In October 2024, ScholarshipOwl explored student perspectives on their financial aid prospects as they prepare to submit the FAFSA for the 2025-26 school year. During the launch of the overhauled 2024-25 FAFSA, there were numerous technical problems that resulted in delayed financial aid awards for students. In this month’s survey, we learned that about half (51%) of the students who submitted the 2024-25 FAFSA were adversely impacted by the technical problems and delays, with one-third (34%) of FAFSA submitters perception that the new FAFSA is worse than the previous version.

Who participated in the survey?

In October 2024, ScholarshipOwl surveyed 12,503 high school and college students on the ScholarshipOwl scholarship platform to learn more about their perspectives on the new FAFSA.

Among the respondents, 61% were female, 37% were male, 2% identified themselves as a different gender identity or preferred not to respond to the question. Nearly half (48%) were Caucasian, 21% were Black, 19% were Hispanic/Latino, 6% were Asian/Pacific Islander, 2% were American Indian/Native American and 5% selected “other” or preferred not to respond to the question.

More than half (53%) of the respondents were high school students, with the overwhelming majority high school seniors; more than one-third (36%) were college undergraduate students, primarily college freshmen and college sophomores; 6% were graduate students and 4% identified themselves as adult/non-traditional students.

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarshipsHow confident are you that the financial aid you receive through FAFSA will meet your needs for covering your education expenses?

- 11% said very confident

- 27% said somewhat confident

- 34% said not very confident

- 28% said not confident at all

Do you expect to graduate college with student loan debt?

- 76% said yes

- 24% said no

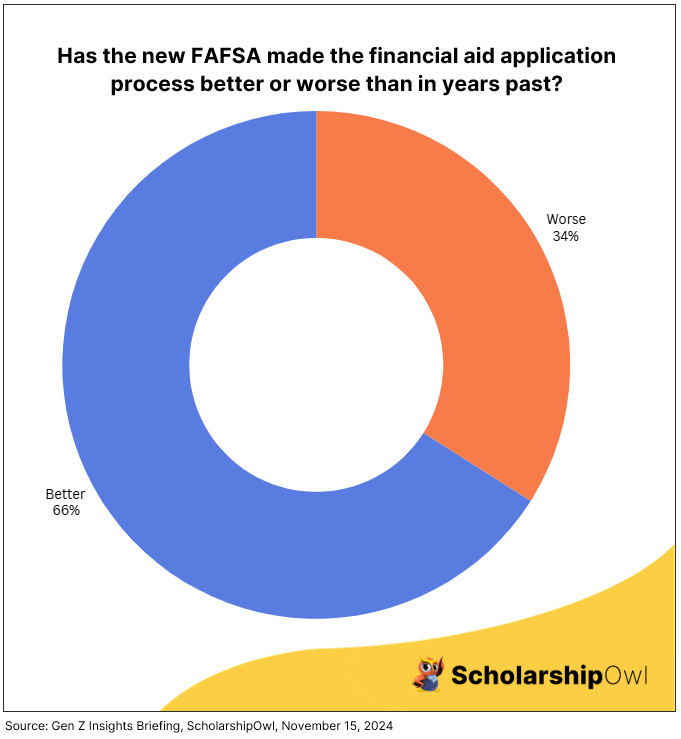

Has the new FAFSA made the financial aid application process better or worse than in years past?

Among the 6,397 respondents who had submitted the FAFSA previously:

- 66% said the new FAFSA has made the process better

- 34% said the new FAFSA has made the process worse

If you submitted the FAFSA this year, were you personally adversely impacted by the delays that occurred with the launch of the new FAFSA?

Among the 6,582 respondents who submitted the FAFSA this year:

- 49% said yes

- 51% said no

Key takeaways

The survey results indicate that Gen Z students overwhelmingly expect that they will graduate with student debt, even if they are awarded federal and/or state grant aid through the FAFSA. And in fact, 62% of respondents stated that they either are not very confident or not confident at all that financial aid awarded through the FAFSA will be enough to cover their education expenses. This makes sense when considering the cost of college as compared to the amount of grant aid available.

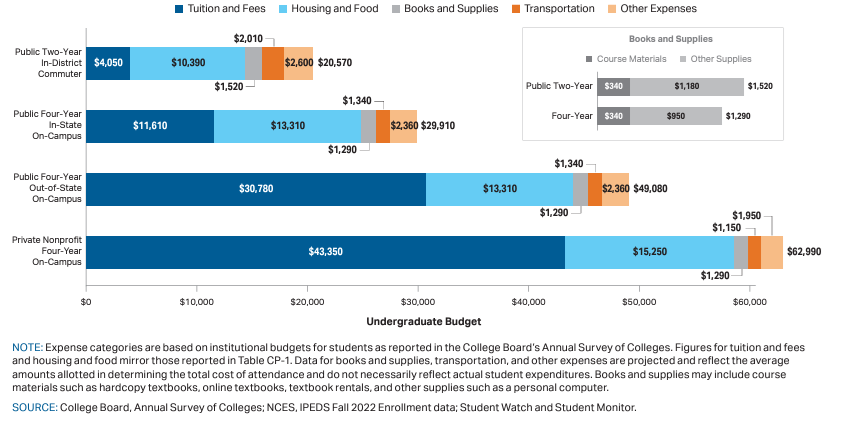

According to a 2024 study conducted by the College Board, the average cost of attending college for full-time undergraduate students ranges from $20,570 to $62,990 annually, depending on the type of institution attended. Even students with the greatest financial need cannot cover these costs from federal and state grant aid alone. To fully cover college costs, students also need to earn income through scholarships and employment – and even then, they may still need to take out student loans, especially if they are not able to receive financial assistance from their family.

Average Estimated Full-Time Undergraduate Budgets (Enrollment-Weighted) by Sector, 2024-25

It was hoped that the new FAFSA would streamline the application process while also resulting in 610,000 more students receiving the Pell Grant as compared to the previous FAFSA, with 1.5 million more students having access to the maximum Pell Grant award of $7395 for the 2024-25 school year. But even if the new FAFSA is able to achieve these numbers, it is clear that students will still need additional sources of funds to cover their college costs. Students seem to understand the situation they’re in, with 76% of respondents expecting they will need to take out student loans in addition to any grant aid and scholarships they might receive.

The ill-fated launch of the new FAFSA unfortunately caused significant upheaval, and ultimately adversely impacted nearly half (49%) of our respondents who submitted it. On the more positive side, two-thirds (66%) of respondents did feel that the new FAFSA has made the application process better than in years past. This is a hopeful result for the students who will be submitting the FAFSA in the future.

What can Gen Z students do to pay for college without being burdened by student debt?

There are a number of steps that students can take to ensure they have an affordable path to college:

- Prioritize applying for scholarships with ScholarshipOwl. Apply for scholarships all summer long, and throughout the school year.

- Work part-time during the school year and full-time during breaks. Save your earnings to use for your college education.

- Submit the FAFSA every year for every year that you’ll be in college, beginning in your senior year of high school, and continuing to submit it annually until you complete your college education.

- When you receive your financial aid offers, compare them and focus on choosing the most affordable college. If your first-choice school offered you a less financial aid and scholarships than other schools offered, contact your preferred school to see if you can negotiate your offer to one that is more affordable for you.

- Don’t “fund your gap” with student loans – use debt-free sources instead.

- Avoid applying for credit cards until after you complete your education. Instead, you can use a debit card linked to your checking account, enabling you to pay for purchases with money you already have, enabling you to avoid interest.

- Always consider starting at a community college, which offers a truly affordable option – and don’t forget that community colleges also offer federal and state grant aid, and they also offer scholarships. So even if you are planning to attend community college, always submit your FAFSA and always apply for scholarships!

REMEMBER: Student loans and credit cards should always be a last-resort option for paying for college-related expenses. Focus on debt-free sources that will enable you to graduate without the burden of owing thousands of dollars for college! Focus on applying for scholarships and jobs, NOT loans, so that you can graduate debt-free. There IS an affordable path to college – for further information, and to start applying for scholarships, visit www.scholarshipowl.com.