at all of their repayment options, the SAVE Plan will have significant advantage over the other plans:

The SAVE Plan offers the following benefits right now:

- Decreases monthly payments by increasing the income exemption from 150% to 225% of the poverty line. This means SAVE can significantly decrease your monthly payment when compared to what your payment would be with other income-driven repayment plans. Some borrowers may even qualify for a $0 monthly payment, depending on their income and family size. Visit the SAVE Plan to find out more.

- The SAVE Plan eliminates 100% of remaining monthly interest for both subsidized and unsubsidized loans after making your scheduled payment. This means that with the SAVE Plan, your loan balance won’t grow due to unpaid interest that accrued since your last payment.

- If you are married and file your taxes separately, the SAVE Plan excludes your spouse’s income when determining your monthly payment amount.

In July 2024, when the SAVE Plan is fully implemented, borrowers will enjoy these additional benefits:

- Your monthly payment will be capped at just 5% of your discretionary income, meaning that in July of next year, your payments will be cut in half!

- If you have an original principal balance of $12,000 or less, you’ll receive forgiveness of any remaining balance after 10 years of payments. For each $1000 borrowed above that amount, an additional year of timely payments will be required for forgiveness, up to a maximum of 20 years for borrowers with only undergraduate loans, or 25 years for borrowers who have graduate school loans.

- If you consolidate your loans, you’ll retain the progress you’ve made toward forgiveness in the form of “credits.” You’ll receive credit for a weighted average of payments that count toward forgiveness of the loans being consolidated.

- You’ll automatically receive credit toward forgiveness for specific periods of deferment and forbearance – this includes periods of deferment before July 1, 2024. Note that credit for forbearances will be applicable only to forbearances received on or after July 1, 2024. You’ll also be able to make additional “buyback” payments to get credit for most other periods of deferment or forbearance.

Help! My student loans are now in repayment. What should I do?

The student loan payment pause ended on October 01, 2023. If you are still in school, you can continue to defer payment on your loans. But if you are not a currently enrolled student, your loans are now in repayment. While that may be a bit scary to think about – especially when we are all struggling with inflation, the most important important thing to remember is that burying your head in the sand won’t help you… But your loan servicer will! So take these steps:

- Go to StudentAid.gov to find out who is currently servicing your loan. During the pandemic, many loans were sold to other servicers, so there is a high likelihood that your loan has changed hands.

- Visit your loan servicer’s website, and create an account or login to your existing account and find out the amount of your loan payment as well as your payment due date.

- Explore repayment plan options, including the SAVE Plan. Select the repayment plan that best meets your needs.

- If you need help selecting a repayment plan, call your loan servicer for assistance. Be sure to ask about the SAVE Plan!

Is it possible to pay for college without the burden of student debt?

YES! If you don’t yet have any student loans, or if you already have loans but want to avoid taking on additional debt, there IS a way! Use debt-free sources to pay for college instead:

- Access federal and state grant aid by submitting the FAFSA.

- Prioritize applying for scholarships with ScholarshipOwl.

- Work part-time during the school year and full-time during breaks. Apply your earnings toward your college education.

- Choose a more affordable path to college, such as by starting at a community college.

You CAN go to college without taking out student loans!