The start of a new year often brings a sense of renewal, but for millions of American students, there is a familiar, heavy shadow: student loan debt 2026. As tuition costs continue to climb and the economic landscape shifts, the dream of a “debt-free” education feels more like a financial gamble than a guarantee. ScholarshipOwl believes that transparency is the first step toward change. That’s why we surveyed over 12,000 students this month—to capture the real-time financial pressures facing the next generation and to illuminate a more sustainable path forward.

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarshipsThe 2026 Student Debt Landscape: National Statistics

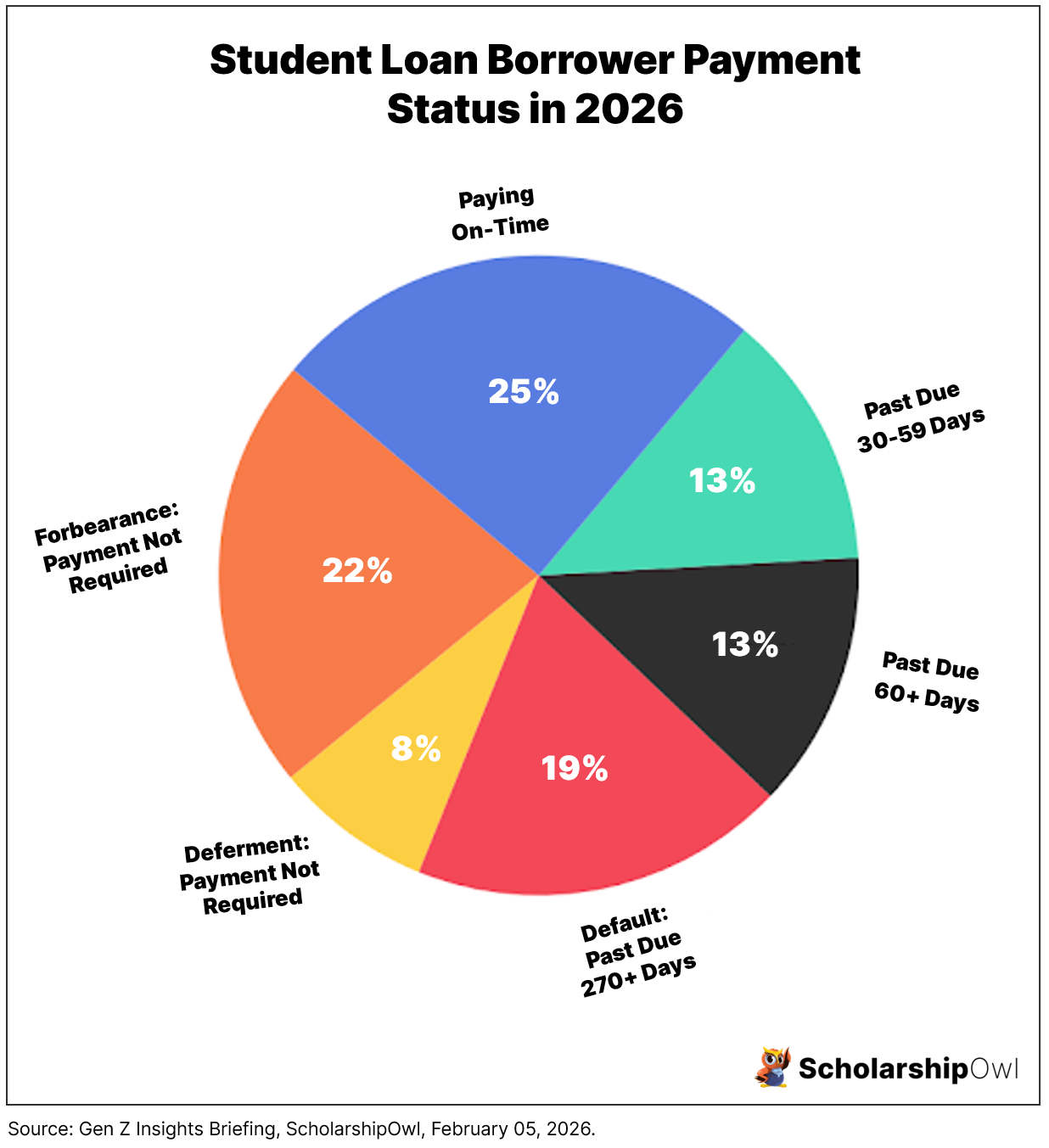

To understand the weight of our survey results, we must look at the current state of borrowing in America. As of early 2026, the student debt crisis has reached a critical “default cliff”:

Total Borrowers

Approximately 45 million Americans currently hold student loan debt, totaling over $1.75 trillion.

The Default Crisis

Recent data indicates that nearly 9 million borrowers are currently in default (270+ days past due), a sharp increase following the expiration of pandemic-era protections.

The “Danger Zone”

The number of borrowers struggling to keep their heads above water is staggering. Approximately 5.8 million borrowers are currently 90 days or more past due on their payments—the highest delinquency rate ever recorded.

Rising Delinquency

Roughly 21% of all borrowers have reported a recent delinquency, returning to and exceeding pre-pandemic levels as economic uncertainty persists.

Who Participated in the Survey?

In January 2026, ScholarshipOwl surveyed 12,654 high school and college students on the ScholarshipOwl scholarship platform to find out more about how they feel about student loan debt and its implications on their future.

Among the respondents, 59% were female, 39% were male, and 2% identified themselves as a different gender identity or preferred not to respond to the question. Just over half (55%) were Caucasian, 16% were Black, 16% were Hispanic/Latino, 6% were Asian/Pacific Islander, 1% were American Indian/Native American and 6% selected “other” or preferred not to respond to the question.

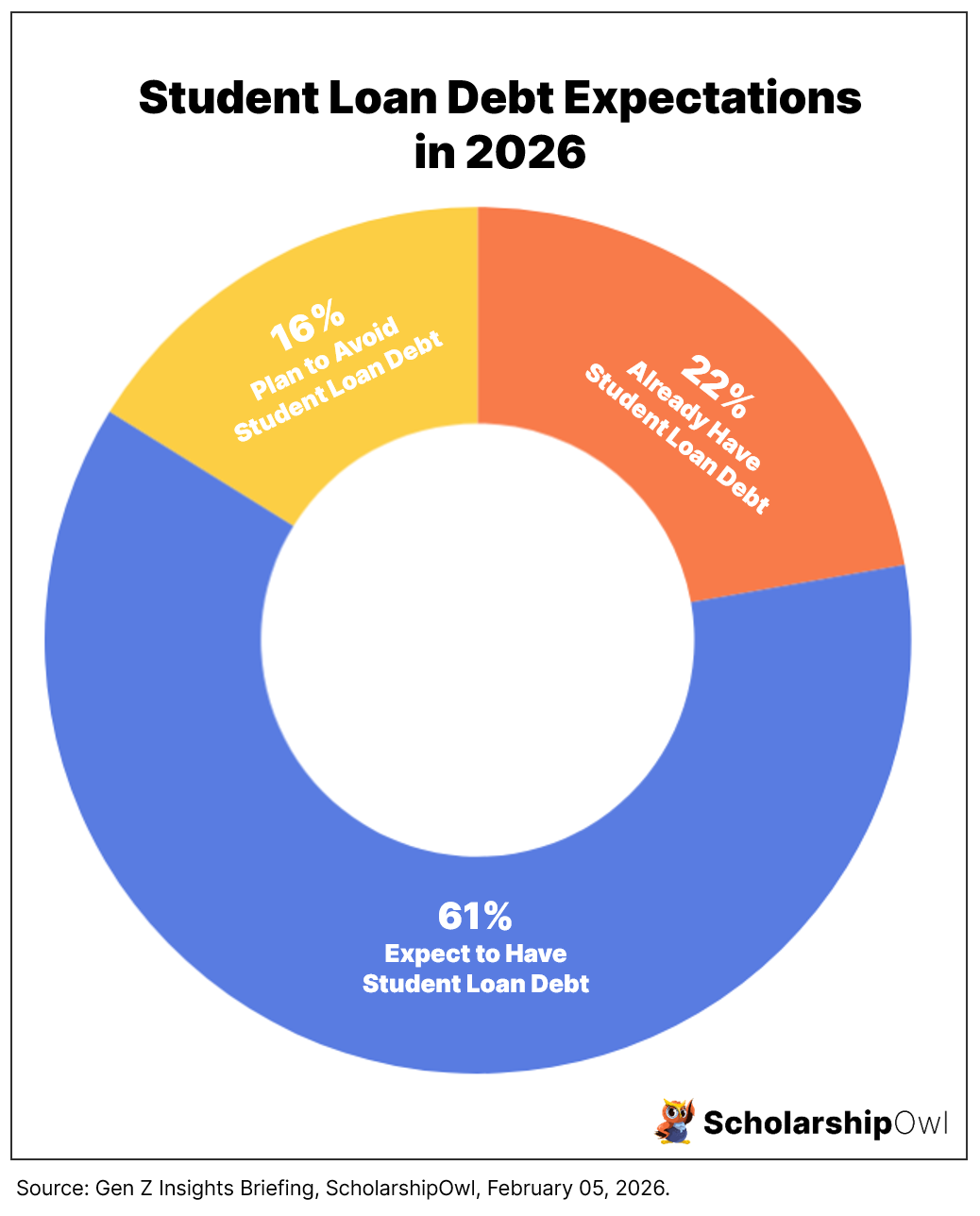

Question 1: Have you already taken out one or more student loans?

Amongst the respondents, just under one-quarter (22%) said yes, and nearly two-thirds (61%) said, that they hadn’t yet taken out student loans, but that they expect they will need to, bringing the total to 83% of respondents who either are already in student debt or plan to be. Just 16% said they have not taken out student loans yet, and that they won’t be in the future.

Question 2: If yes, do you already regret taking on student debt?

Amongst the 3,473 respondents who already have taken out student loans, nearly three-quarters (71%) acknowledged that they already regretted taking on student debt, while just under one-third (29%) said they do not.

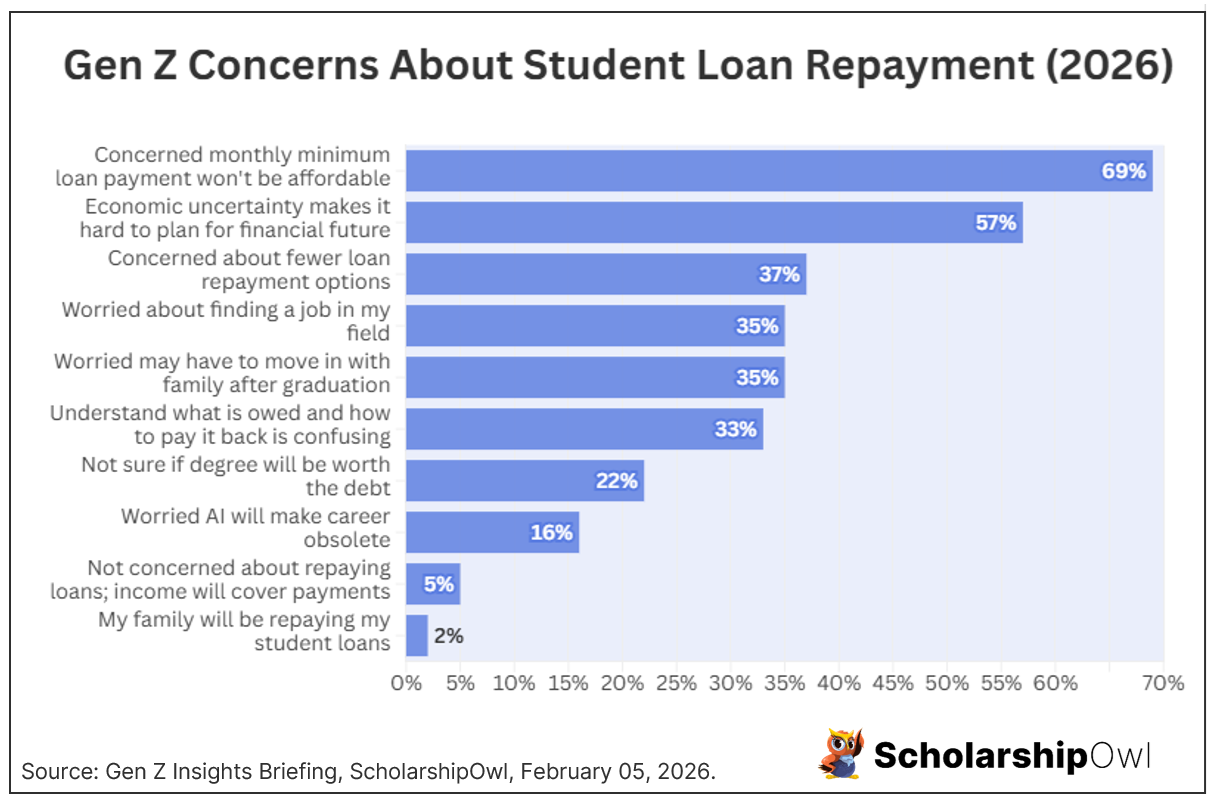

Question 3: What are your concerns about future student loan repayment? Select all that apply.

Among the respondents, just 1,388 students (11%) said that they will not be taking out any student loans to pay for college, so they won’t have to worry about how to repay them. Excluding those students from the calculation, the remaining 11,266 respondents indicated they were concerned about having student debt and potentially struggling to repay it. The overwhelming majority (90%) selected more than one response.

- 69% selected “I’m concerned that my monthly minimum loan payment will be higher than I can afford”

- 57% selected “On-going economic uncertainty feels stressful, so it’s hard to plan for my financial future”

- 37% selected “I am concerned that there aren’t going to be as many loan repayment options, so my choices will be limited”

- 35% selected “I’m worried it will be hard to find a job in my field after I graduate”

- 35% selected “I’m afraid I’ll have to move back in with my family due to my loan payments”

- 33% selected “Trying to understand what I owe and how to pay it back is confusing”

- 22% selected “I’m not sure if my degree will have been worth the debt I’m taking on”

- 16% selected “I’m worried that AI might make my planned career obsolete”

- 5% selected “I don’t have any concerns about repaying my loans, as I know my income will be enough to cover my monthly payments”

- 2% selected “My family will be repaying my student loans, so it’s not something I’m worried about”

Analyzing the Survey Results: A Generation at Risk

Our student loan debt 2026 survey reveals a student body that is acutely aware of the “debt trap.” The results highlight a significant disconnect between the need for an education and the ability to afford it.

The Debt Expectation

The survey found that borrowing is no longer the exception; it is the rule. A combined 83% of respondents are either already in debt or expect they will need to take out loans to finish their education. Only a small fraction (16%) believe they can navigate college without borrowing.

Immediate Regret

For those who have already signed on the dotted line, the honeymoon phase ended quickly. Of the 3,473 respondents currently holding debt, 71% already regret the decision. This suggests that the reality of interest rates and repayment terms is hitting home far sooner than in previous generations.

The Repayment Anxiety Gap

When we look at the 11,266 students who expect to face repayment, the concerns are multifaceted. It isn’t just about the money; it’s about the loss of a predictable future:

-

-

-

-

69% fear their monthly payments will simply be unaffordable.

-

57% point to on-going economic uncertainty as a barrier to financial planning.

-

35% are terrified that debt will force them to move back in with family, delaying their independence.

-

Notably, 16% are now factoring in AI’s impact, fearing their degree might become obsolete before the debt is even paid off.

-

-

-

How to Build a Debt-Free Path to Graduation

The data proves that relying on loans is a high-risk strategy. To avoid becoming a statistic, students should prioritize these four pillars of debt-free funding:

Maximize Free Government Aid with FAFSA

Always start with the Free Application for Federal Student Aid (FAFSA). When you submit the FAFSA, you’ll be applying to find out if you are eligible for need-based federal and state grants which do not have to be repaid. You can also apply to be considered for federal work-study. In addition, should you want to take out federal student loans, you can only do so after you’ve submitted the FAFSA.

Work Your Way Through College

We recommend students begin working part-time at age 16 and continue through college, transitioning to full-time work during summer breaks. “Cash-flowing” even a portion of your living expenses can prevent thousands in high-interest debt from accumulating.

Prioritize Earning Scholarships

Treat scholarship applications like a part-time job. Unlike a paycheck, scholarship awards are generally tax-free when used for tuition and books.

Community College and Transfer

Consider completing your first two years at a community college where costs are significantly lower, then transferring to a four-year institution.

The ScholarshipOwl Advantage

Searching for scholarships can feel like a second full-time job. ScholarshipOwl was designed to eliminate the “grind” so you can focus on winning.

Universal Application

No need to fill out endless repetitive applications. With ScholarshipOwl, your profile serves as a universal application. So it’s one and done, just complete your profile and we’ll port that data into all of the applications you want to submit!

AI-Powered Recommendations and Unparalleled Matching

Our advanced platform matches you with scholarships where you are most competitive based on your unique profile.

Vetted Opportunities

Our exclusive credibility scoring system analyzes every scholarship on our platform, assigning a credibility score so that you’ll know which scholarships to focus your time and energy on as you apply.

Application Management

Track your deadlines and submissions in one dashboard, making it easy to track and monitor your applications.

Not yet a member of ScholarshipOwl? Sign up for a free 7-day trial at www.ScholarshipOwl.com.

Conclusion

The student loan debt 2026 survey data is a wake-up call, but it doesn’t have to be your personal reality. Our survey shows that while the majority of students feel forced into debt, the anxiety and regret that follow are heavy burdens to carry. By leveraging grants, maintaining a consistent work schedule, and using smart tools to streamline your scholarship search, you can take control of your financial destiny. You deserve an education that empowers your future, rather than one that bills you for it for the next thirty years.

So apply for scholarships and jobs, not loans. Get started today at www.ScholarshipOwl.com!