The narrative of the American student often centers on academic competition, but for Gen Z, the central tension is increasingly about financial hardship. As inflation drives up costs for everything from tuition to groceries, how are students and their families truly coping?

Win more scholarships with less effort

Simplify and focus your application process with the one-stop platform for vetted scholarships.

Check for scholarshipsIn November 2025, ScholarshipOwl surveyed 14,646 high school and college students on our platform to gain a clear, unvarnished perspective on the financial hardship facing the next generation of college attendees. The results reveal a population navigating persistent economic headwinds, but also one deploying strategic and resourceful measures to secure their education. This data paints a vivid picture of the current economic reality and underscores the critical importance of financial aid and scholarships.

Who Participated in the Survey?

In November 2025, ScholarshipOwl surveyed 14,646 high school and college students on the ScholarshipOwl scholarship platform to learn more about financial hardship that Gen Z students and their families are facing.

Among the respondents, 62% were female, 34% were male, and 1% identified themselves as a different gender identity or preferred not to respond to the question. Over half (51%) were Caucasian, 18% were Black, 18% were Hispanic/Latino, 6% were Asian/Pacific Islander, 2% were American Indian/Native American and 6% selected “other” or preferred not to respond to the question.

Nearly two-thirds (62%) of the respondents were high school students, with the overwhelming majority high school seniors; more than one-quarter (28%) were college undergraduate students, primarily college freshmen and college sophomores; 5% were graduate students and 3% identified themselves as adult/non-traditional students.

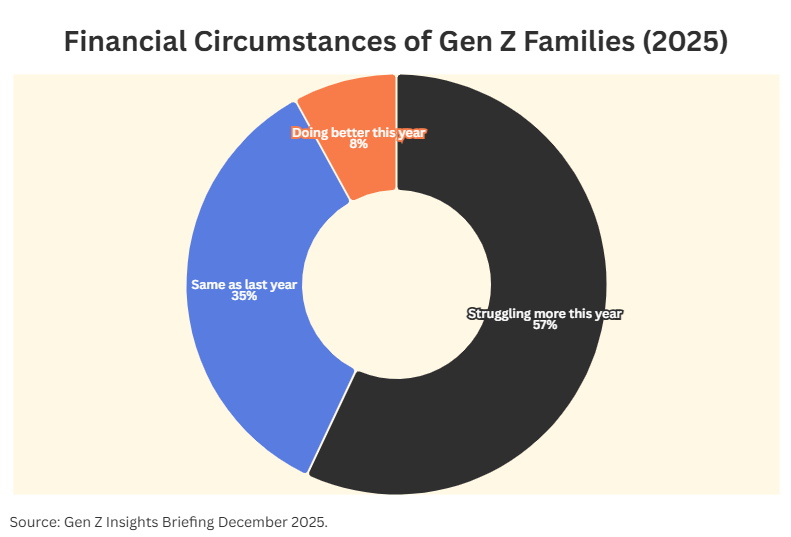

In thinking about how things are going financially for yourself and your family, which of the following statements best describes your financial situation?

- 57% selected “We are struggling more this year than last year.”

- 35% selected “It’s about the same as last year.”

- 8% selected “We are doing better this year than last year.”

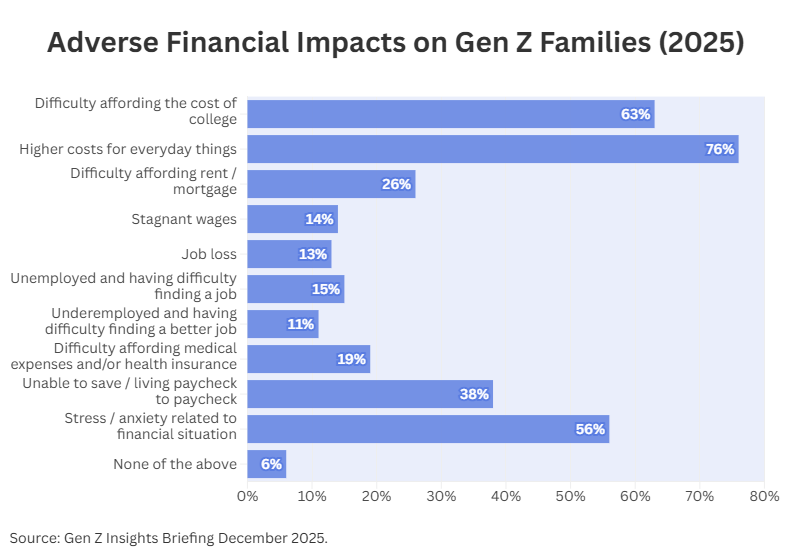

Which of the following has adversely impacted you OR your immediate family in 2025?

Students were asked to select all that applied, and most selected multiple responses.

- 63% selected “Difficulty affording the cost of college.”

- 76% selected “Higher costs for everyday things (groceries, etc.)”

- 26% selected “Difficulty affording rent / mortgage.”

- 14% selected “Stagnant wages.”

- 13% selected “Job loss.”

- 15% selected “Unemployed and having difficulty finding a job.”

- 11% selected “Underemployed and having difficulty finding a better job.”

- 19% selected “Difficulty affording medical expenses and/or health insurance.”

- 38% selected “Unable to save / living paycheck to paycheck.”

- 56% selected “Stress / anxiety related to financial situation.”

- 6% selected “None of the above.”

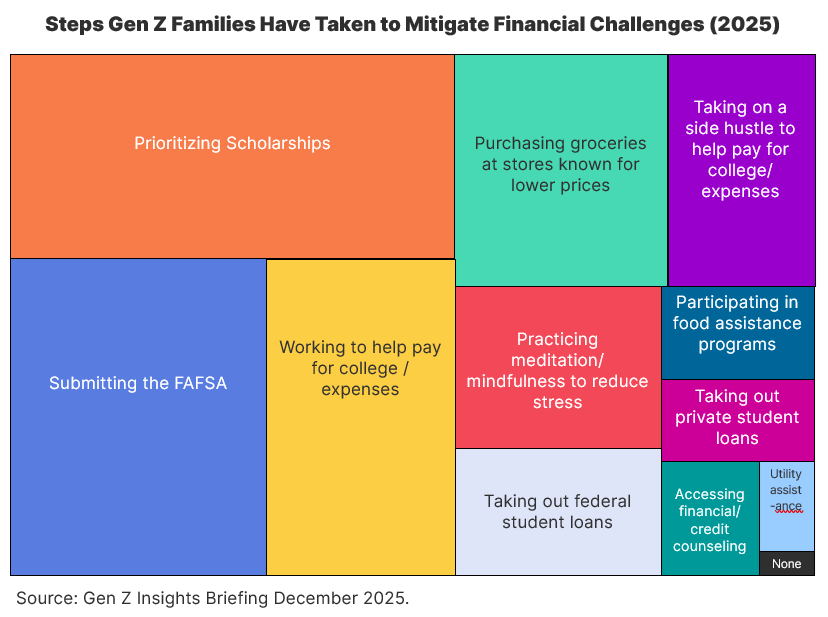

What steps are you taking or have you taken to help mitigate the financial challenges you are experiencing?

Students were asked to select all that applied, and most selected multiple responses.

- 83% selected “Submitting the FAFSA to apply for federal and state grant aid.”

- 91% selected “Prioritizing applying for scholarships.”

- 26% selected “Taking out federal student loans.”

- 12% selected “Taking out private student loans.”

- 61% selected “Working part-time or full-time to help pay for college and everyday expenses.”

- 34% selected “Taking on a side hustle to help pay for college and everyday expenses.”

- 50% selected “Purchasing groceries/necessities at stores known for lower prices.”

- 14% selected “Participating in food assistance programs (SNAP, WIC, food banks, or food pantries).”

- 5% selected “Participating in utility assistance programs (LIHEAP, state/local programs, etc.)”

- 11% selected “Accessing financial counseling / credit counseling services.”

- 34% selected “Practicing meditation / mindfulness etc. to reduce my stress.”

- 1% selected “None of the above.”

Key Takeaways: Analyzing Gen Z’s Financial Hardship Landscape

The survey results point to significant and widespread financial distress, forcing students to adopt aggressive strategies to mitigate rising costs and fund their education.

The Majority is Struggling, and Inflation is the Primary Driver

Financial Erosion

The data reveals that 57% of respondents feel they are struggling more this year than last year, indicating a sharp decline in financial stability for the majority of families. Only 8% reported improvement.

The Cost-of-Living Crisis

The top-cited challenge was “Higher costs for everyday things (groceries, etc.),” selected by 76% of students. This demonstrates that day-to-day inflation is having a more pervasive and direct impact on family budgets than even housing or job loss.

Widespread Impact

High costs are compounded by the difficulty of affordability across the board: 63% cited difficulty affording college, 38% reported being unable to save/living paycheck to paycheck, and 26% noted difficulty affording rent/mortgage.

Financial Stress is a Mental Health Crisis

Pervasive Anxiety

The emotional toll of financial instability is alarmingly high, with 56% of students reporting stress/anxiety related to their financial situation. This highlights that financial hardship is not just an economic issue, but a critical mental health challenge for Gen Z.

Active Coping

In response to this stress, 34% of students reported actively practicing meditation or mindfulness to reduce their anxiety, suggesting a significant portion of this generation is self-managing their stress through proactive mental health techniques.

Students are Resourceful and Prioritizing Free Money

Scholarships as the Lifeline

When asked how they mitigate financial challenges, prioritizing applying for scholarships was the single highest response, selected by 91% of students. This shows students overwhelmingly recognize scholarships as the most vital and primary tool for closing the financial gap.

Maximizing Federal Aid

A robust 83% reported submitting the FAFSA, indicating strong engagement with federal and state grant opportunities.

Working to Bridge the Gap

The need for earned income is clear: 61% are working part-time or full-time, and 34% are taking on side hustles. This suggests many students are making difficult choices that may compromise study time in order to cover immediate expenses.

Avoiding Debt (Where Possible)

Compared to earning and applying for aid, fewer students selected debt as a mitigation step: only 26% plan to take out federal loans, and a mere 12% are opting for private student loans, underscoring a strong collective desire to minimize debt.

Need for Support

Necessity Shopping

Half of the respondents (50%) report purchasing necessities at lower-priced stores, a common tactic for families under budget pressure.

A concerning but necessary finding is that 14% are participating in food assistance programs (SNAP, WIC, food banks), and 5% are accessing utility assistance programs, illustrating that basic needs are being threatened for a significant minority of students.

Accessing Assistance

A concerning but necessary finding is that 14% are participating in food assistance programs (SNAP, WIC, food banks), and 5% are accessing utility assistance programs, illustrating that basic needs are being threatened for a significant minority of students. In addition, 11% are accessing financial counseling credit counseling services, demonstrating that families are taking positive steps to help mitigate their circumstances.

Strategic Action in the Face of Adversity

The data from the ScholarshipOwl survey confirms that Gen Z is facing an unprecedented convergence of high educational costs and rising daily expenses. Yet, the overwhelming response from these students is not surrender, but strategic action.

The fact that 91% of respondents are prioritizing scholarships is a powerful message: the most effective path out of this financial challenge is through securing non-repayable aid. As the cost of college continues to be impacted by the broader economy, platforms that simplify and maximize scholarship applications are no longer just a convenience—they are a necessity. By diligently applying for scholarships and completing the FAFSA, Gen Z students are turning financial adversity into an organized, proactive search for a debt-free future.

Gen Z students are taking strategic control, with 91% recognizing scholarships as their lifeline. If you’re ready to join the majority who prioritize securing free money, you need a system that ensures efficiency and opportunity. Turn your financial plan into funded reality. We are here to simplify that effort—sign up for your free 7-day trial at ScholarshipOwl.com!