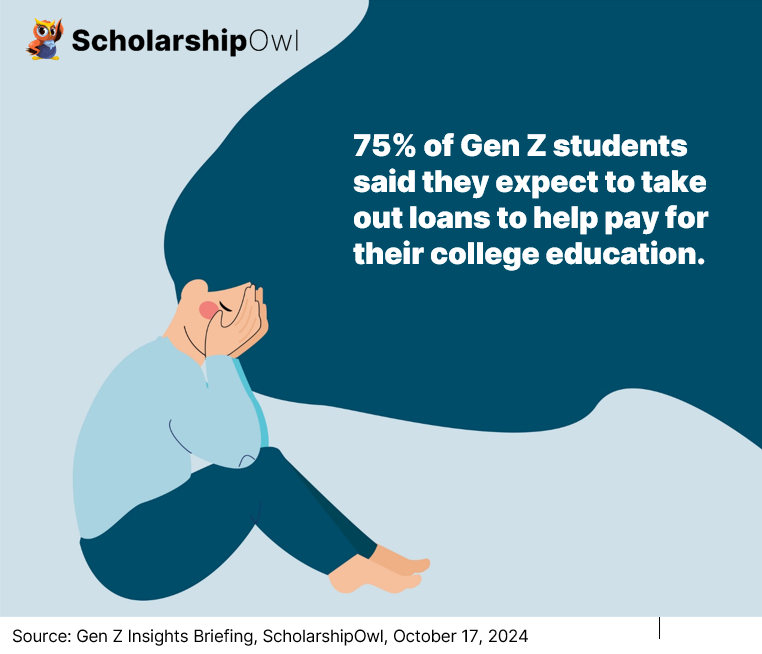

In September 2024, ScholarshipOwl continued its research regarding how Gen Z students pay for college. This month, we focused on their reliance on student loans and credit cards to help pay for college-related expenses. Unfortunately, three-quarters (75%) of respondents reported that they expect to take out loans to help pay for their college education, and more than one-third (37%) have a credit card they use to help pay for their expenses.

Who participated in the survey?

In September 2024, ScholarshipOwl surveyed 8,932 high school and college students on the ScholarshipOwl scholarship platform to learn more about debt they accept to help pay for college.

Among the respondents, 63% were female, 36% were male, 1.5% identified themselves as a different gender identity or preferred not to respond to the question. Nearly half (45%) were Caucasian, 21% were Black, 20% were Hispanic/Latino, 6% were Asian/Pacific Islander, 1% were American Indian/Native American and 6% selected “other” or preferred not to respond to the question.

More than half (52%) of the respondents were high school students, with the vast majority high school seniors; more than one-third (40%) were college undergraduate students, primarily college freshmen and college sophomores; 6% were graduate students and 4% identified themselves as adult/non-traditional students.

Do you expect to take out loans to help pay for any part of your college education?

- 75% said yes

- 25% said no

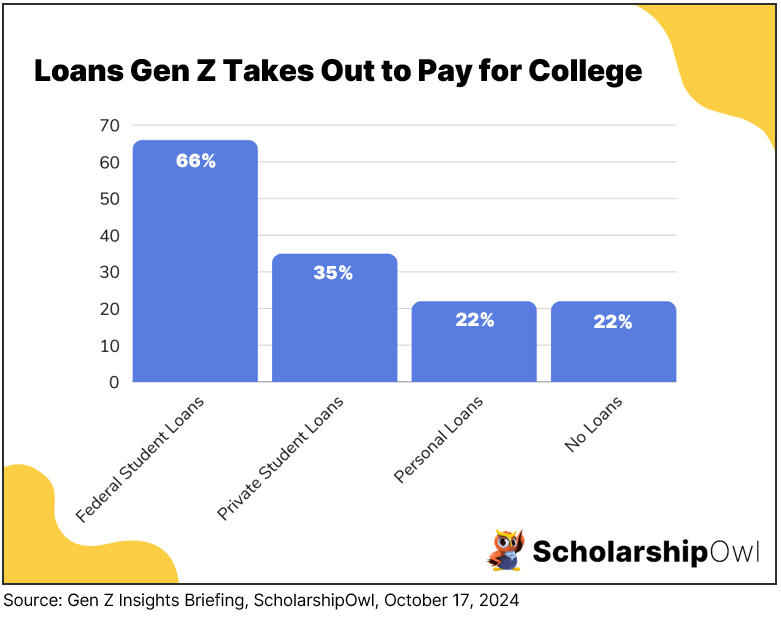

What type(s) of loans do you think you’ll need to pay for your education, including grad school if you plan to attend? Select all that apply.

- Federal student loans: 66%

- Private student loans: 35%

- Personal loans from family/friends: 22%

- I won’t be taking out any loans: 22%

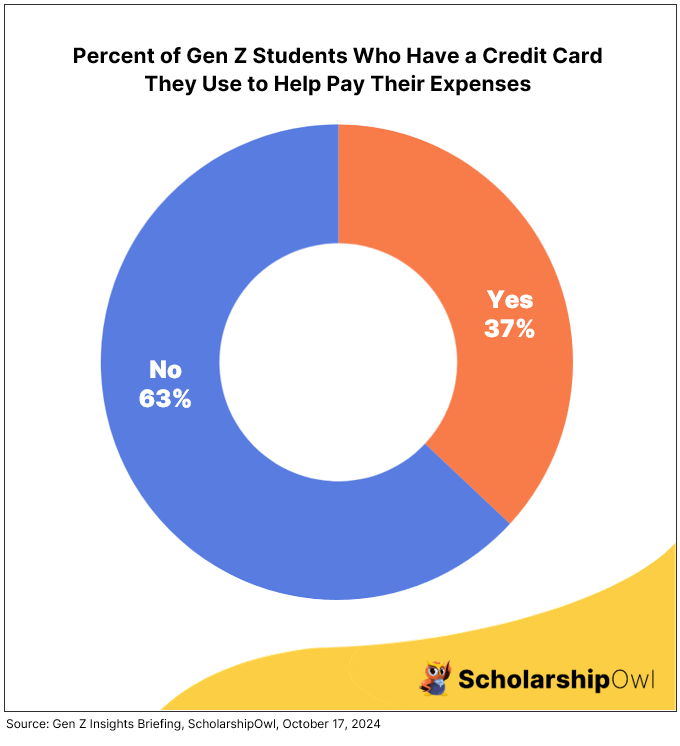

Do you currently have a credit card that you use to help pay for your expenses?

- 37% said yes

- 63% said no

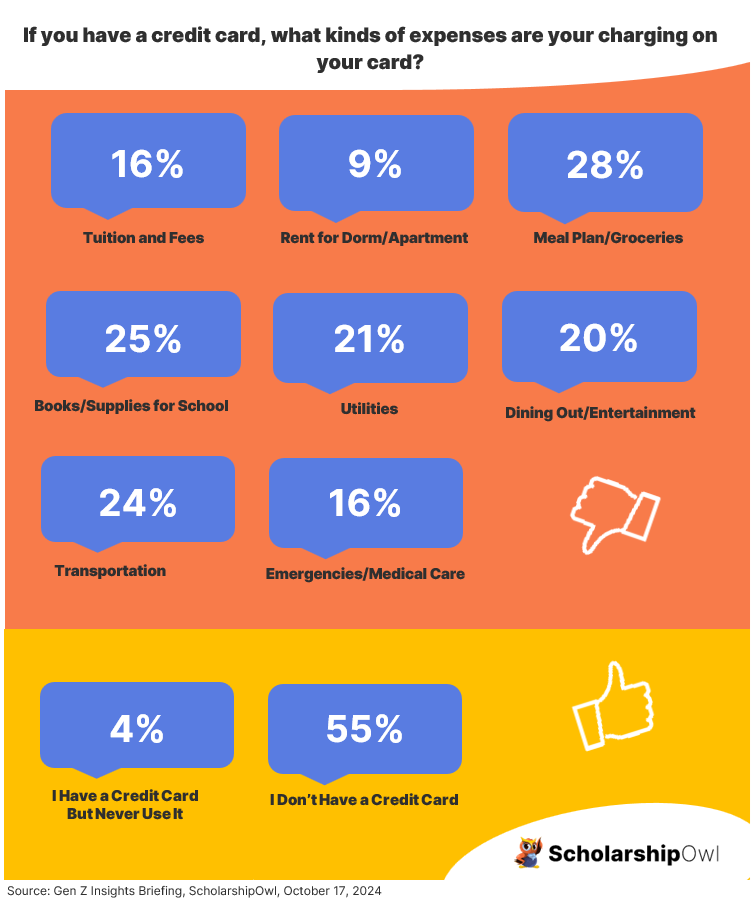

If you have a credit card, what kinds of expenses do you charge on your credit card? Select all that apply.

- Tuition and fees: 16%

- Rent for your dorm / apartment: 9%

- Meal plan / groceries: 28%

- Books / supplies / laptop for school: 25%

- Utilities (cell phone, WiFi, gas & electric, cable): 21%

- Dining out / entertainment / activities: 20%

- Transportation (car, airfare, etc.): 24%

- Emergencies / medical care: 16%

- I have a credit card but I never use it: 4%

- I don’t have a credit card: 55%

Key takeaways

The survey results indicate that Gen Z students unfortunately rely on debt-laden sources to pay for college-related expenses. To a certain extent, it’s not surprising that the vast majority of students expect that loans will be needed to pay for the ever-rising cost of college. But it was a bit unsettling to discover that 45% of Gen Z students are using credit cards to pay for college-related costs including tuition, fees, room and board, books and supplies, etc. The amount of debt that Gen Z students often graduate with can be staggering.

The Education Data Initiative found that students who have taken out loans to pay for college graduate with an average of over $40,000 in loan debt, including both federal student loans and private loans. Given that it takes an average of 20 years to pay off student loan debt, that amount will grow exponentially due to interest as well as penalties resulting from late payments.

An August 2023 survey conducted by U.S. News & World Report found that over 42% of college students have credit card debt. Nearly half of those respondents (49%) said that they got into their credit card debt by paying for college essentials such as books and fees and/or living expenses.

Source: U.S. News & World Report: https://money.usnews.com/credit-cards/articles/survey-over-42-of-college-students-have-credit-card-debt

How can Gen Z students ensure they can afford college without taking on the burden of debt?

There are a number of steps that students can take to ensure they have an affordable path to college:

- Prioritize applying for scholarships with ScholarshipOwl. Apply for scholarships all summer long, and throughout the school year.

- Work part-time during the school year and full-time during breaks. Save your earnings to use for your college education.

- Submit the FAFSA every year for every year that you’ll be in college, beginning in your senior year of high school, and continuing to submit it annually until you complete your college education.

- When you receive your financial aid offers, compare them and focus on choosing the most affordable college. If your first-choice school offered you a less financial aid and scholarships than other schools offered, contact your preferred school to see if you can negotiate your offer to one that is more affordable for you.

- Don’t “fund your gap” with student loans – use debt-free sources instead.

- Avoid applying for credit cards until after you complete your education. Instead, you can use a debit card linked to your checking account, enabling you to pay for purchases with money you already have, enabling you to avoid interest.

- Always consider starting at a community college, which offers a truly affordable option – and don’t forget that community colleges also offer federal and state grant aid, and they also offer scholarships. So even if you are planning to attend community college, always submit your FAFSA and always apply for scholarships!

REMEMBER: Student loans and credit cards should always be a last-resort option for paying for college-related expenses. Focus on debt-free sources that will enable you to graduate without the burden of owing thousands of dollars for college! Focus on applying for scholarships and jobs, NOT loans, so that you can graduate debt-free. There IS an affordable path to college – for further information, and to start applying for scholarships, visit www.scholarshipowl.com.