As the 2026-27 academic year approaches, the landscape of college financing continues to shift. Between legislative changes—such as the One Big Beautiful Bill Act—and the ongoing evolution of the FAFSA, students and families are navigating a complex financial environment. To better understand how the next generation of students is paying for college, ScholarshipOwl conducted a survey of over 24,000 students in December 2025.

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarshipsThe results offer a revealing look at the state of college affordability: while FAFSA completion remains high, a significant portion of students are finding that federal aid isn’t meeting their expectations, leading to heavy reliance on external funding sources including scholarships and student loans.

Who Participated in the Survey?

In December 2025, ScholarshipOwl surveyed 24,332 high school and college students on the ScholarshipOwl scholarship platform to find out more about how they will be paying for college.

Among the respondents, 60% were female, 39% were male, and 1% identified themselves as a different gender identity or preferred not to respond to the question. Nearly half (47%) were Caucasian, 22% were Black, 18% were Hispanic/Latino, 6% were Asian/Pacific Islander, 2% were American Indian/Native American and 6% selected “other” or preferred not to respond to the question.

More than half (55%) of the respondents were high school students, with the overwhelming majority high school seniors; more than one-third (34%) were college undergraduate students, primarily college freshmen and college sophomores; 7% were graduate students and 4% identified themselves as adult/non-traditional students.

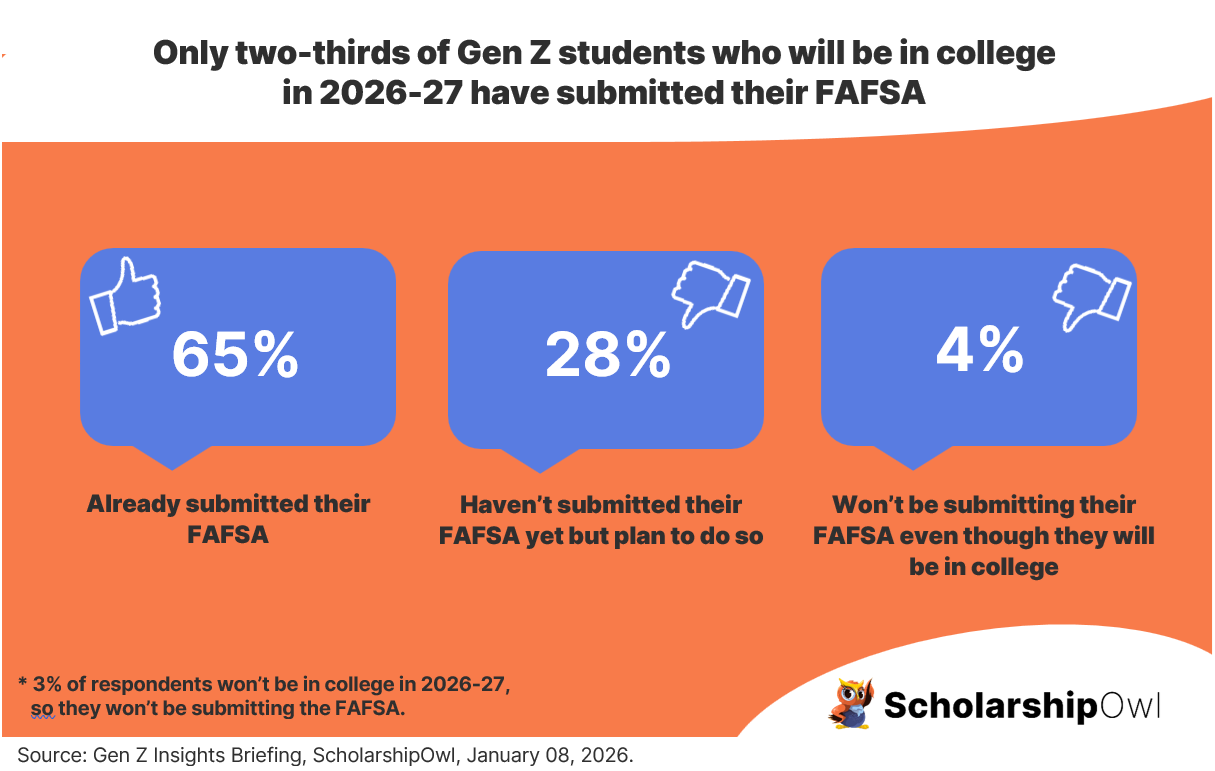

Question 1: Have you submitted the 2026-27 FAFSA that opened in late-September yet?

Amongst the respondents, nearly two-thirds (65%) confirmed they had already submitted their FAFSA, while over one-quarter (28%) haven’t yet submitted the FAFSA, but still plan to do so. A small percentage (4%) do plan to attend college in the 2026-27 school year, but they don’t plan to submit their FAFSA. The remaining students (3%) won’t be attending college in 2026-27, and as such, they will not be submitting the FAFSA for that academic year.

Question 2: If yes, in your FAFSA submission summary, which of the following are you eligible for? Select all that apply.

A total of 15,755 students said that they had submitted the FAFSA, so only those students’ responses were incorporated into the results for this question.

College Funding That Must Be Repaid

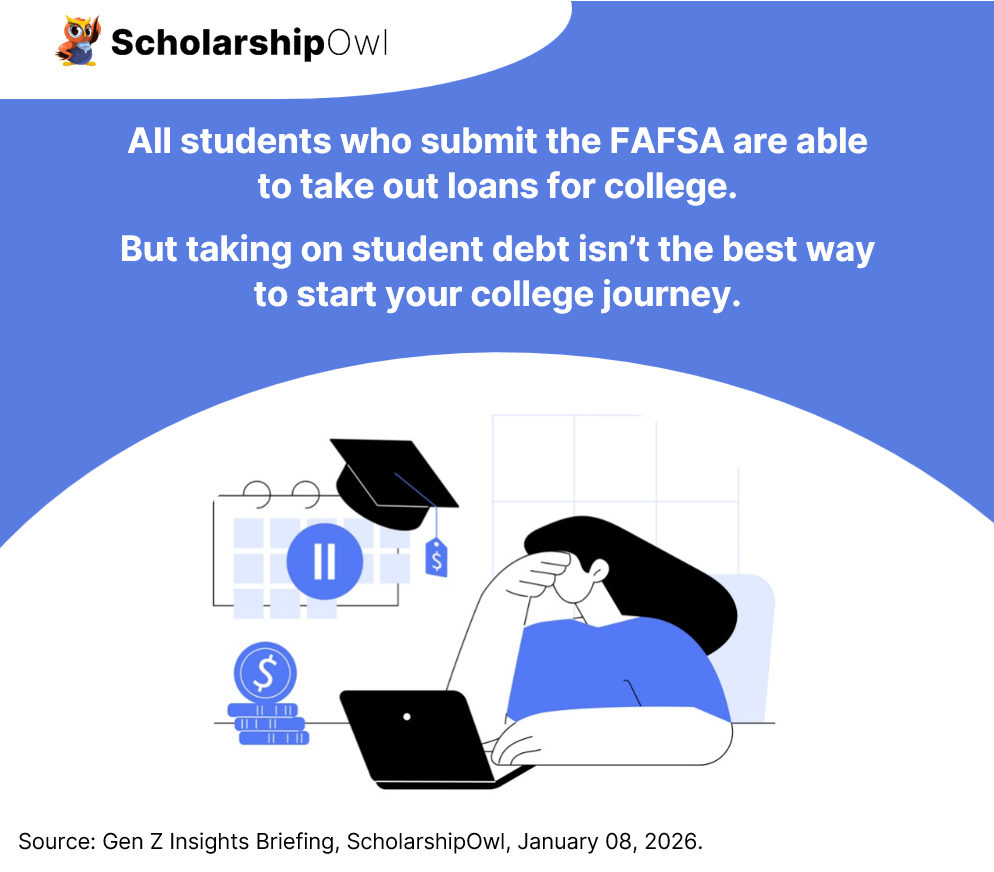

Loans

It should be noted that ALL students who submit the FAFSA are eligible to take out federal student loans:

-

-

- Undergraduate students are typically offered both a subsidized and an unsubsidized student loan. Annual caps:

-

-

-

-

-

- $5500 for freshman year

- $6500 for sophomore year

- $7500 for junior year

- $7500 for senior year

-

-

-

- Graduate students are eligible for unsubsidized student loans, and continuing graduate students are eligible for a Grad PLUS Loan; however, Grad PLUS Loans have been eliminated for students starting a new graduate program beginning with the 2026-27 school year, per the One Big Beautiful Bill Act.]

-

-

-

-

- Maximum graduate school loan is $20,500 per year for most graduate school programs, with a $100,000 maximum lifetime cap;

- For “professional programs” (medical school, law school, dental school, etc.), the maximum loan amount is $50,000 per year, with a maximum lifetime cap is $200,000.

- The aggregate maximum total lifetime borrowing cap for ALL federal student loans across both undergraduate and graduate programs is $257,000.

-

-

In addition, parents of students who submit the FAFSA are able to take out Parent PLUS Loans to help pay for college, as long as the borrowing parent can pass the required credit check. Be aware that beginning on July 01, 2026, there are new loan caps on Parent PLUS Loans:

-

-

- $20,000 per year per child

- $65,000 maximum lifetime per child

-

College Funding You Don’t Have to Borrow

Grants

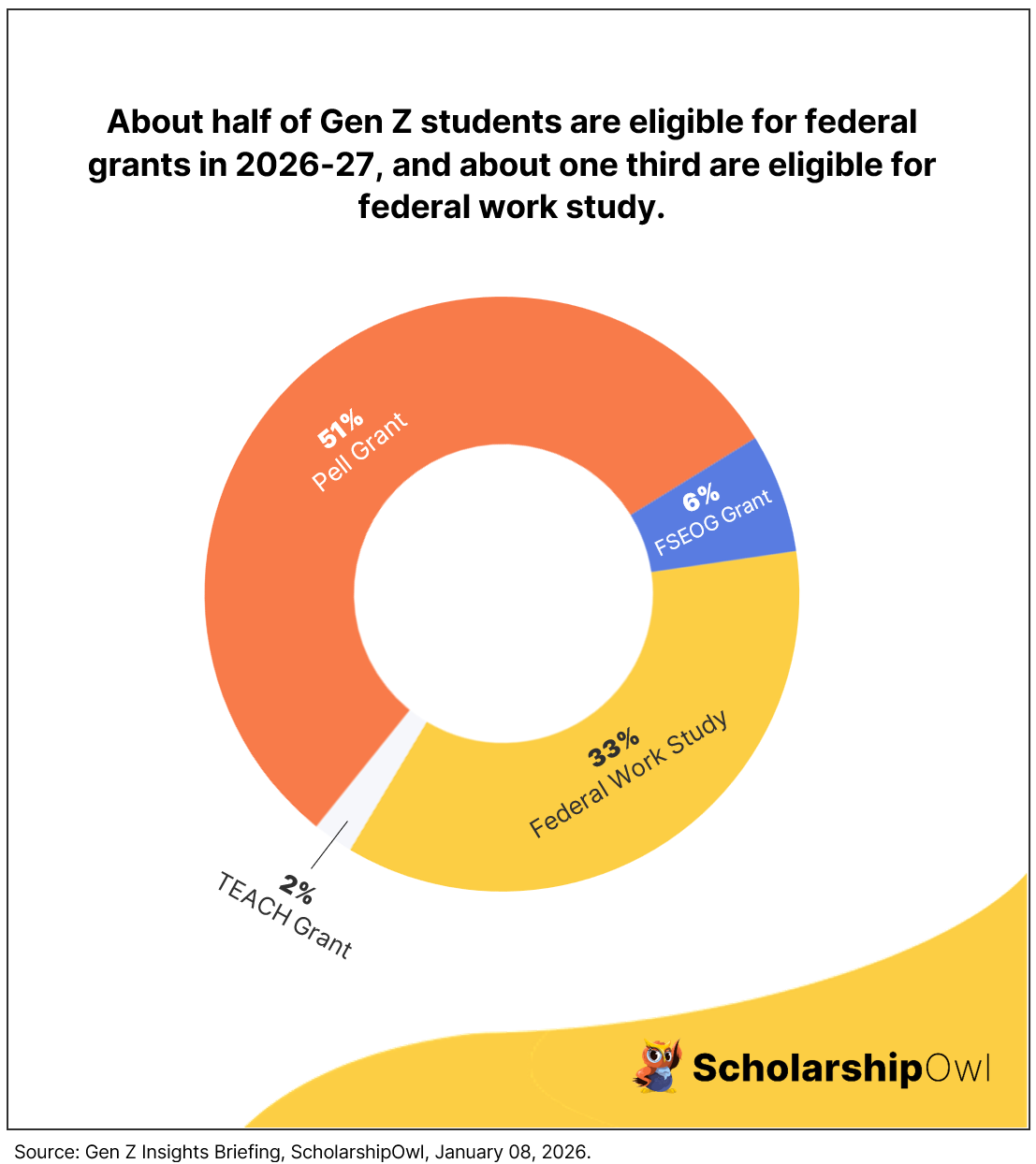

In addition to loan options, just over half (51%) of those who had already submitted their 2026-27 FAFSA said they were eligible to receive a Pell Grant.

A very small number of students (6%) indicated they were eligible for the Federal Supplemental Educational Opportunity Grant (FSEOG) which is available only to students with exceptional financial need.

Just 2% said they were eligible for the Teacher Education Assistance for College and Higher Education (TEACH) Grant, which is reserved for those pursuing a career in teaching, and who agree to teach in a high-need field at a school that serves low-income students for at least four years.

Federal Work Study

One-third (33%) of students who had already submitted their 2026-27 FAFSA said they were eligible for federal work-study. Federal work study enables eligible students to obtain a job on campus to help them pay for college. While all students can obtain a part-time job either on campus or in the nearby community, students who have a work study job have certain advantages:

-

- Some campus jobs are designated as “work study only” or “work study preferred,” meaning that work study students are often prioritized amongst the applicant pool.

- In addition, earnings from work study jobs are not counted as income on the next year’s FAFSA.

Question 3: How well does your FAFSA Submission Summary match with your expectations for your eligibility for need-based aid?

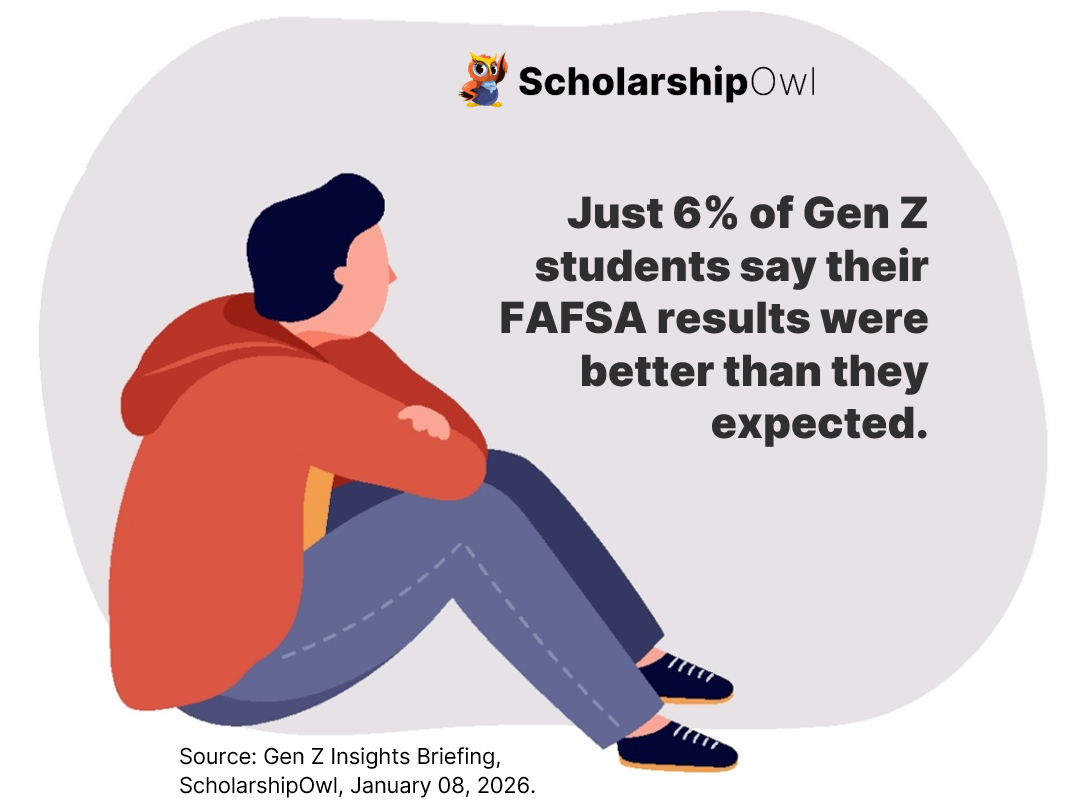

Amongst the 15,755 of students who had already submitted the FAFSA, nearly half (44%) said that their FAFSA Submission Summary was worse than they had expected, and half (50%) said that their FAFSA results were about what they had expected. Just a small percentage (6%) said that their FAFSA results were actually better than they had expected.

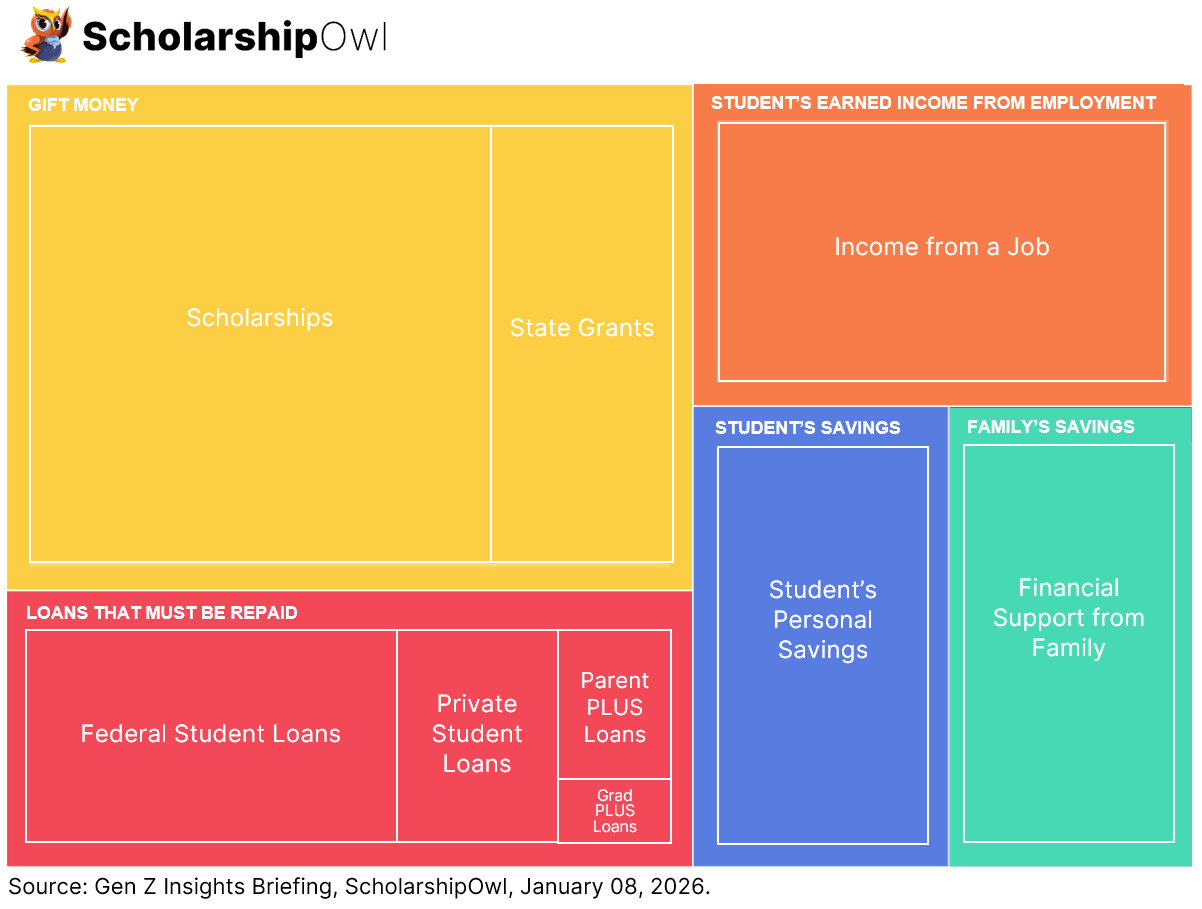

Question 4: Which of the following will you rely on to help you pay for college costs not covered by federal grants? Select all that apply.

Most students selected multiple funding sources from the list to help them achieve their goal of paying for college:

- 88% selected “scholarships”

- 56% selected “income from a job”

- 41% selected “my personal savings”

- 39% selected “financial support from family”

- 38% selected “federal student loans”

- 33% selected “state grants”

- 17% selected “private student loans”

- 8% selected “Parent PLUS Loan”

- 3% selected “Grad PLUS Loan”

The Shifting Tide of College Financing

The survey results reveal several critical trends that will define the 2026-27 school year:

The Expectation vs. Reality Gap

Perhaps the most striking finding is that 44% of students felt their FAFSA results were “worse than expected.” With only 6% finding their results “better,” there is a clear disconnect between what families hope to receive and what the federal government actually provides. This suggests that as the cost of attendance rises, the federal formula for “need” may not be keeping pace with the lived reality of middle-class and working families, making paying for college more challenging.

Scholarships Are No Longer “Extra”—They Are Essential

With 88% of respondents indicating they will rely on scholarships to pay for costs not covered by federal grants, scholarships have moved from being a “bonus” to a primary pillar of the college budget. This exceeds the reliance on jobs (56%) and far outpaces federal student loans (38%), signaling that students are becoming more debt-averse and are proactively seeking “free money” to avoid the burden of high-interest borrowing. Clearly, paying for college with scholarships and other debt-free sources is preferred by Gen Z students.

The Impact of Loan Reform

The data shows that only 8% of students plan to use Parent PLUS loans and 3% plan to use Grad PLUS loans. This low engagement may be a direct reaction to the 2026-27 loan caps and the elimination of Grad PLUS for new programs. As federal borrowing options become more restricted, we see a corresponding rise in students looking toward personal savings (41%) and family support (39%) to make ends meet.

Proactive Financial Planning

Despite the complexities, 65% of students had already submitted their FAFSA by December. This high early-filing rate shows that students are aware of the “first-come, first-served” nature of many state and institutional grants, demonstrating a high level of financial literacy and proactivity among the current applicant pool.

Still, the fact that 28% of respondents haven’t yet submitted the FAFSA despite their plan to do so demonstrates that some families may need additional information and support to complete this essential financial aid step.

Key Takeaways

The December 2025 survey results serve as a wake-up call for the higher education community. The “Expected vs. Reality” gap is real, and it’s driving students to look beyond the federal government for help. With nearly 9 out of 10 students now targeting scholarships as their primary secondary funding source, the competition for private aid is higher than ever.

For the 2026-27 school year, the message from students is clear: federal aid and loans are no longer enough. To achieve a debt-free degree, students must take a multi-pronged approach—balancing early FAFSA filing with a consistent, aggressive scholarship strategy and part-time employment.

Don’t Leave Your Future to Chance

With scholarship competition at an all-time high, you need every advantage to stand out and stay organized. Don’t wait until the fall tuition bill arrives to begin applying. Start your ScholarshipOwl 7-day free trial today to access personalized matches, automated applications, and a streamlined dashboard that helps you leverage every opportunity to fund your education debt-free!