The silence of the “waiting period” is finally breaking. After four years of maintaining a high GPA, grinding through AP and IB classes and exams, and spending your weekends volunteering or on the field for your varsity sport, the moment has arrived. Your hard work has been packaged into an application, and now, the colleges are responding! It’s time to start making your admission decision!

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarshipsThis phase is often more stressful than the application period itself because it involves making a life-changing financial and personal decision in a very short window. Here is your comprehensive guide to navigating the “Decision Season.”

How Will I Be Notified About Each Admission Decision?

The days of waiting by the mailbox for a thick envelope are largely over. Most colleges will notify you of their admission decision through your portal accounts. If you haven’t yet set up all of your portals, do so right away. That way, you’ll see messages about information that the college still needs from you to make their decision, and of course you’ll also see their admission decision post!

Check College Portals Daily

While it may be annoying to have to login to all of your portals on a daily basis, it’s important that you take the time to do so. Check for messages about documents they need to make their admission decision and/or to be able to complete your financial aid and scholarship offer.

If documents are requested, submit them right away.

Email Alerts

Each college will ask you to setup a special email account that they will use to contact you. As with the college portals, if you haven’t yet set up your college email accounts, do so now. If possible, setup those email accounts to forward to your regular email address that you use daily. That will enable you to avoid having to check multiple email accounts daily.

Once you have been offered admission through your portal, you will also likely receive an email letting you know that your admission decision is waiting for you in your portal.

Be sure to also keep an eye on your “Promotions” or “Spam” email folders to ensure you don’t accidentally miss an important email notification.

Admission Notification in the Mail

If you are admitted, a formal packet often follows by mail 1–2 weeks later. This packet usually contains lots of fun stuff from the college, celebrating your admission offer. You might receive stickers, a college banner, socks, etc. in addition to a formal admission offer and detailed next steps.

How Do I Compare Admission Offers to Know Which One Is Best for Me?

Once the excitement of the “Yes” wears off, you need to compare your options objectively to be able to make your admission decision. Create a spreadsheet to evaluate:

Academic Strength

Look specifically at the department of your intended major. Does it have the internships, labs, or alumni networks you need?

Retention Rates

What percentage of freshmen return for sophomore year? High retention often signals a supportive campus environment.

The Net Price

Don’t get distracted by a $20,000 scholarship if the tuition is $80,000. Focus exclusively on the Net Cost (Total Cost minus Gift Aid). Remember: Loans are NOT gift aid, as they must be repaid with interest.

Location

Consider the location of the college in relation to what you hoped. Is it near home or far from home? Is it in an urban or rural setting? What kinds of jobs and internships are available on-campus an in the nearby community? What is the weather, and is it something you feel you can manage? How costly will it be for you to travel back and forth during breaks?

Campus Culture

What are your social and political views, and how well do they align with the college?

Your Own Perception Based on Your Visit

Have you visited the campus in-person? If not yet, it would be a good idea to do so if it is a college you are seriously considering. If you have visited, how did you feel while at the college? Did it feel like you would really enjoy your college experience there? Or did you feel like something wasn’t quite right? Visiting in person if at all possible can be a key factor in helping you make your admission decision.

My Financial Aid Offers Are Confusing. How Do I Evaluate Them?

Financial aid offers usually arrive within a few days of your admission. Choosing a college that is more affordable for you and your family is one of the best ways to ensure you are making the right admission decision. To compare them, you must distinguish between gift aid (awards you don’t pay back) and other types of financial aid.

What is Gift Aid?

Gift aid are funds that are offered that don’t require you to pay them back. They are literally “gifts” to you.

-

-

- Federal grants are gift aid awarded based on your financial need as determined by the Free Application for Federal Student Aid (FAFSA). Low-income students will typically receive federal and/or state grants, and some middle-income students may receive them as well. Families with higher incomes typically are not eligible for federal grants.

- State-funded grants and scholarships are also gift aid. In most cases, these awards are also based on financial need; however, some states do provide a guaranteed scholarship via a “Promise Program” for community college attendance or for attendance at an in-state public university. Check your state to find out what options may be available to you.

- Institutional scholarships are awarded from the college, and can be either need-based or merit-based. Some colleges require that you submit the CSS Profile to apply for institutional scholarships, so make sure you know which colleges require this – click here to find out more. Always read the fine print regarding institutional scholarships. In some cases, the scholarships are a one-time lump sum award for a single year only, while others are renewable for all four years of college. For renewable scholarships, there are often terms and conditions that must be met, such as agreeing to live on-campus, achieving a specified minimum GPA, and remaining a full-time student throughout enrollment.

-

What is Work-Study?

Federal work-study is a program that enables students with financial need to be able to obtain a job on campus to help them pay for college. To ensure that you are considered for work-study, check the applicable box on your FAFSA. Only those who check that box will be considered for work-study.

Note that even if you aren’t offered work-study as part of your financial aid offer, you can still obtain a part-time job on campus or in the nearby community. Most students who are diligent in their job search efforts can find a part-time job while in college.

I Was Offered Student Loans. Should I Accept Them?

Loans are not gift aid. Loans are a debt that you are being offered the “opportunity” to take on, with the understanding that you’ll repay that debt and all associated interest.

Federal Student Loans

Federal Student Loans have a fixed interest rate, and payment can be deferred until 6 months after you graduate. Once that 6 months elapses, you’ll need to start making payments on your loans whether or not you have found a job in your field.

All students who complete the FAFSA are eligible to receive federal student loans, regardless of their credit history or income. Federal student loans do not require a co-signer. These loans offer certain borrower protections, and students can choose between the Standard Repayment Plan and an income-driven repayment plan called the Repayment Assistance Plan (RAP) as described in the One Big Beautiful Bill Act that went into effect in 2025.

-

-

-

-

- Subsidized Loans are loans in which the federal government will take care of the accrued interest while you are in school.

- Unsubsidized loans are loans in which you as the borrower will be responsible for paying that accrued interest, either while you are in school, or after you graduate.

-

-

-

How Much Can I Borrow?

The maximum allowed amount that students can borrow are listed below:

-

-

-

-

-

-

- $5500 for freshman year

- $6500 for sophomore year

- $7500 for junior year

- $7500 for senior year

- $20,500 per year for most graduate school programs; $100,000 maximum lifetime cap (Federal Direct Unsubsidized Loans only)

- $50,000 per year for designated “professional” programs such as medical school, law school and dental school; $200,000 maximum lifetime cap (Federal Direct Unsubsidized Loans only)

- $257,000 aggregate maximum total lifetime borrowing cap for ALL federal student loans across both undergraduate and graduate programs.

-

-

-

-

-

Private Student Loans

Private student loans are available through private lenders. These types of loans require that the student borrower have a co-signer, and both the borrower and co-signer will need to go through a credit check and income verification process to qualify.

There are many lenders who offer private student loans. If you are considering taking on private student debt, you’ll want to compare the lenders to ensure you are choosing a reputable firm, and also to compare the available interest rates, as they do differ. The interest rate you’ll be offered will depend on the results of the credit check and income verification, the amount you are borrowing, and the interest rates available at the time that you are taking out the loans.

Some private lenders do offer different kinds of repayment plans, while others do not. Research lenders carefully to make an informed decision.

Ultimately, it is ALWAYS BEST to avoid taking out private student loans for undergraduate education. If you can’t afford a particular college without taking on private debt, it’s best to choose a more affordable college. If you are considering taking on private student loans for medical school, law school, or dental school, these programs typically are so expensive that it isn’t possible to attend without taking out some amount of private student loans. Other graduate programs such as master’s degrees may or may not be possible without private student debt. Be thoughtful and careful before deciding to take out private student loans, and explore all options to avoid it where possible.

I Got Wait-Listed. What Should I Do?

A waitlist offer means you are “admissible,” but there isn’t room in the freshman class yet. Wait-listed students may be moved off the wait list should enough accepted students decline their admission offers, freeing up spots for students on the wait list.

The Odds

Historically, waitlist movement is unpredictable. Some years a school might take 100 students; the next year, zero. As such, it’s important to not count on getting moved off the wait list.

The Strategy

If this is your top choice, you must formally “accept” your spot on the waitlist. Review the instructions for accepting your wait list spot. Sometimes it will be simply clicking a “yes I want to be on the wait list” box, while in other cases, you might be asked to write a formal Letter of Continued Interest (LOCI). If asked to write a letter, tell them specifically: “If admitted, I will attend.”

The Timeline

You likely won’t hear back until after May 1st (Decision Day) – often well after that date. For wait listed students, you might not even hear until late-July or early-August if a spot has opened for you.

As such, if you want to ensure you have a spot at one of the colleges you’ve applied to, be sure that you accept an admission offer by May 1st from one of the other colleges and also pay your enrollment deposit, and you may also need to pay a housing deposit. Focus on getting excited about the college you’ll likely be attending while waiting to find out if you will be offered an admission slot off the wait list.

Be aware though that if you are eventually offered an opportunity to attend your wait-listed college that you will likely have to forfeit your enrollment deposit and housing deposit at the other college if you want to accept your newly-awarded admission offer. As such, moving off the wait list will cost you the amounts you’ve paid elsewhere, and then you’ll of course also have to pay a new enrollment deposit and housing deposit to move off the wait list. For this reason (among others), some students who are eventually offered admission off the wait list just decide to stay with the college that they already committed to.

I Was Declined From a College I Really Hoped to Attend. What Can I Do?

A rejection letter is a redirection, not a defeat.

Process the Emotion

It is okay to feel frustrated. You put a lot of work into that application.

The Appeal Option

You can appeal a denial, but only under specific circumstances: a significant error in your file (like a transcript mistake) or a major life event that wasn’t mentioned. General “I really want to go” appeals are rarely successful. And in general, it is quite rare for a college to change their mind and accept a previously declined student. But it CAN happen. So if this particular college is really important to you, it may be worth submitting an appeal.

That said, similar to the above section regarding wait-listed students, appeals are often not reviewed until after May 1st, so you’ll want to secure your slot at a college that accepted you, pay the enrollment and housing deposits, and focus on getting excited about the college you committed to while waiting to hear back on your appeal.

My Financial Aid Offer Was Less Than I Expected. Can I Ask for More?

How to Appeal

Submit a formal “Professional Judgment” request to the Financial Aid office.

Leverage

If a similar school offered you $5,000 more in merit aid, share that offer with your preferred school. They may match it to win you over; however, this usually is only something that a private or out-of-state college will be swayed by. Public in-state universities will typically not offer additional financial aid or scholarships unless you have special circumstances, as outlined below.

Special Circumstances

Highlight any “Special Circumstances” like a parent’s job loss, high medical expenses, living in an abusive home environment, being homeless or at risk of homelessness, or support of an elderly relative, etc. that isn’t reflected on the FAFSA.

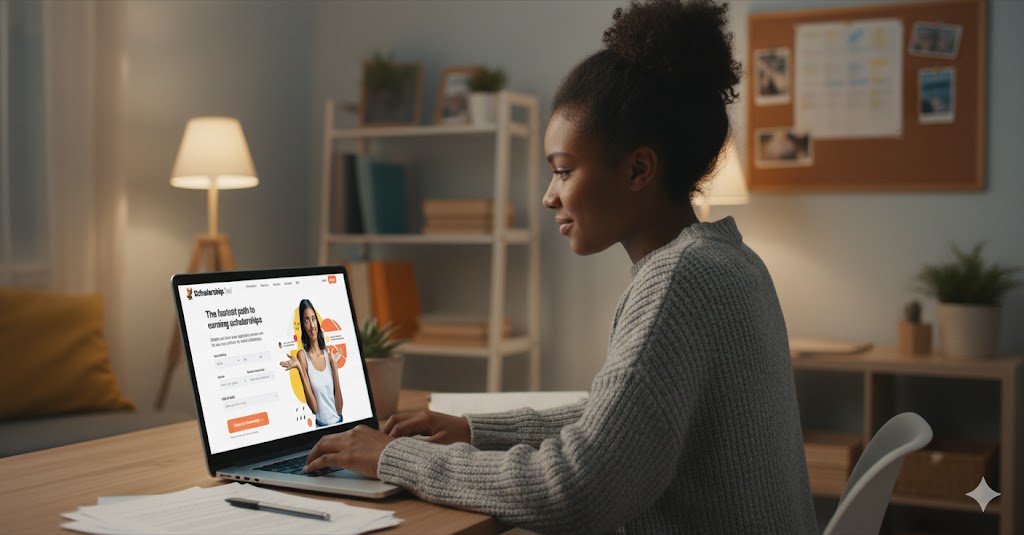

What Is the Best Source of Scholarships That Can Help Me Make Up My Funding Gap?

Even with a great aid package, most families face a “gap” of several thousand dollars. This is where ScholarshipOwl really makes the difference.

ScholarshipOwl Is More Than Just a Scholarship Website

Most scholarship sites are just lists. ScholarshipOwl is a one-stop platform that streamlines the application process, AND helps you to prioritize the scholarships you have a better chance of winning!

AI-Powered Scholarship Recommendations and Unparalleled Matching

ScholarshipOwl uses your profile data to find scholarships you are actually eligible for, saving you hours of searching.

Access Strategy Tools

With ScholarshipOwl, you can focus on vetted scholarships with high credibility scores, and fewer applicants. You can also track the status of your submitted applications. Don’t love writing scholarship essays? Leverage the ScholarshipOwl AI Essay Assistant to help you get started on your essays! Or apply for tons of scholarships that don’t require an essay at all!

Don’t Stop

Many students stop applying for scholarships once they choose a college. The most successful students apply for scholarships year-round, aiming for 3 scholarships per week all the way until they finish their college education.

Not yet a member of ScholarshipOwl? Start your free 7-day trial at www.ScholarshipOwl.com!

I’ll Have to Borrow to Be Able to Afford the College I Want to Attend. Should I Take Out Loans?

If you must borrow, prioritize federal student loans and avoid private student loans if at all possible. More details about loans can be found earlier in this blog post.

If the only way to attend is via massive private loans, the school is likely not a sound financial investment and it will be best if your admission decision on these colleges is a “no.” Your future self will thank you for choosing a more affordable path!

I’m a Parent Considering Taking Out Loans to Help My Child Pay for College. What Are My Options?

Parents often feel a heavy burden to “give their child the best.” But it’s important to understand that taking on debt may not be in your best interest, and also may not be in the best interest of your child, who would likely need to take on federal student loans in addition to the loans you yourself are considering taking on.

Before taking out debt, be sure you understand your options:

Parent PLUS Loans

Parent PLUS Loans are federal loans in the parent’s name. They have higher interest rates than student loans, and the debt is owned by the parent, not the student. As such, even if your child says they will pay back Parent PLUS Loans for you, they are not legally obligated to do so – only you are legally obligated to repay these loans.

Many well-meaning students with the best intentions will agree to repay these loans, and may even sign a document agreeing to do so. But again, only you as the parent is legally bound to repay Parent PLUS Loans, and graduating students often find that they can’t afford to repay their own student loans as well as yours. On top of that, your newly-minted college graduate may not be able to afford paying their rent, utilities, car payment, car insurance, food, etc. along with loan debt. So the most sincere promises made might unfortunately be unkept.

If you choose to take out Parent PLUS Loans to help your child pay for college, the annual maximum is $20,000 per child, with a lifetime maximum of $65,000 per child.

Home Equity Line of Credit (HELOC)

If you own a home and have a significant amount of equity in your home, you may want to consider taking out a HELOC to help your child pay for college. HELOC loans use your home as collateral, and you can generally write-off the interest you would pay on your HELOC if you itemize your taxes.

Private Parent Loans

Some parents take out personal loans to help their child pay for college. Your ability to do so will depend on your credit rating as well as your income, assets, etc.

Now You Know Your Options. Should You Take On Debt to Help Your Child Pay for College?

There is much to consider here. You should absolutely NOT feel that you “should” take on debt to help your children pay for college. Remember:

-

- Your child can borrow for college; you cannot borrow for retirement.

- If you take on debt to help one child pay for college, you may feel personally obligated to do so for subsequent children. So think carefully before proceeding.

- If you do decide to move forward, ensure the debt is manageable (no more than 10% of your monthly income) before signing.

- Expect that any debt you take on will be YOURS to repay, not your child’s. Whatever they promised, and no matter how sure they were when making those promises, their income after graduating may be less than they anticipate and/or their monthly expenses may be higher than they anticipate.

Are There Other Things I’m Not Thinking of that Could Help Pay for College?

If the math isn’t adding up, consider these “under the radar” tactics:

Get Your Employer to Help You Pay for College

Work for a company that will help you for your degree via tuition reimbursement or other education benefits. There are actually MANY restaurants and retailers that will do this, even for part-time employees!

Reframe the Definition of a “Dream School”

Attending a lower-cost state school is often a better admission decision than attending a “prestigious dream school” that leaves you with tens of thousands in debt. Isn’t graduating debt-free the real dream??

Start at a Community College

Spending two years at a local college and then transferring to your top choice can save you $50,000+ without changing the name on your final diploma! Choosing to start at community college is a smart decision, both academically and financially! Sometimes this is absolutely the right admission decision you can make, regardless of how many universities accepted you.

Gap Year for Savings

Take a year to work full-time and prioritize applying for scholarships. You’ll be able to save a significant amount of money and apply it towards your education.

Conclusion

The next few weeks will be a whirlwind of emotions and numbers. Remember: the goal isn’t just to get into college; it’s to get through college and into a career without a mountain of debt. Evaluate your offers with a clear head, use ScholarshipOwl to bridge your funding gap, and make the admission decision that sets you up for long-term freedom!